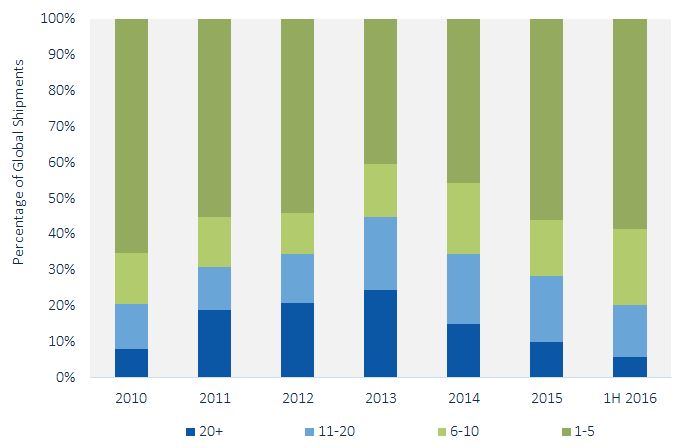

The solar PV inverter market is concentrating, with the top 10 inverter manufacturers accounting for 80 percent of global shipments in the first half of the year, according to GTM Research’s latest report.

“We haven’t seen the leading vendors hold share this high since 2010, when solar demand was highly centered in continental Europe,” said Senior Solar Analyst and report author Scott Moskowitz.

In fact, the top five vendors alone made up more than half of global inverter shipments.

FIGURE: Market Share Breakdown of Global Shipments by Vendors Ranked 1-5, 6-10, 11-20, and 20+

Source: The Global Inverter and MLPE Landscape H2 2016

The report, The Global Inverter and MLPE Landscape H2 2016, is a comprehensive analysis of the global inverter market and profiles 31 vendors in the space.

Huawei maintained its top position from 2015, shipping 17 percent of the world’s supply of PV inverters in the first half of the year. However, in terms of inverter revenue, SMA was again the leading player.

Bankable suppliers are gaining share as low prices continue to drive out competition. Inverter prices in some segments have fallen by 10 percent in just the last six months.

“Pricing pressure remains a constant, unrelenting reality in the maturing solar inverter market,” said Moskowitz. "Central inverter prices in the U.S. have fallen the most half-over-half due to increased competition from string inverters and proliferation of lower cost, 1,500-volt models”.

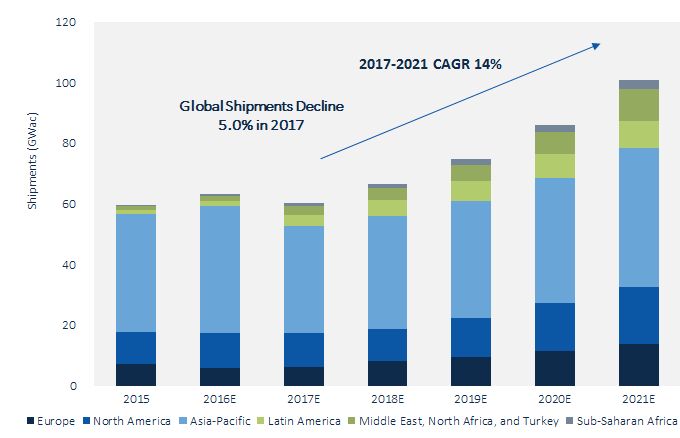

Global PV inverter shipments will reach a record 63.5 gigawatts (AC) in 2016 before declining 5 percent in 2017 due in part to reduced demand in the world’s three largest solar markets: China, The United States and Japan. Despite the shipment drop, inverter revenue will fall by just 1.2 percent in 2017 with gains coming in sales of residential string inverters and module-level power electronics.

The long-term outlook is more positive. GTM Research forecasts shipments to surpass 100 gigawatts by 2021, led by China, albeit a declining share. The report notes that new markets in the Middle East and South East Asia will be the fastest growing regions between 2016 and 2021.

FIGURE: Global PV Inverter Shipments by Region, 2015-2021E (MWac)

Source: The Global Inverter and MLPE Landscape H2 2016

***

For more data and analysis, download the executive summary here.