The financial services firm UBS is predicting a "difficult year ahead" for global investor-owned utilities.

In a recent research paper, UBS equities analysts outlined a combination of challenges for utilities: rising interest rates that will likely push investors toward higher-risk stocks and away from utility stocks, as well as the slowing demand for power worldwide.

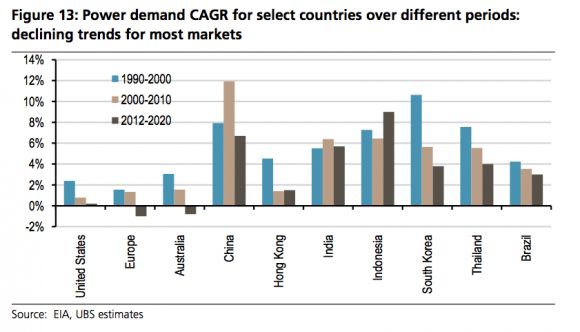

The second issue is a structural one that will afflict utilities well beyond 2014. Through 2020, UBS analysts predict negative growth in Europe and Australia, zero growth in the U.S., and substantially slower growth in developing countries where new power supplies are being added most rapidly.

"We forecast year-on-year power demand growth to be negative in key developed markets in 2014 and beyond," wrote the analysts. "Regulatory and consumer focus on energy efficiency initiatives will further erode the demand pie. Simultaneously, we expect renewables -- especially solar and wind -- to continue to gain competitiveness as cost structures improve, and renewables supply to further pressurize the demand curve and profitability of conventional generators."

Aside from Indonesia, most key emerging markets will see considerable declines in electricity demand compared to traditional growth rates. A combination of emerging efficiency standards and increasing renewables deployment are causing the slowdown. However, UBS is still modestly bullish on these markets due to their overall growth potential, as the following chart indicates.

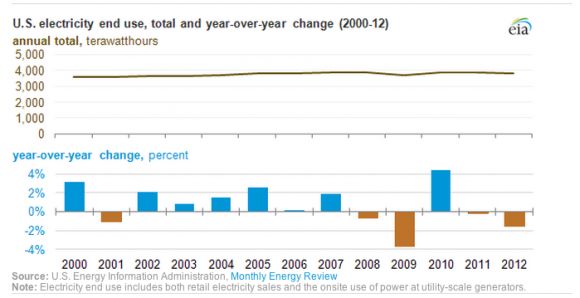

Two reports just released by the U.S. federal government echo the demand trends for developed markets outlined by UBS.

On Friday, the Energy Information Administration reported that U.S. electricity sales have fallen in four out of the last five years, and will likely decline again in 2013. According to EIA, demand in the industrial sector continues to drop, while demand in the commercial and residential sectors remains flat. Meanwhile, utilities are set to spend $15.6 billion on efficiency programs by the end of the decade, with an increased focus on demand response.

Renewables also continue their strong ascendance in America, aided by flat demand. According to the latest figures from the Federal Energy Regulatory Commission, renewables provided 99 percent of all electricity generation capacity in October, and 100 percent in November.

However, overall penetrations are still relatively low compared to Europe, and U.S. power providers have avoided many of the hardships that large European utilities have faced. Since 2008, the top twenty European utilities have lost half their value due to a confluence of conditions in deregulated markets: declining demand for electricity, an over-build of fossil plants, and slipping wholesale prices from renewables.

Along with efficiency, UBS predicts that distributed solar will have the most disruptive impact on utilities in the coming years -- particularly in Europe.

"Over 2014, distributed, point-of-use solar should prove to be the most disruptive renewable technology. Distributed solar (rooftop solar panels at end-points of consumption) are becoming economical at a faster pace compared to utility-scale solar or wind installations," concluded UBS. "In several liberalized power markets, rooftop solar panels are driving power prices at the margin; and given their zero marginal production costs, they are pushing thermal generation down the merit order."