The U.S. solar market nearly doubled last year. From 30,000 feet, it's a spectacular view.

Along with soaring 95 percent, solar actually became the largest source of new generating capacity in 2016 -- beating gas and wind.

Take a look.

But come down closer to earth, and the view changes drastically.

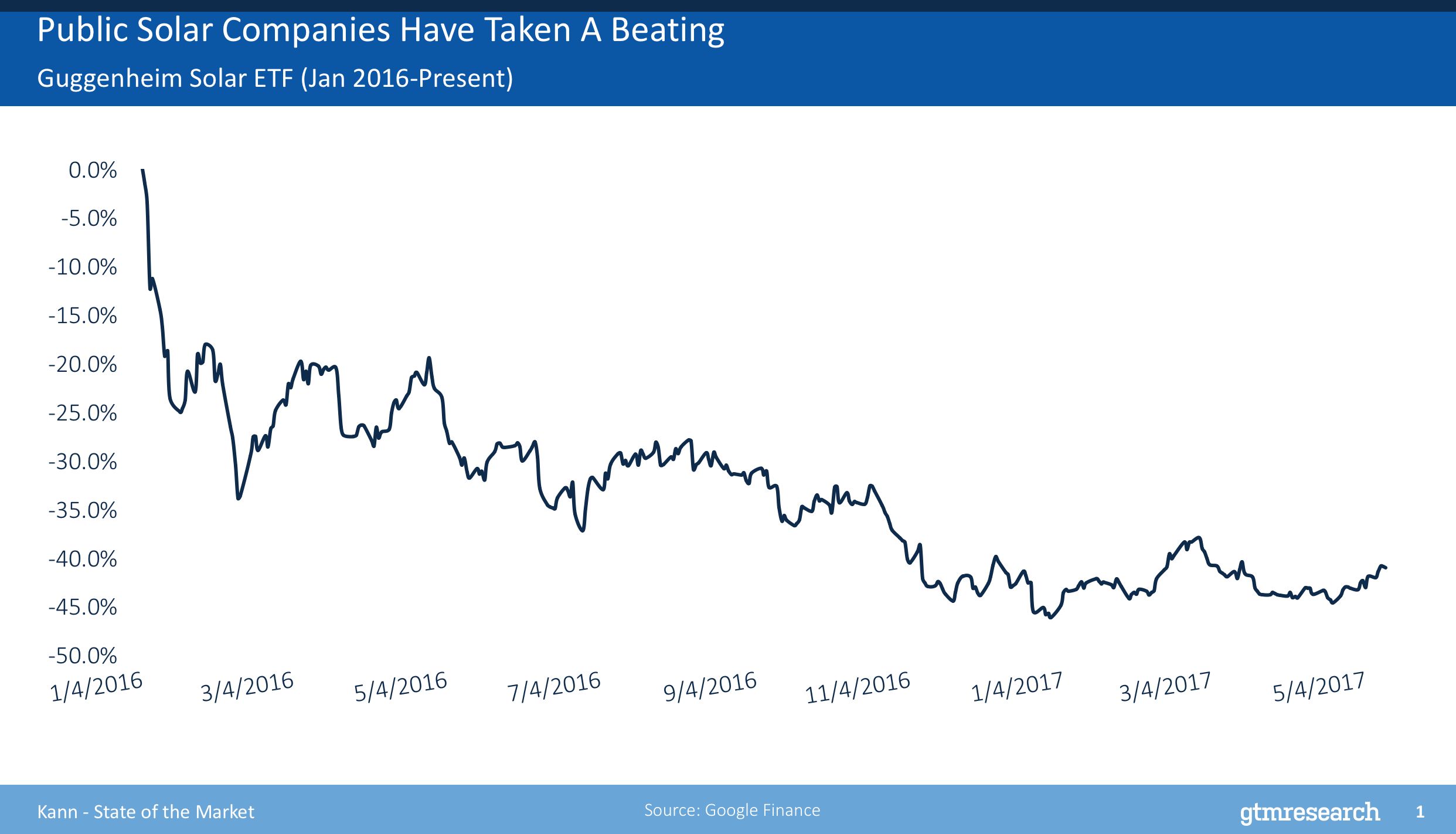

Public companies are watching their valuations tumble, and investors are taking their money elsewhere. With residential companies restructuring and manufacturers under severe pricing pressure, it's hard to see how the trend will reverse anytime soon.

But if installation volumes are so high in the U.S. and around the world, why are investors so down on the sector?

We've chewed on this before. Many of the problems are unique to individual companies. However, they do share a common theme: too much complexity and a lack of discipline.

It’s not about the macroeconomics of solar, says Vishal Shah, a managing director at Deutsche Bank. It's about simplifying business models, ditching the growth-at-all-costs mentality, and telling investors a clear story.

“If you look at the industry overall, the volume increase has been quite significant. We don’t see that stopping," said Shah, speaking at GTM's Solar Summit this week. "What this industry needs is cost discipline."

Investors see solar business models as overly complicated or too risky in a vicious pricing environment. "Simplify the business model," exhorted Shah.

He offered some examples.

Before getting acquired by Tesla, SolarCity's vertical integration strategy, ballooning customer acquisition costs, and confusing accounting practices turned a lot of investors off. But when the company finally focused on more moderate growth and lower installation guidance, "the Street didn't like that" either.

Investors found it difficult to understand SolarCity's complex story, said Shah.

Now that the company is a part of Tesla, it will be harder to evaluate its performance. (Although it now arguably benefits by becoming a part of the Elon Musk narrative, and hiding some of its problems within a much larger company.)

SunEdison's breathtaking collapse was also caused by too much complexity. Instead of focusing on steady project origination and development, SunEdison became a financial engineer and too much growth. Its planned acquisition of residential installer Vivint further baffled investors, crushing the stock.

"It became harder to analyze," said Shah. Investors don't want to spend their time trying to figure out the complexity of a sub-billion-dollar market cap company, so they go elsewhere. "That's the feedback."

The inverter and solar optimizer maker SolarEdge -- the most recent solar IPO -- suffers from a different perception problem. While the company has been disciplined and maintained margins of 30 percent, investors are worried that margins continue to fall downward because of severe price competition. "It's hard for a hardware company to go public in this type of environment," said Shah.

So are there other industries similar to solar, where demand is high but companies can't seem to make money?

Look to the airline industry, said Shah.

"There are a lot of similarities. Companies went bankrupt and there was no price discipline. But if you look at airlines today, it's an example of where solar could be."

From 2001 to 2008, 15 airlines in the U.S. alone went bankrupt. But they turned things around quite dramatically by implementing better pricing structures. Since top airlines restructured, the Arca airline index has far outpaced the S&P 500.

Harvard Business Review has published an instructional look at the turnaround in the industry. "We term the steps that the airlines took to save themselves 'edge strategy' -- the strategic monetization of the huge value that often lies untapped on the edge of a core business." (Low fuel prices didn't hurt, either.)

In such a nascent, fragmented solar market, it's hard to say what kind of edge strategies would appeal to investors. For Tesla/SolarCity, it could be the premium solar roof product and a customized consumer experience, rather than growth for growth's sake; for SolarEdge, it could be expanding analytics and distributed resource management.

Meanwhile, public solar companies are stuck in an awkward place. Their addressable market is nearly limitless, but investors still don't agree on the best way to tap that growth.

“It’s hard to make money. But if you look at just the volume trends, there’s no reason not to be bullish on this sector," said Shah.

Are you a Squared member? If so, lucky you -- you can watch this interview and all our other panel discussions from this week's Solar Summit. If not, sign up to get access to a ridiculous amount of in-depth content.