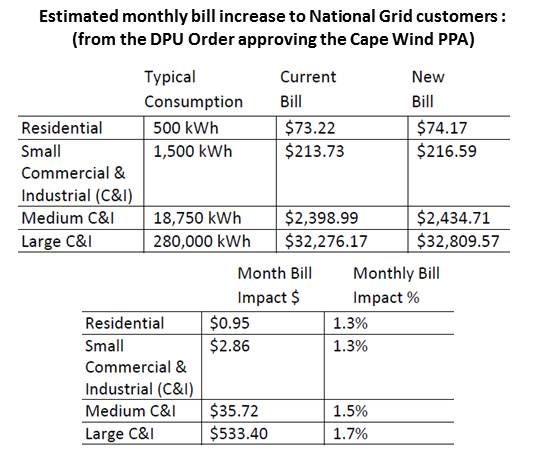

Cape Wind cleared another legal hurdle in the last week of 2011 and claimed its place as the most likely first full-scale U.S. offshore wind installation. The Massachusetts Supreme Judicial Court (SJC) affirmed the state’s Department of Public Utilities (DPU) decision that the Power Purchase Agreement (PPA) between Cape Wind and National Grid, the state’s utility, would be a cost-effective use of ratepayer money.

The PPA requires National Grid to pay Cape Wind 18.7 cents per kilowatt-hour for 50 percent of the 468 megawatt project's output in the first year of operation (which may be 2014 or 2015) and 3.5 percent more each subsequent year over the 15-year contract. Well-funded opponents of the project backed by Koch brothers coal money, according to Cape Wind spokesman Mark Rodgers, claimed National Grid’s PPAs should be made on a strict “least-cost basis.”

The SJC supported the DPU’s opinion that Cape Wind has “unique attributes,” Rodgers said, and offers National Grid’s customers benefits unavailable from other renewables. State mandates require the utility to obtain 15 percent of its power from renewables by 2020.

Least-cost wind, Rodgers explained, would have to be brought in from out of state, but transmission constraints make that problematic and potentially expensive. Furthermore, he added, Cape Wind-generated electricity is available at peak demand periods and, even at the PPA rate, often beats the peak period spot market rate. A recent Charles River study, Rodgers noted, found Cape Wind’s electricity could save the state’s electricity customers “billions.”

Cape Wind expects a final Federal Aviation Administration (FAA) finding of “no hazard” to clear up its last remaining regulatory obstacle, Rodgers said, leaving only two additional hurdles: finding a buyer for the 50 percent of its output not covered in the National Grid PPA and finding project financing.

Rodgers said the legal certainty from the SJC decision should help in the pursuit of both.

Being unable to secure financing for a 200-megawatt project off the coast of Delaware forced NRG Energy subsidiary Bluewater Wind to forego its PPA with Delmarva Power & Light (DP&L) and turn its $2-million-dollar deposit over to DP&L ratepayers in the same week as the Cape Wind success. Bluewater Wind’s PPA with DP&L was done in 2008, making it the first U.S. PPA for offshore wind. Both NRG Energy and DP&L said they hope to see the project go forward when it becomes financially feasible.

Bluewater Wind founder and CEO Peter Mandelstam recently told GTM he is committed to the project.

“We’ve continued to hold discussions with several potential buyers and investors but haven’t yet concluded a deal,” reported NRG Energy spokesman David Gaier. “We’ll prudently maintain our offshore wind assets -- which includes working with the Bureau of Ocean Energy Management (BOEM) on a lease for the Delaware project -- and continue to seek a buyer or major investor for that project.”

_540_449_80.jpg)

Financing flowed to onshore wind projects as the year closed, potentially foreshadowing the boom-and-bust in store for the industry if Congress does not resolve the political gridlock holding extension of its vital production tax credit (PTC) hostage.

NextEra Energy Resources subsidiary Redwood Trails Wind LLC obtained $234 million in financing for 236.8 megawatts of wind energy projects in Oklahoma and California, and subsidiary Golden Winds LLC got $131 million for 2011 and a promised $78 million for early 2012 for 205.9 megawatts at three California project sites. JPMorgan Capital Corp. was the only financing institution named.

Edison Mission Energy got $242 million in financing for three contracted wind energy projects, two in Oklahoma and one in West Virginia, totaling 204 megawatts. Funding for the two presently producing Oklahoma projects will be available immediately. Backing for the West Virginia project will be made available when it goes into operation early next year. Providers for the financing package and letters of credit were not named.

First Wind obtained $210 million in financing for its 105-megawatt Palouse Wind project in Washington state, scheduled to go on-line in 2012. KeyBank National Association, Nordduetsche Landesbank Girozentrale, CoBank ACB, and Banco Santander were the involved financial institutions.

Wind industry watchers expect a lot of money to be invested in projects that can go into operation before the PTC expires at the end of 2012, fueling a wind boom. If the PTC is not extended, investors in pursuit of tax equity -- estimated to represent some $7 billion -- are expected to take their money elsewhere, causing an industry downturn.

When Congress allowed the tax credit to lapse in 1999, the wind industry’s installed capacity fell 93 percent. When it lapsed in 2001, the drop was 73 percent. A 2003 lapse produced a 77 percent drop.

This time, however, the consequences of a bust in 2013 could impact the economy at large, according to American Wind Energy Association (AWEA) CEO Denise Bode, because “the wind manufacturing sector has really grown over the last four or five years” from “25 percent of our component parts being manufactured in the U.S. to over 60 percent. You have not had the PTC expire at a time when you had such significant [numbers of] manufacturing jobs at stake.”