[pagebreak:VinodKhoslaBiofuelsPartTwo]

[Editor's Note -- we published Mr. Khosla's introductory piece, What Matters in Biofuels? here. He detailed his perspective on biofuels production technologies and his firm's investment thesis here. And he concludes his biofuels primer with today's piece on biofuel feedstocks.]

Part II: Feedstock.

Feedstock cost, environmental impact and even its politics are critical variables. With each investment one has to pay attention to which feedstocks to get started on, what the process can accommodate over time, the economics, the alternative uses and scalability potential (hence the economics to the feedstock producers among their alternatives) for each feedstock.

Technologies that use food-based feedstocks are likely viable in the near term but will have increasing costs, poor politics, and feedstock competition unless the production technique is compatible with cellulosic to sugar hydrolysis technology (such as HCl and others in development).

For fuels, processes that can directly use all components of biomass (cellulose, hemi-cellulose, sugars, starches and lignin) may have an advantage of higher yields per ton and lower costs per ton. Oil based processes for biodiesel are not likely competitive except in niche applications and in certain geographies.

Though multiple cellulose and hemi-cellulose to sugars conversion technologies are in development, personally I am most bullish about some of the recent surprise developments in acid hydrolysis. At scale, HCL-like technologies should be able to produce food and non-food grade sugars at between $0.08 to 0.12 per pound at $50 per ton biomass costs. To speed up and increase cellulosic sugar cost reduction, HCL CleanTech has developed a number of front end extraction processes that, while contributing to the purity of the sugars, increase the potential of co-product value: their de-acidified lignin is unadulterated (27 percent of the wood dry basis) and tall oils and resins (5 to 7 percent of the wood) are pre-extracted from the wood.

This or similar surprise technology developments could make biomass the new feedstock for sugars based processes. Though traditionalists may argue with me about other technologies that can also convert biomass to sugars cost effectively, such as enzymes and steam or ammonia explosion I have not seen them progress rapidly enough.

In my view “paper mill compatible woodchips”, sometimes needed for sugar based processes, will cost in the U.S. at scale $65 to $70 per dry ton and $50 to $60 per dry ton for whole logs for processes that can tolerate bark and wood slash. These prices will start declining quickly in the U.S. as the ecosystem and cultivation of alternative “fuels grade biomass” (which does not need to meet paper mill feedstock quality metrics) develops within five years. The non “paper or lumber” quality biomass ecosystem, which will include co-feed of wood slash, bagasse or corn stover, will develop quickly in the next 5 years as the first commercial cellulosic biofuels units become operational. Mixed biomass feedstock (for technology that can accept agriculture and forest waste mixed with whole logs) will decline towards $40 to $45 per dry ton by 2020 or sooner in the US.

There is a surprising amount of forest waste available; a good example would be hardwood waste, which can reach up to 30 percent or more of the harvest: southeast timber has roughly 18 to 22 percent waste by mass, whereas the Northeast and Alaska have as much as 30 percent. Ultimately, scaling fuels will depend upon exploiting these near-term available non-food feedstocks. In the mid-term (5 to 10 years) winter cover crops (where appropriate) and energy crops planted in crop rotations or on marginal land (over one billion acres of marginal land worldwide has been put out of production due to degradation)[1].

The appropriate perennial, polyculture biomass production approaches, (which can restore degraded lands) will come into play in addition to continued wood, agricultural waste and bagasse use. Long term (10 to 15 years), dramatically improved energy crops, new cropping practices and new chemical fertilizer reduction strategies (such as polycultures) could yield well over a billion tons of biomass in the United States alone, if not substantially more, without significant land impact.

As a result, the most promising technologies must be able to exploit these ligno-cellulosic sources and ideally, mixed feedstocks to have the lowest costs. Use of bark, waste and mixed feedstocks will lower costs and be a significant competitive advantage for any process. Accepting mixed feedstocks will be a major advantage for any conversion process. Such technologies, in my estimation, should yield more than 2000 gallons of fuel per acre (ethanol equivalent) in the long term (versus 400 to 500 gallons per acre today with corn ethanol) to provide material biomass fuels scalability without significant land use impact.

At a high level, at 2000 gallons per acre, to reach 36 billion gallons, we need 18 million acres of land (which need not be farmland), compared to 309 million acres of cropland currently in production (of 406 million acres of total cropland). If one displaces corn ethanol and recovers that land, the numbers for land usage could be substantially lower to meet our 36 billion gallon goal (though corn does co-produce animal feed). In the last 10 years alone, more than 30 million acres went out of production due to degradation, crop yield improvements and conservation.[2] The issue is further complicated by the recovery of land that takes place (covered in more detail in my previous papers) as diets shift from red meat (beef) to white meats (chicken), which take less than 5% of the land beef requires for corn cultivation for animal feed.

In contrast, technologies that focus on specialty oils like jatropha, rape seed (used extensively in Europe for biodiesel), palm oil and the similar are less attractive because their gallon per acre yields are far lower (40 to 50 gallons per acre for jatropha, up to 600 gallons per acre with palm oil), and we don’t expect these oil yields to increase substantially over the next decade. Not only that, jatropha in particular is toxic to animals. Additionally, used restaurant grease, oil from old tires and animal waste, are largely irrelevant as feedstocks at the global scale, though they can be used to produce cost effective fuels where available. As a result, we are not considering them here in detail because in my view, they are not likely to achieve relevant scale, regardless of profitability.

Photosynthetic algae are touted as something exciting due to very high batch yields (suggesting greater than 4000 gallons per acre). However, as discussed earlier, they currently appear to be cost prohibitive for biofuels applications due to high culturing and processing costs, except perhaps for use in specialty products (e.g., Omega 3 supplements, proteins). There are several cost breakthroughs that we believe are necessary for photosynthetic algae to become competitive: continuous high strain yields (strain survival and resistance to contamination). That said, there is always the possibility of an unexpected technology disruption of the traditional efforts. The Synthetic Genomics effort, is one such possibility, though unpredictable, long term and with substantial GMO risk, and potentially high reactor costs. Other photosynthetic efforts like Joule are also potential shots on goal. In my view none of the traditional efforts seems currently viable to reach economic costs for fuels and some of the newer approaches are too early to assess predictably. This statement is based on our firm having evaluated dozens of business plans based on photosynthetic algae, though there are ones we have not evaluated.

Meanwhile, there will be numerous opportunities for local, opportunistically low-cost local feedstock, but such specific instances can’t be relied upon globally and are not generally scalable. Cellulosic sources could be cheaper in other parts of the world. Eucalyptus for example in Brazil can be $30 to $40 per dry ton (used today for steam generation) and bagasse in certain circumstances can cost substantially less. Eucalyptus yields of 6+ tons per acre in drier regions like Matta Grasso and over 9 dry tons per acre (300+ wet tons per hectare in a 7 year growing cycle) in better rain regions like Sao Paulo are common today.

In the mid-term, use of energy canes, new crops and new regions, like the Brazillian Cerrado, could substantially reduce costs as well. Cellulosic and lingo-cellulosic plants are by the far the most scalable feedstock for biofuels on the planet (and most abundant), and will likely be the least expensive as well. Energy crops are likely to play a significant role in the long term and may actually improve row crop agronomy and environmental impact.

Next page: scaling production

[pagebreak:VinodKhoslaBiofuelsPartTwo2]

Scale

As mentioned earlier, in order to produce biofuels that meaningfully impact global oil demand, yields will have to approach 2000 gallons ethanol equivalent per acre, the feasibility of which I laid out in a previous paper. Achieving this eminently doable target will result in a 75+ percent reduction in land requirements compared to corn ethanol to produce a given quantity of biofuels.

Today, most biofuel demands are met with corn and sugar cane, but that won’t remain so for long. Energy crops such as switchgrass and miscanthus will produce 5 to 10 tons of biomass per acre per year in the near term, and will rise to 10 to 15 tons per acre in the decade after the technology for conversion is proven and to 15 to 20 tons per acre or more over the following few decades, if yield improvements similar to those in row crops are achieved. Even sugar cane as a feedstock for fuels may be supplanted by more productive energy crops in a few decades (though sugarcane in Brazil produces an impressive 75 tons of raw material per hectare per year, or 30 wet or 15 dry tons per acre, including sugar, bagasse and leaves). Sugarcane today yields roughly 600 gallons of ethanol per acre today (with no additional energy input).[3] Energy canes that co-produce sugars and biomass or are focused solely on biomass production may increase yields year acre even in the short term (recent data reveals ethanol yields of over 1,200 gallons per acre).[4] This becomes even better with cellulosic sugar conversion technologies. Miscanthus has huge potential for rain fed regions, while various grasses like switch grass and sorghum, as well as water efficient plants like agave, are very appropriate for drier regions.

A few years ago, I forecast that as processes mature, one ton of cellulosic biomass will yield 110 gallons of ethanol equivalent, approaching our target of 2000 gallons of ethanol equivalent per acre as yields approach 18 to 20 dry tons per acre. If Kior, for example, is able to reach 2 barrels per ton of production (equivalent to 140 gallon ethanol equivalent per ton) in the next five years, then it will only take 14 tons per acre to reach this 2000 gallon per acre goal; such adjustments to estimates will continue to happen. If these process improvements prove out, we will need smaller yield improvements than I forecast only a few years ago. Encouragingly, Ceres and Mendel, two energy crop companies, forecast biomass crop yields at roughly 15 to 20 tons per acre, depending upon the region, rain and soil.

Again, for comparison, though corn is currently one of the most efficiently grown agricultural products in the world, it only produces 400 to 500 gallons of ethanol from an acre of corn (though animal feed byproducts do increase the effective yield equivalent per acre), with an additional ~300 gallons of ethanol equivalent cellulosic biofuel theoretically possible from the stover. Corn requires prime crop land, which stokes “food versus fuel” politics (perception is important), requires fertilizer, herbicides and pesticides, and is estimated by some sources as not being particularly carbon efficient (various estimates put the savings at 10 to 20 percent compared to gasoline for corn, versus greater than 50 percent for sugar cane and greater than 70 percent for cellulosic feedstocks), though that is dependent on assumptions. I expect corn-based ethanol will likely be retired as a fuel in the next 10 years as it becomes increasingly uncompetitive.

The sugar or starch based processes that currently run on corn will likely transition to hydrolysed cellulosic sugars, such as the ones produced by HCl Cleantech, which will likely be cheaper, more scalable and less controversial than corn or sugar cane based sugars, probably within the next few years. As for near term cellulosic sources, before other cellulosic sources scale up, we have plentiful supplies of wood chips and wood waste (especially in light of the hundreds of paper mills that have gone out of business in the US in recent years –each site is a potential great biofuels opportunity, with huge benefits to the local communities, which are devastated when paper mills or wood mills shut down) to enable decent scale cellulosic production and to help meet the current 36 billion gallon target for biofuels.

According to the DOE billion ton report from a few years ago, there is roughly 200 million tons of non-merchantable forest material alone. If that is fully utilized, we can approach the 36 billion gallon target at the possible Kior yields with this forest waste alone. Collecting and harnessing even a small amount of this potential waste will create jobs and community income and directly replace billions per year that the US spends on oil imports. And if some people think this is optimistic there are many other sources of biomass like winter cover crops that have not been accounted for.

It’s interesting to note that 36 billion gallons, the minimum target under Federal legislation by 2022, is a $90 billion market at $2.50 per gallon of ethanol equivalent. This can support many $10 billion dollar companies in the United States alone. And though I cover only U.S. mandates here, similar mandates exist in Europe and many other countries.

It’s also worth pointing out that the US currently consumes just over 280 billion gallons of oil annually,[5] so there’s plenty of room for upside, much wealth that can be created, and the phenomenon can be easily replicated in many regions of the world with similar local benefits. Any producer of biofuels that is cost competitive with crude oil will likely find a market, even if it isn’t the lowest cost process. Conventional oil supplies, though I expect them generally to be able to scale to meet demand, will come at increasing cost and with increasing environmental, financial and other risks. I am not an ardent believer in peak oil theory though I am not qualified to judge it either.

Agronomic Approaches and Land Use

Biofuels are seen both as an incredible opportunity to improve land quality, biodiversity and the environment, and as a huge threat, depending on who you ask. The devil is in the details; I believe that any biomass effort should be subject to an environmental assessment, similar to my CLAW proposal (Carbon emissions, Land use, Air pollution, and Water use), described briefly in Part I. If managed well, biomass production for energy could usher in a rebirth of the rural economy, through improved and expanding arable land and increased revenue. Dollars that once went overseas will stay in the country and revitalize impoverished communities. The key to making this vision a reality is to explore all options and recognize that one size does not fit all; energy crops, perennials, polycultures, better crop rotations, agroforestry, technological breakthroughs in managing plant nutrition and disease, and new harvesting technology.

For the regressives who project fixed land use and biomass production capacity based on yesterday’s technology, un-optimized yields and practices, I just beg to differ. Many people simply refuse to accept that the future can be different from the past and yet extrapolating an unsustainable present is a bankrupt strategy by which to reach a sustainable future. Much research remains to be done but the potential clearly exists for significant jumps in our biomass capacity. With proof of this biomass as a source of liquid fuel, this research will accelerate.

For instance, energy crops like miscanthus have benefits as perennials, and with proper agronomic techniques and technologies can reduce water and nutrient demands while improving soil quality. The cost of biomass is going to be set by marginal land rent and productivity, so good agronomic practices will convert directly into increased revenue (with little environmental impact, or perhaps some benefit) which will ultimately drive down the cost of biomass as its production processes are fine tuned and optimized.

As I have mentioned earlier, while miscanthus has huge potential for rain fed regions, various grasses like switch grass and sorghum may be appropriate for drier regions. Other possibilities include water efficient plants like agave and other plants that use the Crassulacean acid metabolism (CAM) mechanism for drier regions. These “CAM” plants can be five to ten times more water efficient than grasses.

The beauty of cellulosic processes is the flexibility of biomass feedstock, which allows the use of short and long rotations (up to 10 year rotations), agroforestry (interplanted rows of trees and row crops), and polycultures. Technologies that can use mixed feedstocks will have much lower long-term costs and less price volatility. By using feedstock flexible technologies we have an opportunity to increase biodiversity and symbiotic production of nutrients, which improves soil quality and yields, while not adversely affecting fuel output. Technologies like enzymatic hydrolysis, besides higher early costs, will likely be more feedstock specific and feel less likely to succeed in my opinion.

One option I have previously proposed is the usage of a 10 year x 10 year energy and row crop rotation. As row crops are grown in the usual corn/soy rotation, lands lose topsoil and get degraded, need increased fertilizer and water inputs and decline in biodiversity. By growing no-till, deep rooted perennial energy crops (like miscanthus or switchgrass - see below) for ten years following a ten year row crop (i.e. - corn/soy) cycle, the carbon content of the soil and its biodiversity can be improved and the needs for inputs like fertilizer decreased.

The land can then be returned to row crop cultivation after ten years of no-till energy crops. Currently unusable degraded lands may even be reclaimed for agriculture using these techniques over a few decades. A University of North Dakota study[6] highlights some of the benefits for food crops. We expect similar or even greater benefits for food crop/energy crop long cycle (ten year) rotations, especially in soil carbon content:

(1) Improved yields: a crop grown in rotation with other crops will show significantly higher yields than a crop grown continuously.

(2) Disease control: changing environmental conditions (by changing crops) changes the effect of various diseases that may set in with an individual crop, and crop rotation can limit (and often eliminate) diseases that affect a specific crop.

(3) Carbon content: perennial energy crops in the rotation can increase soil carbon content and reduce the impact of top soil loss materially

(4) Better land: the study notes farmers practicing crop rotations comment on improvements in soil stability and friability. In addition, crop rotations have the potential to increase the efficiency of water usage (by rotation deep-rooted and more moderately-rooted crops or rotation of perennials in long cycles with row crops).

Another potentially important crop practice is the idea of utilizing polyculture species clusters instead of monocultures. This is specifically enabled by the many technology processes which can accept a mixture of biomass types. In the past most human agriculture and forestry required monoculture - one did not want soya beans mixed in with our corn or beans with our grasses! The Land Institute notes that polycultures (and the resulting plant diversity) have significant benefits – from the provision of an “internal supply of nitrogen, management of exotic and other harmful organisms, soil biodiversity, and overall resilience of the system.” Further research shows that grasslands that suffer from overgrazing or drought tend to recover faster if there is greater biodiversity.

The Australian Rural Industries Research and Development Corporation notes that “Polyculture is shown to offer the proverbial ‘free lunch’ by producing more from less.”[7] The report goes on to note that polycultures yield in greater amounts from smaller areas, and their yields are generally more stable than monocultures (with regards to income level and general risk). Furthermore, polycultures were found to be more efficient in gathering resources such as light, water, and soil nutrients. Other researchers have found similar potential in the yields and environmental benefits of polyculture crops. Though it is hard to extrapolate data from low production potential areas (where these studies were conducted) to the high production potential areas that are needed, we think this is an area that requires further exploration and study.

Meanwhile, winter cover crops like legumes and winter rye (no biomass optimized winter cover crops have been developed, but grasses are a good candidate), grown on row crop lands during their idle period during winters, can yield 3 to 5 tons per acre with no additional land usage and may actually improve land ecology where row crops are grown anyway. In conjunction with winter cover crops, annual crop residue may become a viable supplement to winter cover crops annual biomass yields per acre.

While cover crops have been utilized historically for the agronomic benefits (more on the benefits of crop rotations later), increased biomass yield has not always been a primary area of focus. While many traditional cover crops such as legumes (clovers, vetches, medics, field peas) offer limited potential for biomass yields, other cover crops like small grains (winter rye, wheat, oats, triticale) offer substantial potential – we’re confident that they can achieve the 3 to 4.6 ton yields that we project, and perhaps even go further. Currently, these crops (and rye in particular) achieve yields of up to 4 to 5 tons per acre[8]. It is notable that these crops need no irrigation and very little fertilizer.

These crops today are generally managed for forage or grain - managing for forage is perhaps closest to managing for total biomass, but there are still differences in practices that offer potential for substantial yield improvements, along with plant breeding and many of the improved agronomic practices (we discuss these later in the paper). Our research leads us to be optimistic about this area, and we believe further investigation is called for. There are over 300 million acres currently in cultivation, so significant acres could be put into a winter cover crop rotation. At 3 tons per acre, 100 million acres under winter cover crop cultivation would yield nearly 300 million tons of usable biomass per year. And winter cover crops have many environmental benefits including reduced nitrogen run-off.

Perennial polycultures, drought and salt tolerant plants (a huge upside for humanity), long term crop rotations, winter cover crops and innovative low input (water and fertilizer) techniques are very powerful tools in improving agronomy, environmental impact, yields and biodiversity while potentially recovering even non-arable land. Meanwhile, some companies are aiming at dramatically reducing fertilizer and pesticide demand, by developing creative new approaches and technologies. These techniques will shape the ultimate level of impact. In many scenarios, a little imagination, a lot of research and a continued focus on biofuels could actually increase available land by creating incentives to recover degraded lands. In my view imagination is in shortest supply when it comes to agronomic econometrics that extrapolate the past to predict the future instead of inventing a new future. I have spoken about this phenomenon elsewhere.

Well over a billion acres of land that was formerly agricultural has been abandoned worldwide because of degradation due to poor farming practices,[9] and there is another billion acres of underutilized grassland, savanna and shrubland that could be used as well.[10] Thinking globally, I suspect that pasture intensification and the land that would free up as the single largest lever that can be pulled to produce biofuels. This is currently managed land, often with very modest return, and there is twice as much of it as there is cropland. At the extreme is the “CREATION” of arable land as was achieved by Embrapa in the Brazilian Cerrado,[11] where tons of lime were deposited to reduce acidity, nitrogen fixing bacteria were employed, and some African grasses and other crops were introduced and specially engineered to thrive in the tropics (soy beans and brachiaria).[12] This gives me much hope.

Biofuel production, if managed well, could result in a vast increase in biodiversity and healthy arable land, with all the benefits to rural economies and quality of life that would bring. More arable land is available in the Brazilian Cerrado today, land that was not arable just a decade ago, with the potential for crop or biomass production, than is under crop cultivation today in India and the US combined. I suspect biofuels and chemicals may be one of the more powerful tools we will have in lifting many rural economies, and much of Africa out of poverty.

Next page: Market Dynamics, conclusions and appendices

[pagebreak:VinodKhoslaBiofuelsPartTwo3]

Market Dynamics

Every biomass source and crop will have different market dynamics, and it is unclear how the ecosystem will evolve, especially given the expansive options laid out in the previous section. Valuable co-products or synergistic technology pairings are another important part of the economics and may be key to scaling some biofuels cost-effectively (those that cannot use the whole plant). For example, cane and energy crops produce lignin-rich residue with more than enough energy content to power the fuel production facility, creating additional value. Only co-products with markets proportional in size to the liquid fuel market – i.e. commodity animal feed and energy – can realistically be sold to support a biofuels business. One could also co-locate cane sugar-based specialty chemicals production (such as Amyris or LS9), with renewable crude oil production using the underutilized bagasse. Bagasse to oil conversion would create far more value than burning bagasse for electricity, though well-meaning local policies can change that equation completely.

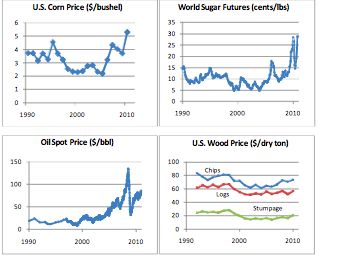

Feedstock price volatility will be mitigated by feedstock flexible technologies, and reinforces the value of using non-food feedstock. As can be seen in the charts below, over similar time periods, corn and sugar have had high volatility (though oil has been worse), while wood products have been stable. The profitability of the corn and sugar-based biofuels companies are very much affected by the price of corn and sugar, depending on the value of their co-products. Thus the ability to use biomass such as wood and wood waste, or agricultural waste, is a huge advantage in the uncertain market ahead.

If interest in biofuels sustains and feedstock production becomes a focus, crop varieties and scaled processes will be optimized (e.g., efficient collection and use of agriculture co-feeds and waste, tree bark, saw dust, leaves, energy cane etc), driving down costs in the coming decades. In the short run, collection of sugarcane field waste (often burned in place today), corn stover, corn cobs and other waste could reduce the biomass costs for many processes well below going rates for paper-grade wood chips. When it comes to new plant breeds, the feedstock innovation cycle is likely to be slow, and lag biofuels technology development by 5 to 10 years after the first biofuels plants prove their economics (or oil hits $150- a likely phenomenon). Using corn yield improvements in the past half century as a guide (38 bushels per acre in 1950 to over 160 bushels today), the upside potential in cellulosic feedstock development is substantial.

Not only that, biomass to sugars conversion technologies can open up sugar fermentation technologies to the whole world of cellulosic sources by cheaply producing fermentable sugars from cellulosic materials. Sugar and cellulosic feedstock prices will drop as the ecosystem expands and matures. Sugars, as high as $0.20 to $0.30 per pound in the US today (versus 15 to 20 cents per pound internationally),[13]will drop to $0.12 per pound and eventually to $0.08 per pound over the next decade or two from cellulosic sources. These improvements will be driven by crop productivity, sugar conversion technologies, specialized transport and processing equipment, competition and improved logistics efficiency as well as new crops. The flexibility to move from wood to agricultural waste to specialized energy crops and beyond will help stabilize and commoditize the “price per btu” on the open market. If this ecosystem develops, I predict that additional traded markets will appear in the next 10 years for agricultural waste, energy cane, miscanthus, grasses, fermentable hydrolyzed sugars of various grades and “mixed biomass,” among many others.

Conclusion

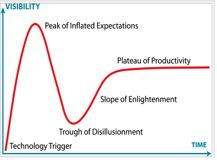

Looking at it from the point of view of the “hype” cycle, we are long past the peak of inflated expectations and have just passed the trough of disillusionment. We are currently on slope of enlightenment on our way to advanced biofuels becoming a significant and positive part of the economy and the energy picture.[14]

Many biofuels technologies have made significant progress over the last few years; there have been some surprises, some partnerships and some clear winners and losers. Some have failed for real technology reasons, but many others for business reasons, market/investor biases or technology-exclusive regulation. Many technologies are as yet unclear and some seem to be promising. There are many positive surprises to come. However, we believe that cellulosic feedstock, regardless of the processing technology and end-product, is the likely winner at scale in the fuels market. Still, sugars will work in the chemicals market.

Over the last few years the industry has seen a tremendous number of strategic and technical iterations coupled with new discoveries. Novel business plans have been developed, to exploit capital light opportunities, as well as to branch out into high value specialty chemicals. It is critical to continue nurturing the next generation biofuel landscape. Though it may appear like a lot of capex is required for many of these projects, there is less market risk and more upside compared to a battery effort like A123 (which has raised roughly $1 billion). The fuels market is huge and established, and all it takes is to be below the market price of this increasingly scarce commodity.

At least half a dozen technologies will be competitive with oil, with some more profitable than others. The critical point is that for the next 10 years at least, there will be an unbounded demand for biofuels, the quantities required by the current mandates both in the US and in many other countries will be an achievable stretch with all the technological innovation. US and worldwide demand of oil will be such that biofuels will not compete with each other, they all compete far more with oil. Each technology is suited to particular local conditions, and with the expected demand, there is lots of room for all these and even more technologies. Within a decade after beginning to scale (2012?), advanced biofuels will become material in the oil supply equation, and will be a significant market force within twenty years. I firmly believe that in 30 years, the price of oil will be more dependent on the marginal cost of land than anything to do with exploration, drilling, OPEC, or Middle East instability.

To those who accuse me of believing because I’ve invested in these technologies; I continue to invest because I continue to believe.

APPENDIX A:

So what makes a good biofuels investment? Before investing, I evaluate a company on the following checklist. A word of caution; new technologies can change some of these questions or render them irrelevant, and the questions don't apply equally to every technology approach. Consider them guidelines of the kind of questions I ask rather than “mandatory” questions. There are also questions that are missing here that would be appropriate for particular technologies.

I’ll be using some math in this section, here are the rough numbers:

Gallon of ethanol equivalent (GEE) = 76,000 BTU per gallon

Gallon of transportation hydrocarbon equivalent (GTHE)[15] = a proxy for “transportation fuels”, has the same heating value as a 50 percent gasoline, 50 percent diesel blend – around 122,000 BTU per gallon

Barrel of oil equivalent (BOE) = 42 gallons of crude oil, containing roughly 5.8 million BTU, 48 GTHE, and 76 GEE

1. The first breakeven plant or retrofit for fuels should cost no more than roughly ~$100 million to allow for rapid implementation and easier access to boot-up capital. Boot-up for the first plant is a critical issue and often results in large time delays in projects. Though there are no absolutes here, risk aversion increases exponentially as risk size increases. It also increases exponentially with the size of the organization (think Exxon, Shell, BP) that must take the risk.

2. In part I, I mentioned $5 to $6 capex per GEE for low opex processes, which will pencil out to a good IRR. I also stated that an ideal target would be $3 per gallon of hydrocarbons, or GTHE (which is roughly $1.90 per GEE) for fuels after the first few plants, for the most competitive cellulosic fuels at mid-term maturity. For high value chemicals, targeting $0.25 of gross margin per $1.00 in capex may be a better metric. Capex calculations should be based on true costs, including cost of capital. The most important metric may be a 3 to 5 year payback on the investment which might trump the above metrics as it substantially lowers risk in volatile commodities markets.

3. Feedstocks for fuels should be non-food–based and globally scalable. One off feedstocks reduce a company’s ability to scale rapidly. Historical feedstock price stability is very desirable, and processes that accept mixed feedstocks will have a large (availability and cost) competitive advantage.

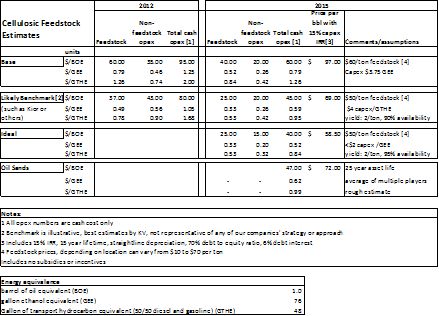

4. For example, take my hopes for Kior as a likely benchmark for total cash opex. I would expect, with a bit of luck and at $55 per dry ton feedstock costs, to get below cash costs of $1.25 GEE ($ 2.00 GTHE) in a full size 2,500 barrels per day facility by late 2012. By 2015 I expect cash costs to be $0.80 GEE ($1.25 GTHE) with about an equal cost for feedstock and other cash operating costs. This corresponds to a feedstock cost of $0.50 GEE dropping to below $0.40 GEE over time, which is under the target I mentioned in Part I, of $60 BOE (just under $0.80 GEE or $1.25 GTHE) near term, as well as the “safe” target of $40 BOE (around $0.55 GEE or $0.85 GTHE) by 2015 in a mature facility. Any biofuels company should aspire to beat these metrics.

5. In part I, I mentioned targeting non-feedstock opex of $20 to $25 BOE, (roughly $0.30 to $0.35 GEE) for a mature and competitive technology by 2015, with an ideal target of $15 BOE. Building on that, near term, non-feedstock opex costs should be no more than ~$0.75 GEE (this is $50 BOE, $1.10 GTHE) for fuels in the first few commercial plants, not including feedstock (production costs simply need to be in line with target markets, so pathways targeting high value chemicals can be higher). By 2015, the target should be below $0.40 GEE, though I would like to see numbers below $0.25 per GEE (near $15 per BOE) eventually. This would get us to costs that are profitable at $50 per BOE (for example: $15 per BOE opex, $25 BOE feedstock, plus depreciation and return on capital)

6. For fuels the guideline I use, the cost of the final product cost should be such that feedstock accounts for 50 percent of the total cost, even initially (assuming inexpensive and stable feedstocks). The best will get to where feedstock is 60 to 70 percent of total opex costs (very cheap “other” opex), though technologies like solar fuels (algae) will be exceptions if they can be economic. This comment is generally true of cultivated feedstocks.

7. Feedstocks for specialty chemicals markets can be sugars-based as sufficient scale exists for sugars and starches for the chemicals business but not for a large fuels business.

8. Cost effective boot-up tactics are a critical consideration because a technology that can’t get started in at least one market will never reach its full theoretical potential. Amyris has found some very high value markets. Retrofit/bolt-on approaches like those of Kior, LS9, LanzaTech, Gevo and Amyris are examples of clever boot-up strategy.

9. A demonstration plant or leased capacity should be at least 100,000 gallons per year, and have a clear path to commercial scale. In the end, the only reason for a demo plant is to a) produce samples and b) to verify engineering data. Without this scale a technology cannot be reasonably assessed. Similarly costs for a process that is more than 2 to 3 years to first commercial unit is no better than speculation. Though the appropriate scale can vary and is hotly debated, I use either annual capacity scale or, depending upon the technology, the size of the vessel or fermenter as a guideline to assess the reliability of the costs numbers and scalability of the process. 200 to 300 percent variations from estimates are not abnormal from naïve estimates when technologies are early or technologists inexperienced in large scale projects.

10. The lifecycle carbon emissions should be at least 50 percent less than conventional fuel, even initially, and the technology should have a path to 80 percent carbon reductions. If one gets to 50 percent initially, an 80 percent reduction target as the technology and ecosystem matures is likely.

Table: Representative base, benchmark and ideal targets for cellulosic biofuels production by 2015

Other questions to ask:

1. What is their feedstock cost, availability and flexibility? This in the principle operating cost of most processes. We believe cellulosic sources will be the most scalable in the long-term and most cost effective, for fuels. Broad availability provides relative feedstock cost stability, as primary feedstock production variable costs (like fertilizer or delivery) are linked to and thus hedged by the price by oil.

a. What feedstocks does the process require now versus possible in the future? Does it use specialty oils or require food-based sugars? If so, is it compatible with hydrolyzed cellulosic sugars like HCL? Can it exploit Waste gases? Does it use Cellulosic materials directly? (We believe the latter two are the best here). Are the prices they project reasonable when scale increases dramatically?

b. Have they locked up significant feedstock in contracts, or is the feedstock relatively available in the US or globally? Is there anticipated competition for biomass in the locations a company has picked? How replicable is the site?

c. What has the company proven with current and anticipated feedstocks? Yields, continuous production, costs? At what scale? Have they shown it with industrialized microbes or just lab microbes? Point yields on a small scale, with special conditions, without separation or post-processing can all be used to make claims. Only the 100,000 gallon per year scale demo or larger vessel scale for production verification with industrial feedstocks and microbes should be used to estimate true yields of end products. Most people don't recognize the difficulty in industrializing microbes, waste management, safety issues and start/stop of processes.

d. Is the feedstock ecosystem on a declining or improving yield and cost trajectory. Trajectory matters critically in all new technologies.

2. Production cost (ex-feedstock) -- These are the costs that will make or break many technologies, and are only really known after the process reaches significant scale. The key question here is, what has been proven?

a. Are their production costs compatible with their target markets?

b. What inputs does their process rely on (e.g., water, chemical additives, nutrients, catalyst, electricity), are those costs predictable and under control?

c. What are their current yields, how close to theoretical? What are the barriers to getting to ideal yields?

d. Will they reach their projected costs and be market competitive within 5 to 7 years of their launch (without subsidies)? Ideal prices would be (and I believe can be) market competitive initially.

e. What product separation/purification or post processing are they using, has it been proven at scale? What purity of inputs is required?

3. Environmental impact – using the CLAW framework at least qualitatively but preferably quantitatively. Questions should be asked of the technology as a whole, but also for every deployment/site a company is planning.

a. How do lifecycle carbon emissions compare to gasoline/diesel?

b. Does the deployment plan involve minimal or beneficial land use changes? (palm oil has been a huge concern due to clearing of rainforest in some regions). Does the technology or feedstock lead to encroachment of rain forest regions or other virgin land use? I would not take the political and environmental risks personally. Often other political risks exist.

c. Are there issues associated with airborne emissions during processing or consumption? What has been tested, and at what scale? What are process effluents and local environmental permitting complexity for the technology? Have they been properly accounted for in costs, both capex and opex?

d. How much water is needed for the process, and how does it compare to gasoline production and refining? Water use should be low, less than 5 gallons of water per gallon of fuel, preferably less than 1 gallon per gallon. Fuel production and refining uses anywhere from 1 to 40[16] gallons of water per gallon of fuel combined, with conventional oil refining claiming around 1 to 2.5 gallons water per gallon of fuel.[17]Water quality requirements if any are also important in these comparisons.

4. Scale-up ability –Quick scaling will decrease adoption risk among competitors, and give a first mover advantage. These questions are directed at the company’s end-product

a. Has the technology been demonstrated at least 100,000 gallons per year scale to have reliable process estimates and cost estimates?

b. Are the products approved or registered by the appropriate state and federal agencies? More importantly, since many companies are early and immediate registration is not required, I try and assess the risk in getting the products registered.

c. Is the product fungible with existing infrastructure? Can it be mixed with fuel, oil, other biofuels directly?

d. Can existing biofuel production assets be leveraged?

e. How experienced is the team in handling agricultural and petroleum supply chains?

f. Time to market is critical if a technology hopes to take advantage of mandates and regulatory benefits like tax credits, RINS etc that may disappear within five years. The RFSII regulation in the US has created a huge but time sensitive opportunity. Economics will change over time.

g. Can a facility be easily replicated exactly (“copy exact”) or is each site customized? Is the process designed for remote operation and management so one does not need high level of skills in remote facilities? Customization is often required when a process has waste effluents or needs inputs that are local to a region. Customization increases the difficulty of rapid replication. Need for local skills (versus remote management) makes staffing, training and scaling difficult and more prone to disturbances.

5. Business plan: Do they have a clever business plan in place, e.g., through strategic cost-sharing partnerships or distressed assets? Is there creativity in EBITDA sharing models? Has the company demonstrated the ability to collaborate with partners to reduce risk across the enterprise from feedstock supply to product offtake? Risk management is often one of the larger issues in such projects.

6. Value/Flexibility of end products– Ethanol is only one possible end-product – some technologies are able to produce a variety of chemicals in order to adjust to changing market demand. Synthetic biology fermentation processes tend to effectively produce a single tailored product, while thermochemical systems create a mixture.

a. How much product flexibility does the technology offer from the same capex? Can they supply the market at prices competitive with fossil alternatives? A one-off above market price contract (e.g., with government agencies) does not signal scalability of a company or help in making the technology a winning technology globally. We focus on unsubsidized market competitiveness in a company’s chosen markets. These markets should be worth at least billions of dollars initially and have potential for expansion.

7. Financing: What will be the amount and timing of the financing needed to get to commercial scale and into a self financing mode? What levels of government support (such as DOE or USDA loan guarantees) are included in the financing plan?

[1] Campbell et al., Env. Sci. Technol. (2008)

[4] http://www.biofuelsdigest.com/blog2/2008/10/22/new-energy-cane-varietals-in-louisiana-have-yields-of-up-to-1240-gallons-per-acre/

[5] Energy Information Administration

[6] http://www.ag.ndsu.edu/pubs/plantsci/crops/eb48-1.htm#general

[7] http://www.rirdc.gov.au/reports/ORG/01-34.pdf

[8] http://www.ag.auburn.edu/aaes/communications/agronomy/ay284smgrfor07.pdf

[9] “The Global Potential of Bioenergy on Abandoned Agriculture Lands” J.E. Campbell et al, Stanford University

[10] Land Availability for Biofuel Production; X. Cai et al, Enviro Sci Tech 2011

[12] The Economist; Aug 26th 2010, “The miracle of the cerrado”

[15] Not a generally accepted acronym

[16] The higher numbers come from oil extracted using water injection in depleted oil fields

[17] http://www.epa.gov/region9/waterinfrastructure/oilrefineries.html

***

Khosla Ventures offers venture assistance, strategic advice and capital to entrepreneurs. The firm helps entrepreneurs extend the potential of their ideas in breakthrough scientific work in clean technology areas such as solar, battery, high-efficiency engines, lighting, greener materials like cement, glass and bio-refineries for energy and bioplastics, and other environmentally friendly technologies, as well as traditional venture areas like the Internet, computing, mobile and silicon technology arenas. Vinod Khosla founded the firm in 2004 and was formerly a General Partner at Kleiner Perkins and founder of Sun Microsystems. Khosla Ventures is based in Menlo Park, California.