In a new report, GTM Research and Solichamba define solar PV asset management software as “any software product or platform that automates a large portion of the commercial, financial, administrative and technical activities assigned to solar PV asset management staff."

Until recently, most asset management (AM) organizations relied on manual processes and combinations of Excel spreadsheets, and many still do. But several factors are making these methods obsolete: Investor portfolios are growing and diversifying; secondary market transactions require comprehensive documentation about the assets and their history; asset management providers must become more productive to remain profitable amidst increasing price pressure; and markets and regulations are becoming increasingly complex.

Several large AM providers have invested in developing proprietary software solutions to address these issues, and there are now multiple off-the-shelf platforms.

An evolving vendor landscape

The GTM Research report identifies different categories of AM software providers:

- AM software firms like leaders 3megawatt and PowerHub

- Financial software firms like RA Power Management

- Monitoring software firms, some of them actively participating in the AM software market (like Alectris) and others including limited AM functions as part of their monitoring platforms but still uncommitted to offering a full AM software product (like 3E and Power Factors)

FIGURE: Asset Management Software Vendor Taxonomy

Product scope varies by vendor

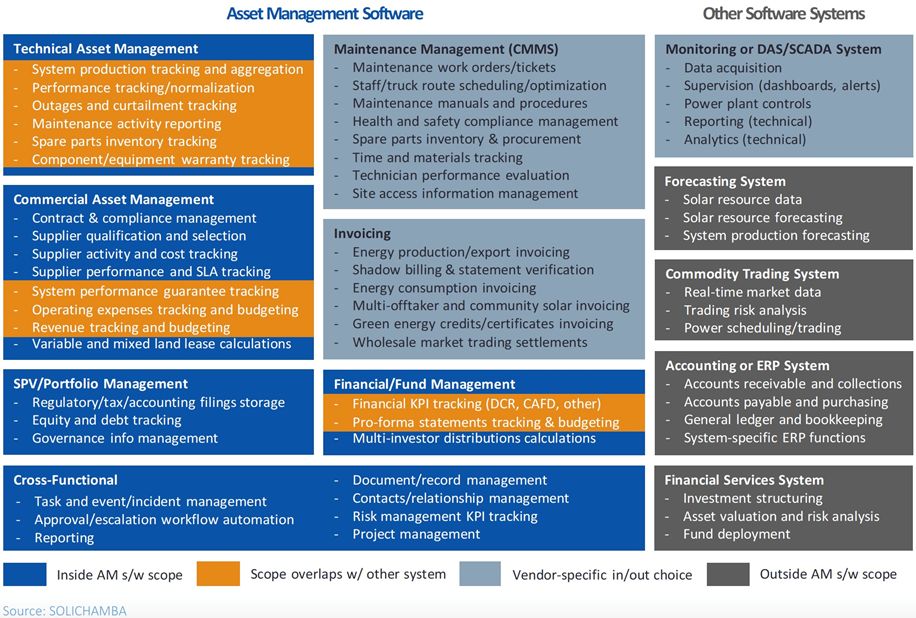

Because AM has areas of overlap with other roles in the solar industry, AM software also has areas of overlap with different software solutions, particularly those used for operations and maintenance, such as computerized maintenance management systems (CMMS) and monitoring systems (also called data acquisition systems, or DAS, and supervisory controls and data acquisition systems, or SCADA).

Since AM also includes activities that are common in the world of finance and accounting, the scope of AM software may or may not include coverage for certain functions that are usually performed with other software platforms that are not specific to the solar industry, such as invoicing and accounting.

For these reasons, the scope of asset management, represented in the figure below from the GTM Research report, includes multiple functional blocks that are sometimes offered by vendors, depending on how they envision their position within the broader software ecosystem.

AM software vs. monitoring software vs. CMMS

Because of the significant areas of overlap between AM software and monitoring software, there is much confusion in the market about the scope of each product, including from providers themselves about the future of their platforms. Monitoring software providers are being asked to provide AM functions, and AM software providers are being asked to provide more monitoring functions. This situation creates tension among industry players and raises the question: Will these two categories ultimately merge?

In the same fashion, the line is often blurred between computerized maintenance management systems (CMMS) and asset management software. Some AM software vendors include a complete CMMS solution, while others rely on third-party product integration or provide a basic functional feature set combined with third-party integration.

While there is no doubt that some providers will decide to play in several spaces and offer monitoring, CMMS and AM in the same platform, this path is far from obvious. AM software must often manage heterogeneous portfolios of plants equipped with different monitoring systems and maintained by different O&M companies, each using a CMMS of its own choice. An integrated software solution covering all these areas would offer value to investors and asset managers with homogeneous portfolios, but could lose some appeal with asset managers in charge of heterogeneous portfolios.

For this reason, GTM Research and Solichamba expect the AM software market, the monitoring software market and the CMMS market to remain distinct in the foreseeable future, although some of the players will continue to operate in multiple markets.

***

For more information about asset management software including market prices, vendor scope comparison and market share, and key trends and outlook, check out the new report Solar PV Asset Management 2017-2022: Markets, Investors, Asset Managers and Software.