The numbers on wind’s year in 2010 are already in, but researchers at one of the nation’s premier laboratory facilities have found some important indicators of which way the wind is blowing by digging into them.

“The heart of this document is in tracking cost, price and performance trends,” said Ryan Wiser of the report he and U.S. Department of Energy Lawrence Berkeley National Laboratory research partner Mark Bolinger wrote on numbers and trends.

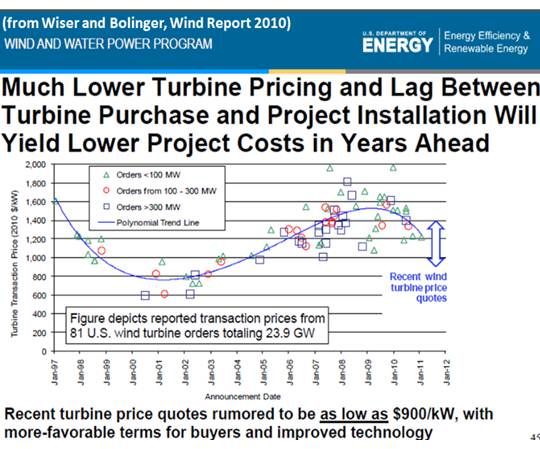

“We have very strong indications that wind project costs and wind project pricing are entering a steep decline phase,” Wiser said, “making wind steeply more economically competitive.”

“Turbine pricing has declined substantially from a high of as much as $1500 per kilowatt down to $1200 per kilowatt or even a little bit south of that.” That decline, he said, “is very likely to turn into aggregate project price declines of an equivalent magnitude.”

Wind-generated electricity is also dropping in price due to “turbines that have scaled, especially in rotor diameter and to a lesser extent in hub height.” This produces turbines with higher capacity factors because they can better capture available wind. “Lower upfront costs and better project performance undoubtedly will lead to better project pricing,” Wiser said.

A drop in project price of twenty percent will surely impact wind’s competitiveness. “The PPAs that people are pricing today in the best wind markets around the country,” Wiser said, “are in the three cents per kilowatt-hour range. Wind is now back in a very competitively advantageous position” despite the fact that “dropping natural gas prices make that competition tougher than ever.”

Because local wind resources and energy alternatives vary, however, “We have to be a little bit careful about making broad statements about competitive positioning,” Wiser said. On the other hand, “larger rotor diameters in particular” and “improved turbines” overall, he went on, “make lower wind speed sites more economically attractive today.”

“Utilities will continue to be the largest purchasers of wind,” Wiser said, and they “have also begun to take ownership stakes of a pretty significant scale since the mid-2000s, which demonstrates the growing maturity of the technology.”

In the offshore wind sector, there was a lot of planning and development activity last year in both the private and public sectors, Wiser noted, singling out federal policy efforts. Offshore wind projects, he said, “are complicated to build. We haven’t built one in the U.S. before. They present technical challenges, cost challenges, permitting challenges, a whole variety of challenges. It takes a while to run through all of those processes, especially on the permitting side. We have a ways to go to get those projects to the finish line.”

Curtailment -- the turning off of turbines when the wind is blowing -- was a less serious problem last year. “We’re making progress,” Wiser said. “Ultimately the answer is going to be more transmission and greater project integration.”

“Transmission is hard to build,” Wiser said, but it is being built. “The initial development of the competitive renewable energy zones (CREZs) in West Texas,” Wiser pointed out, is having an impact. “In Texas, curtailment was a substantial factor but it was below what we saw in the previous year.”

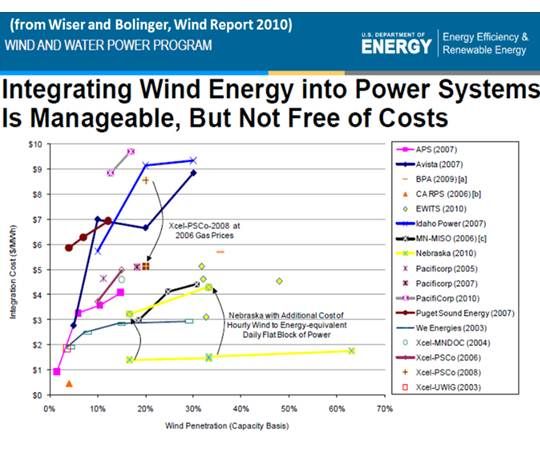

Some say the obstacle to greater grid integration is cost. However, Wiser’s research found otherwise. “Integration costs for managing short-term variability of wind comes to less than a half-cent per kilowatt-hour. That represents ten percent or less of the cost of wind,” he said. “It’s not zero. But the number is certainly economically manageable, though technically challenging at times and requiring some attention.”

Greater grid integration can be achieved through “strategically using demand response kinds of options,” “working with other utilities in the region to try to share the imbalances that exist” and “really trying to forecast.”

Wiser believes system operators are doing “everything they can to manage reliability.” They are, he said, “well aware of the challenges and are actively seeking to manage variability just as they actively seek to manage variability in loads and forced outages of other generation sources. Wind is a different kind of resource, but it doesn’t impose challenges that system operators haven’t confronted to at least some extent in the past.”

Wiser’s report concludes more wind on the grid will require more balancing reserves in the form of fossil fuel generation. Some argue this will cause an increase in greenhouse gas emissions. “The emissions per kilowatt-hour of fossil generation output will increase a little bit,” Wiser said, but “you’re reducing the output of fossil fuel plants in aggregate because you’re increasing the output of wind. There is an emissions penalty,” he said, from the total reduction in emissions.

“I have seen some evidence that the emissions reductions benefits of wind may not be quite as high as some people might have expected because you need to operate the fossil plants in a more flexible fashion,” he said, but “I’ve seen no credible evidence to suggest that aggregate emissions would actually increase in a higher wind scenario.”

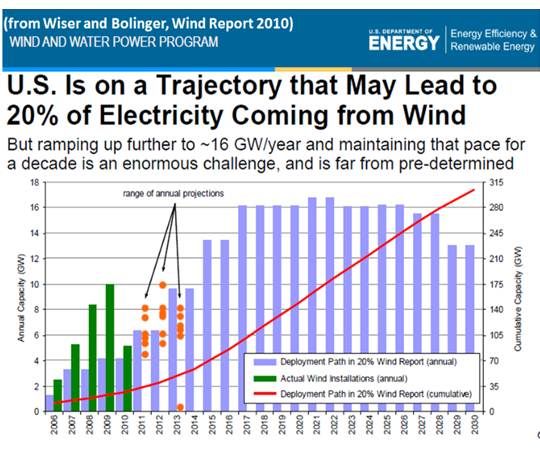

None of Wiser’s research belied the widely heralded 2010 installed capacity drop-off. The U.S. wind industry, Wiser concluded, remains on track to provide the U.S. with twenty percent of its power by 2030 -- but getting there "is going to be a big push.”