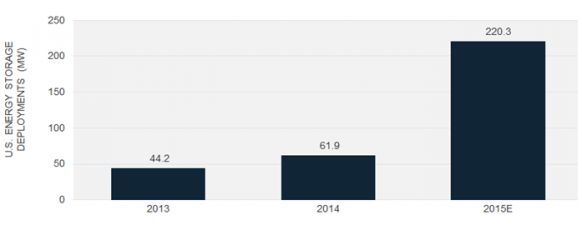

The U.S. is on the cusp of a breakout year for energy storage, according to the inaugural U.S. Energy Storage Monitor report from GTM Research and the Energy Storage Association (ESA). The country is forecasted to deploy 220 megawatts in 2015, more than three times its 2014 total, and growth should continue at a rapid clip thereafter.

Over the course of the past year, 180 grid-connected electrochemical and electromechanical storage installations came on-line, representing 61.9 megawatts of power capacity. That’s up 40 percent from the 44.2 megawatts completed in 2013, according to the report.

It is the first in a series of quarterly reports that the newly minted GTM Research and ESA collaboration will publish on the accelerating U.S. energy storage market. The research covers deployments, markets, policies, financing, pricing and installation forecasts.

FIGURE: U.S. Energy Storage Deployments 2013-2015E

Source: GTM Research/ESA U.S. Energy Storage Monitor

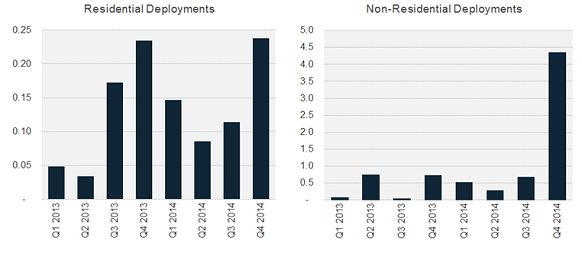

Ninety percent of new U.S. energy storage capacity in 2014 was in front of the meter, while 10 percent was behind the meter at residential or non-residential (commercial, education, military or nonprofit) sites. The report notes, however, that both behind-the-meter segments saw a drastic increase in deployments in the fourth quarter of 2014. GTM Research expects behind-the-meter storage to account for 45 percent of the overall market by 2019.

FIGURE: U.S. Behind-the-Meter Energy Storage Deployments (MW of Capacity)

Source: GTM Research/ESA U.S. Energy Storage Monitor

“The U.S. energy storage market is nascent, but we expect it to pick up more speed this year,” said Shayle Kann, Senior Vice President at GTM Research. “Attractive economics already exist across a broad array of applications, and system costs are in rapid decline. We expect some fits and starts but significant overall growth for the market in 2015.”

The energy storage market is geographically concentrated within the U.S., with the vast majority of deployments in a small number of markets. The report cites PJM and California as taking the early lead in policy, regulatory drivers, and wholesale market structure to encourage storage deployments. In fact, two-thirds of all deployed capacity in 2014 was located in PJM. The market was concentrated in terms of technology as well, with 70 percent of all 2014 deployments using lithium-ion batteries.

“Demand continues to rise for energy storage solutions -- for the entire range of applications,” said Matt Roberts, executive director of ESA. “Companies that understand the market opportunities and the competitive policies that are driving adoption are poised for immense growth.”

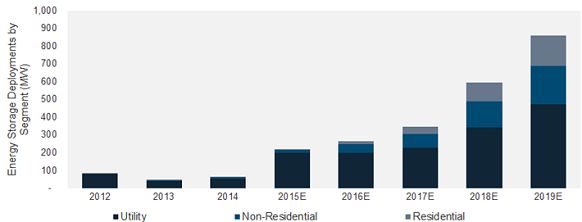

According to Ravi Manghani, energy storage analyst and lead author of the report, “the next five years will be all about growth.” By 2019, GTM Research expects the U.S. energy storage market to reach 861 megawatts annually and be valued at $1.5 billion, about 11 times its size in 2014.

FIGURE: U.S. Energy Storage Deployments by Segment, 2012-2019E

Source: GTM Research/ESA U.S. Energy Storage Monitor

Key findings from the report

- The U.S. energy storage market grew 40% in 2014, installing 61.9 MW

- 90% of storage capacity was in front of the meter

- Weighted average system prices were $2,064/kW in 2014

- The total energy storage market size in 2014 was $128 million

- GTM Research forecasts 220 MW of energy storage installations in 2015

- By 2019, the U.S. will be an 861 MW annual market, valued at $1.5 billion

***

About U.S. Energy Storage Monitor

Delivered quarterly, the U.S. Energy Storage Monitor is the industry’s only comprehensive research on energy storage markets, deployments, policies and financing in the U.S. These in-depth reports provide energy industry professionals, policymakers, government agencies and financiers with consistent, actionable insight into the burgeoning U.S. energy storage market. Learn more at www.energystoragemonitor.com.