For many utilities, advanced metering infrastructure (AMI) is the first of many initiatives on the path to modernizing the electric grid. According to the new GTM Research report Utility AMI Analytics for the Smart Grid 2013-2020: Vendors, Markets and Opportunities, the primary benefit realized by utilities to date has been reduced operating expenses through the automation of meter reading and billing processes, despite the fact that smart meters are capable of monitoring and recording multiple parameters. This data can provide insights into both the status of the distribution grid, as well as the customers that utilities serve. In terms of insolation, however, smart meter data rarely provides measurable benefits. It is only through the implementation of software solutions that provide additional context that the true value of AMI can be realized.

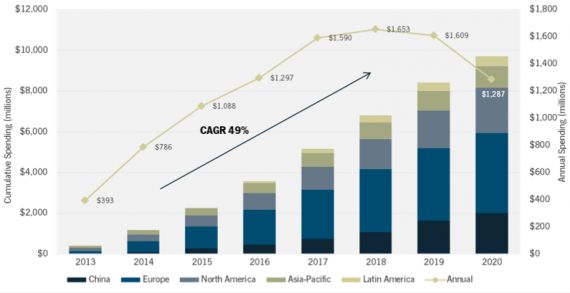

FIGURE: AMI Analytics Market Forecast, 2013-2020

Source: Utility AMI Analytics for the Smart Grid 2013-2020

The forecast presented above aims to provide a quantitative assessment of the global market for smart meter data analytics based off of conclusions and trends gleaned from interviews with numerous utilities and vendors. While many utilities interviewed are already utilizing AMI data for basic applications, none of the utility employees spoken to were content with the extent to which their utility was leveraging AMI data, including, but not limited to incorporating data to enable outage management, voltage optimization, asset management, customer segmentation, load forecasting and demand response, and revenue assurance. Based on these findings, we are confident that the AMI analytics market will be a promising area of growth for software providers, as well as a significant entry point for additional sales opportunities.

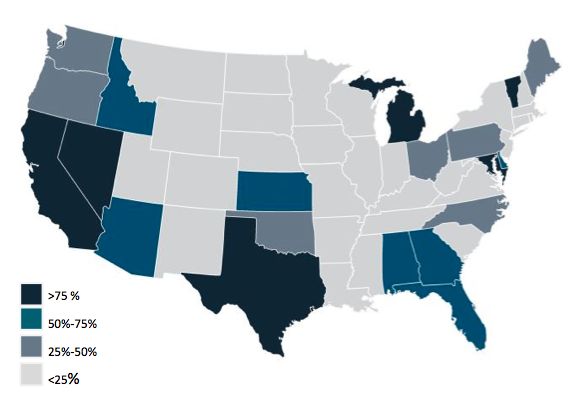

FIGURE: 2013 U.S. Smart Meter Penetration

Source: Utility AMI Analytics for the Smart Grid 2013-2020

The software analytics market for AMI is one of the most promising opportunities for catalyzing the near-term convergence of IT with operational technology. Nevertheless, the market is still in a period of early adoption, even in geographies where hardware is relatively mature. Accelerating the rate of adoption will be depend upon solving both technological challenges such as systems integration as well as cultural challenges related to change management. Furthermore, both vendors and utilities expressed a common belief that unlocking the true value of AMI data will be dependent upon the adoption of a common utility data model, which ultimately represents a final steady state for more effective data utilization. Until then, most of the benefits resulting from AMI will come from the growing capabilities of meter data management systems.