The rise of distributed energy resources remains a worry for utility executives -- not just in how it erodes their revenues, but in how it affects their distribution grids.

This week, Accenture released a new report that asked more than 100 utility executives in 20 countries for their thoughts on the effects of distributed energy, and what steps they're taking to address the rapid-fire changes being wrought on the grid edge.

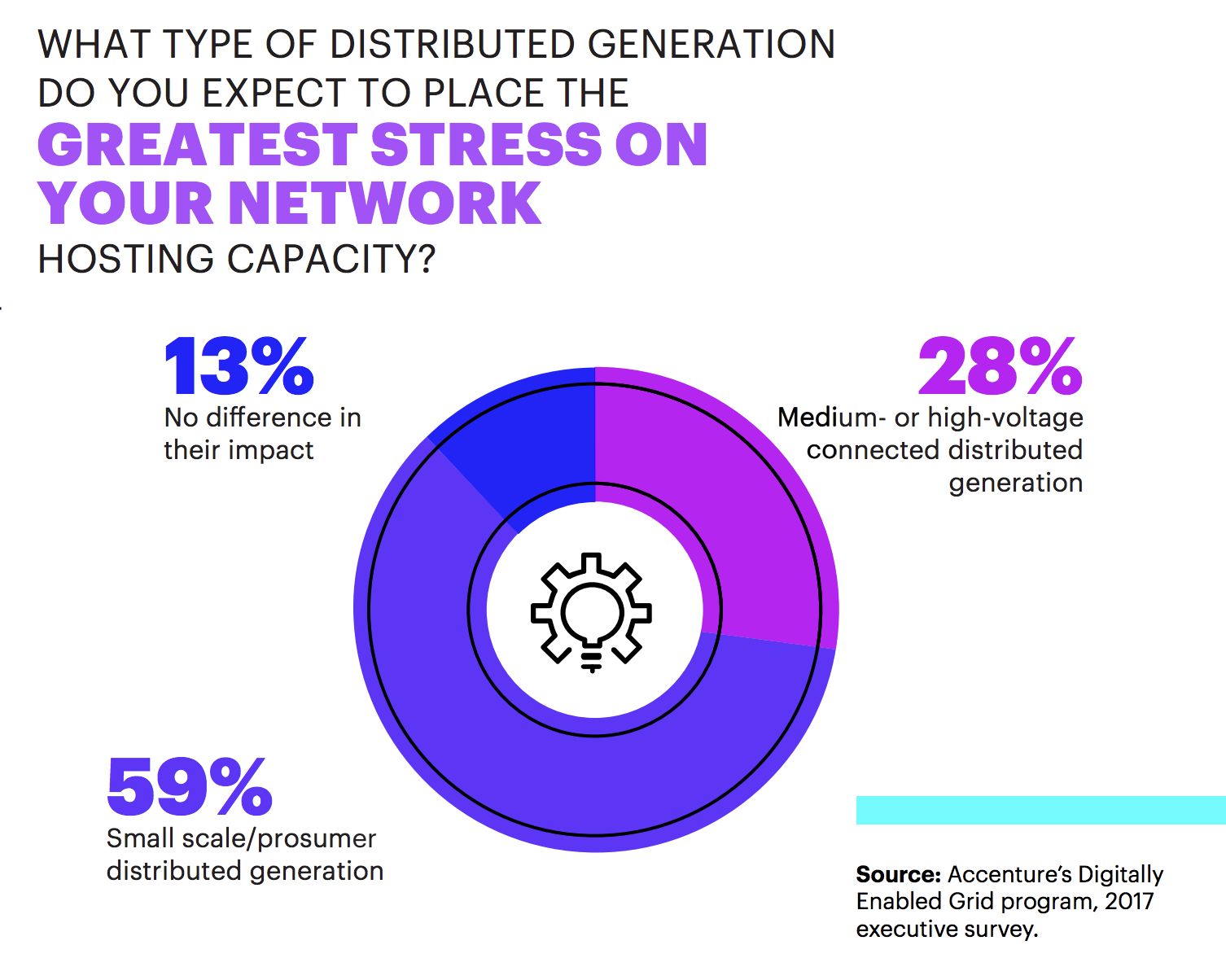

Just under three in five -- 59 percent -- said they’re expecting “small-scale/prosumer distributed generation to place greater stress on network hosting capacity” than any other part of their networks, through the rest of the decade.

These trends will only accelerate over the next decade. Accenture estimates the costs of additional network reinforcement and automation required to manage distributed resources at $20 billion in the United States and €58 billion in Europe through 2030.

At the same time, 61 percent of utility execs surveyed expect distributed energy to reduce revenues by 2030, at least under today’s regulatory structures and business models. For utilities that have to fund grid upgrades through ratepayer revenues, as most U.S. utilities in vertically integrated markets do today, that’s a troubling combination.

Since customers equipped with solar, storage, or other forms of on-site energy are using much less grid power, and thus paying much less into the common ratepayer pot that funds grid improvements, utilities are worried that they’ll be forced into raising rates on everyone else.

That, in turn, would increase the value of distributed resources as a utility bill avoidance measure, boosting deployments, and adding to the costs that the remaining ratepayers must bear -- creating the so-called “utility death spiral."

While the share of customers with distributed energy systems is relatively small today for most utilities, the rise of rooftop solar PV is already putting pressure on utilities in Hawaii, California, Arizona and other solar hotspots. Falling lithium-ion battery prices are expected to lead to a similar rise in behind-the-meter storage, and help lower prices and boost adoption of plug-in electric vehicles.

Accenture’s report linked to its latest consumer research, which indicates that utilities have reason to be concerned about preparing for a rise in customer-owned distributed energy. Some 57 percent of customers are “considering investing to become more power self-sufficient,” and 61 percent are interested in an “online marketplace to sell the electricity they produce.”

Distribution utilities are certainly positioning to fill that role -- 66 percent said they expect their company’s role to “evolve toward DER integrator and DER services market facilitator.” Vanguard states like California and New York are conceiving of utilities as key players in managing the grid edge networks, since they’re already in charge of running the grids that connect them.

However, fewer than one in four utility execs reported that their organizations had made “great progress” in a set of goals Accenture has laid out for utilities seeking to make this transition.

“Smart grid deployments to date have focused more on technology deployment and piloting new grid innovations, but in the vast majority of cases have not ingrained new skills or processes into the distribution utility operating model,” according to the report.