Earlier this year, the internet swooned over the idea of turning everyday roads into solar energy systems that could power cities. The tagline of the inventors: "solar freakin' roadways."

Those without a deep background in energy or materials wondered what could possibly hold back such an innovative idea. Others responded by identifying the long list of problems.

At GTM Research, we focus on making sense of what is happening in the solar industry, spotting trends in technology, and forecasting how these changes will impact the market. Because they're still a far-off technology that may never be commercially viable, solar roadways are beyond the scope of our research.

But there's another environment full of asphalt and steel where solar panels can make a huge impact today: solar freakin’ carports.

In GTM Research’s latest report, the U.S. Solar Carport Market, 2010-2018, we analyze the emerging market and identify growth opportunities across the United States. Here are four reasons why developers are -- and should be -- excited about the U.S. solar carport market.

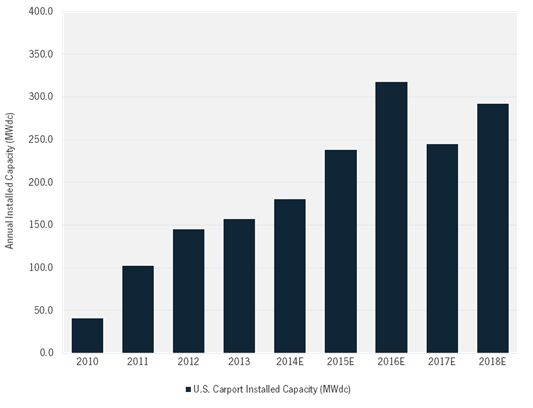

Consistent market growth

While the U.S. non-residential market stagnated in 2014 after having grown only 4 percent over 2013, the solar carport market grew more consistently, and GTM Research forecasts that the market will continue to grow year-over-year until the drop-off in the federal ITC, peaking at 318 megawatts in 2016. Though the solar carport market will remain at a 10 percent to 15 percent share of the non-residential market, we expect that decreasing system prices and developers' growing familiarity with carport projects will keep the market significant on the national stage.

FIGURE: U.S. Solar Carport Market, 2010-2018E

Source: GTM Research report U.S. Solar Carport Market, 2010-2018

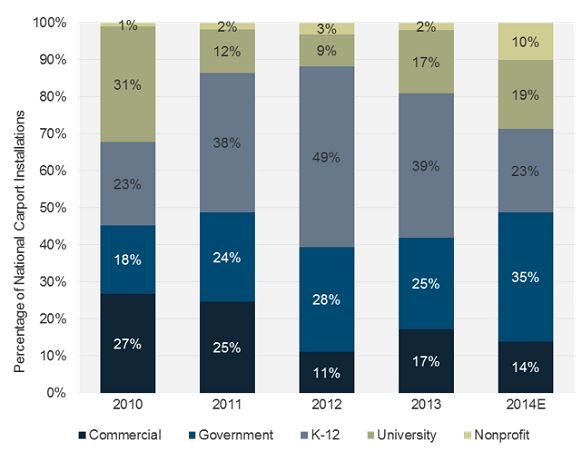

An expansive customer base

The solar carport market has found its groove as a result of average system prices that have fallen 51 percent since 2010 and state-level incentives that have favored the preferred customer for a solar carport systems: schools, government entities, and nonprofits. Solar carports have been championed by the California Division of the State Architect as a way to limit rooftop liabilities for non-residential systems, and developers have targeted those public customers that are less interested in reaching maximum IRRs and more interested in lowering their electric bills.

FIGURE: U.S. Solar Carport Installations by Customer Type, 2010-2014

Source: GTM Research report U.S. Solar Carport Market, 2010-2018

Maturing state markets expanding the solar carport pie

California has been the bedrock of the solar carport industry, with non-residential penetration levels exceeding 30 percent in 2013. Outside of New Jersey and Arizona, however, solar carport penetration has been limited by relatively high ASPs and a lack of scale. Moving forward, we anticipate that state-specific incentives for carports in states like Massachusetts and Maryland, as well as favorable market conditions in Texas, North Carolina, and Hawaii, will broaden the appeal of solar carports and elevate these systems to the status of mainstream solution.

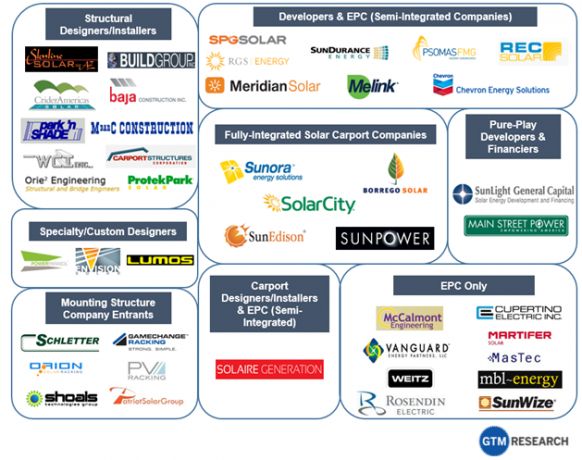

A competitive landscape with falling system prices

In 2013, the leading developers in the solar carport market were the familiar names of SunPower, SolarCity, and SunEdison. Though these developers have their own carport designs and installation teams, the low perceived barriers to entry and heavy market involvement on the part of firms from the standard carport and greenhouse industries have given developers a variety of carport solutions from which to choose.

Turnkey prices for carport structures have fallen dramatically since 2010, and even though the majority of structural costs are tied to commodity steel, we anticipate that improved module efficiencies, lower financing costs, and increased scale and competition will push prices down another 24 percent by 2018. We also expect that as the market grows and pricing competition increases, leading West Coast vendors will begin to spread their focus eastward in search of higher margins. Conversely, East Coast vendors in search of larger state markets will push westward hoping to gain pipeline. The grass isn’t always greener, however, and a sparse developer network will be a challenge for vendors hoping to form relationships with new partners in cross-coast markets.

FIGURE: U.S. Solar Carport Landscape

Source: GTM Research report U.S. Solar Carport Market, 2010-2018

In spite of falling system prices, GTM Research expects the total market value of the U.S. solar carport market to grow to a peak of $843 million in 2016.

***

Download the brochure for the industry's most comprehensive report on the U.S. solar carport market here.