The market for distributed batteries in the U.S. has largely been limited to states with obvious economic benefits: California and New York.

With a robust storage target, high demand charges, and an incentive program for behind-the-meter batteries, California is a clearly compelling place to do business. Although New York is still grappling with the safety of using lithium-ion batteries in buildings, the state's high demand charges make lead-acid storage an attractive offering for commercial businesses looking to shave their power bills.

Installers are increasingly looking to couple these battery systems with solar, although still in limited numbers in only a handful of states.

But are companies thinking too narrowly about where to put these systems? Are there less obvious markets where solar-plus-storage makes sense?

The Clean Energy Group (CEG) set out to answer those questions in an economic analysis of combined PV and battery systems in three cities. The organization didn't just model traditional commercial buildings. Rather, it focused on affordable housing with 100 to 300 units -- a market underserved by solar and battery installers alike.

"Most of the activity is only geared to high-end economics. This project is designed to bend the arc of that trend," said Lewis Milford, president of CEG and one of the authors of the report.

CEG found favorable economics for solar-plus-storage on affordable housing units in Chicago, Washington, D.C., and New York. The analysis modeled project expenses, operations and maintenance costs, average utility bills, grid services, solar renewable energy credits, capital depreciation, local incentives and the federal Investment Tax Credit. It also assumed that lithium-ion batteries were replaced after 10 years and lead-acid batteries were replaced after seven years.

The report was written for two reasons: first, to show that affordable housing can be a viable market for installers, and second, to show that solar-plus-storage is viable as a resiliency tool to protect against outages.

"As we worked to examine the economics of these systems in the multi-family affordable housing sector, we began to realize how persuasive the economics for solar-plus-storage projects can be -- effectively meeting a building’s common area electricity demands from clean energy while providing resilient power for free, in many instances," wrote the authors.

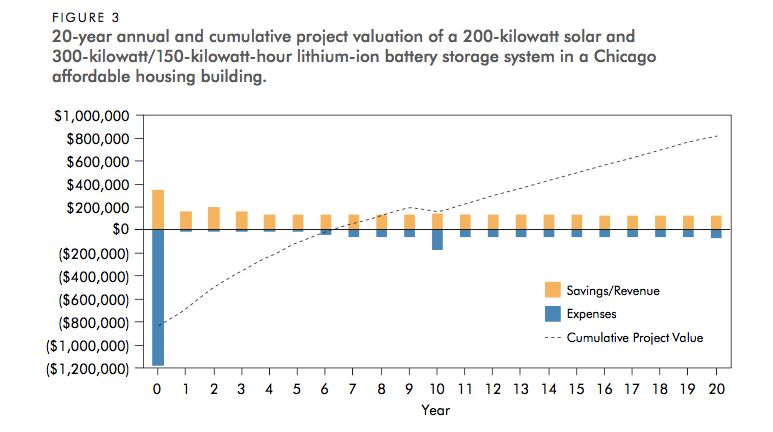

Chicago: 6.2-year payback

CEG modeled three different systems in Chicago: a 200-kilowatt PV-only system; a 200-kilowatt solar system with a 100-kilowatt/50-kilowatt-hour lithium-ion battery; and a 200-kilowatt solar system with a 300-kilowatt/150-kilowatt-hour lithium-ion battery.

Because of mediocre insolation, low electric rates and poor incentives, the solar system on its own offered a 20-year payback. But the addition of batteries improved the economics considerably. Since Chicago is part of the PJM market, where frequency regulation services from distributed batteries are currently assigned a value, the larger battery system sped up the payback to 6.2 years.

"Put simply, the larger the battery, the greater the frequency regulation revenues generated. Because the soft costs involved in installing a battery system do not tend to scale proportionately with the size of the storage system, these costs typically account for a smaller portion of the overall system cost as storage capacity is increased," wrote the authors.

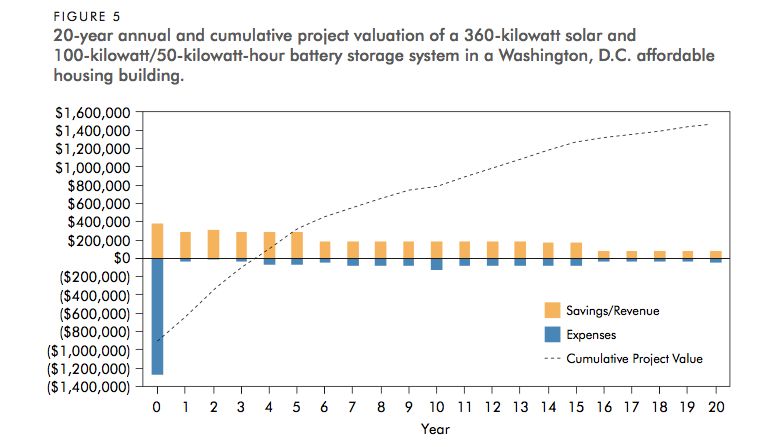

District of Columbia: 3.5-year payback

CEG modeled two systems in Washington, D.C.: a 360-kilowatt PV system and a 360-kilowatt PV system with a 100-kilowatt/50-kilowatt-hour lithium-ion battery.

The solar system on its own offered a very short payback of 3.5 years. This is because of the District's high solar renewable energy credit prices. While the lithium-ion battery added $113,000 in upfront cost, the solar-plus-storage system benefited from frequency regulation services in the PJM market -- keeping the payback period the same. The model also assumed that SREC prices drop by half after year six and vanish entirely after year 15.

"While the payback period is similar for solar-only, the solar-plus-storage system achieves a higher cumulative project value over 20 years and provides a crucial resiliency benefit that solar-only systems cannot," wrote the authors.

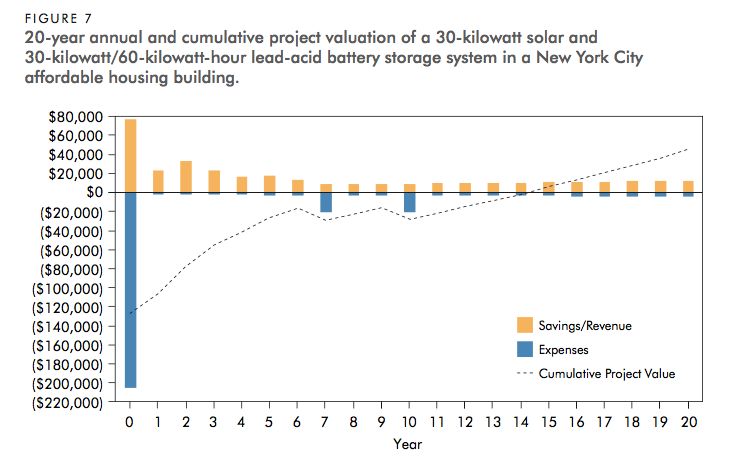

New York City: 14.2-year payback

CEG modeled two systems in New York City: a 30-kilowatt solar-only system and a 30-kilowatt solar system with a 30-kilowatt/60-kilowatt-hour lead-acid battery. (The lead-acid battery was used because New York fire codes limit the use of lithium-ion batteries in commercial buildings.)

New York's local incentives for solar give the PV system alone a payback of 4.3 years. The solar system was sized much smaller than in Chicago or D.C. because of rooftop restrictions in the city.

Adding storage extends that payback considerably. Batteries under 1 megawatt of capacity are currently not able to participate in the New York ISO frequency regulation market. The lack of revenue from grid services made installing a battery much less economic there. However, conventional peak shaving did offer an opportunity for storage -- just with a much longer payback than the other cities modeled.

"Despite all of these obstacles, the economic return for such a solar-plus-storage project in New York City is still favorable. Even with the local market and regulatory barriers, the economic analysis results in a net positive return over the life of the project," conclude the authors.

Multifamily housing is traditionally underserved in terms of efficiency, solar and storage. CEG is hoping to show that the opportunity for solar-plus-storage is broader than demand-charge management for commercial or industrial buildings.

But economics alone aren't going to stimulate activity. Development is limited in the sector because of the lack of rated credit for multifamily housing complexes -- a problem that has plagued commercial solar deployment overall. There are also inherent conflicts between tenants and landlords over who will see the benefits of a distributed energy system or efficiency improvements. Solving these challenges means creating incentive programs aimed directly at affordable housing, argued CEG.

"We have this tremendous activity at the commercial and industrial level. But how do we put incentives, financing and data together to bend that technology trend? The market itself is not going to make it happen on its own in the near future," said Milford. "It's a very interesting public policy challenge."