It took some prodding, but utilities are finally upping their game on electric vehicles.

EVs represent an enormous load-growth opportunity for utilities at a time when efficiency measures and distributed generation are causing low or no increase in electricity sales in the United States.

The Edison Electric Institute (EEI), the national association of U.S. investor-owned utilities, has said that electrification of the transportation sector is necessary for the industry to “remain viable” in the long term. And yet many utilities have been hesitant to invest in either charging infrastructure for their customers or in EVs for their own fleets.

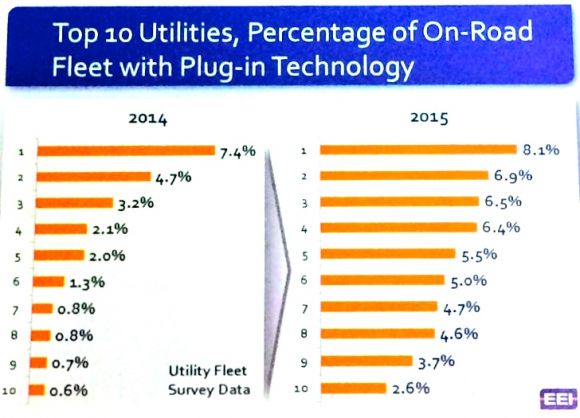

In the U.S., modern EVs came to market in 2010. But as recently as last year, only one investor-owned utility had electrified more than 5 percent of its fleet, according to a presentation made by Anthony Earley, CEO of Pacific Gas & Electric, this week at the EEI annual convention in New Orleans. Earley didn't name names, but PG&E is known to hold the title of having the greenest utility fleet, with more than 1,500 plug-in vehicles.

Tesla Motors CEO Elon Musk, the EEI event headliner, underscored that EVs are the most immediate way for utilities to expand their businesses in the near term, and they could help double electricity demand in the long term.

But first that requires a paradigm shift. Most utilities have been slow to get into EVs because they don’t see cars as a utility issue, or because they’ve been waiting to see if the technology would gain popularity, or because they simply weren’t familiar with the technology and didn’t know how to build a business case around it.

“It’s easy to sit back and buy the vehicles you’ve always bought; you know those vehicles,” Earley told Greentech Media in an interview. “When you bring in electric vehicles, you have to have people who can maintain them, and you have to understand what the economics are to justify them, because electric vehicles tend to cost more upfront. But over their life, they’ll actually cost you less.”

At last year’s EEI convention, Earley publicly challenged his utility colleagues to lead by example and electrify 5 percent of their fleets. One year later, Earley reported that six utilities have now passed the 5 percent threshold and more than a dozen have passed the 1 percent mark -- only six utilities were above 1 percent EV penetration in 2014.

“Now you all know the secret to managing CEOs: shaming works really well,” joked Pat Vincent-Collawn, chairman, president and CEO of PNM Resources.

Over the last year, utilities have taken concrete steps to boost EV adoption. In 2014, more than 70 investor-owned electric utilities committed to investing around $50 million per year, or $250 million over 5 years, to increase the number of EVs in their fleets. Investments in 2015 are already poised to exceed that goal, with $90 million slated for fleet electrification.

This week, EEI and the Department of Energy signed a memorandum of understanding to promote and accelerate the adoption of electric vehicles nationwide through research, outreach programs and charging infrastructure.

The case for rate-based EV infrastructure

A lack of public charging infrastructure is often cited as one of the main barriers to the adoption of EVs, which currently make up less than 1 percent of new vehicle sales in the U.S. Because they are infrastructure companies by design, many argue that utilities are well positioned to lead the charge in building EV stations.

All three investor-owned utilities in California, home to the highest number of EVs in the country, currently have regulation pending to install charging stations in their service territory. The proposals were filed after the Public Utilities Commission lifted a ban on utility-owned EV infrastructure last year.

PG&E has proposed to build 25,000 EV charging stations across its service area, which, if approved, would become the largest deployment of EV chargers in the country. However, PG&E's request for $654 million in ratepayer dollars to fund the program is viewed by some as an unfair burden to place on all utility customers.

How utilities pay for their EV programs could be a sticking point in how their participation in the market progresses. In order to rate-base their investments, regulators will need to be convinced that EVs are a benefit to everyone.

Kansas City Power & Light currently has a proposal to install 1,100 public charging stations filed with the regulatory commissions in Kansas and Missouri, but the utility has decided to move forward with the program before getting regulatory authority. By the end of this month, KCP&L will have installed 300 chargers and expects the entire network to be complete by the end of the year.

The Midwest utility was considering the issue of EV charging for five years before launching the initiative. There was no way to justify the capital investment at current electricity prices without fundamentally changing price signals for customers, said Chuck Caisley, vice president of marketing and public affairs at KCP&L, at the EEI convention.

KCP&L only began debating the possibility of rate-basing its EV investments last year. The first step in that process was collecting input from stakeholders including businesses, environmental groups and political leaders. According to Caisley, these stakeholders universally said that they wanted the utility to pursue an EV program.

“So we took the leap and decided…this was just like a transformer on a circuit of ours; this was essential electrical infrastructure for utilities, and we should be rate-basing and putting it out,” he said.

"We’re being proactive, not reactive"

EV charging is the “Rosetta stone” for everything the utility industry is being asked to do today, things like distributed generation, demand-side management and energy efficiency -- all of which take kilowatt-hours off of the grid and drive up the cost of operations, said Caisley. EV charging helps put kilowatt-hours back onto the grid.

This benefits utilities by creating new load. But utilities say it also benefits the public by increasing throughput on the electrical system, which in turn reduces the fixed costs of running the electrical grid. EVs can also help balance energy usage by charging at night, or help to smooth peaks by charging when solar generation is high during the day. Plus, they help reduce carbon emissions and local air pollution.

For all of these reasons, utilities' EV charging programs are an overall benefit to society and deserve to be rate-based, said Caisley.

“It’s established regulatory thought that incentives and net metering are a good thing, and that we should be doing that for solar. But at a very basic level, that is a subsidy for a small set…of our customers,” he said. “So you cannot make the argument that this very small group of EV drivers, these first adopters, shouldn’t be able to have access to public infrastructure and at the same time say that solar is good.”

David Danielson, head of the DOE’s office on renewable energy and energy efficiency, said one of the first things his agency will do under the memorandum of understanding with EEI is work on a national economic value study to quantify the economic benefits of electric transport on ratepayers, as well as on utility investments in this area.

The study will be commissioned by an outside party, “but it’s likely that those results utility folks can bring to regulators and show the impacts to really convince them of some of the value brought to all ratepayers,” said Danielson.

If regulatory commissions don’t approve KCP&L’s EV charging initiative, the utility will have to eat the $20 million to $25 million cost of the project (which falls within normal spending on similar pilot programs). But if that happens, the utility doesn’t intend to give up on EVs right away. Instead, KCP&L will submit another proposal in a year or two that includes first-hand data on the benefits that EV charging provides, said Caisley.

Most utilities were "asleep at the wheel" when distributed generation came to market, then suddenly found themselves reacting to attacks on the way they do business, he added. "I think [EVs are] an opportunity to reverse that and say, 'Look, there’s value here for all consumers, much more so even than the way we look at distributed generation today.'”

"Unlike with distributed generation...we’re being proactive, not reactive," said Caisley.