In 2012, Suntech was the leading supplier of modules to the U.S. non-residential PV market and the third-ranked supplier to the residential market by market share. While the company’s U.S. subsidiary, Suntech America, will continue operations, the parent’s insolvency poses many questions that will significantly impact its operations in the U.S. solar market.

While Suntech deployed many megawatts of product in the U.S. in 2011 and 2012, GTM Research finds that beyond widespread product failure (which is an unlikely scenario), Suntech’s bankruptcy will have little impact on the U.S. market. Primary reasons include:

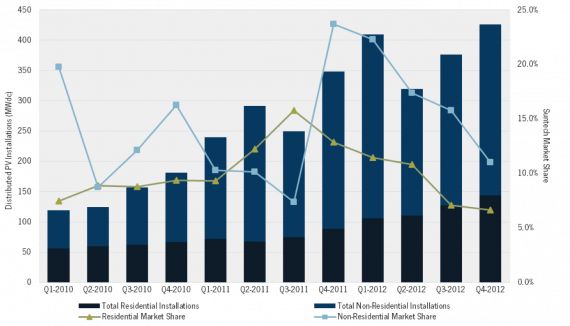

- Throughout 2012, the company had waning market share in both the residential and non-residential markets (see figure below); any uptick in market share will be a result of legacy projects coming on-line in early 2013.

- Major Suntech customers were either heavily reliant on the New Jersey market, which has slowed significantly, or migrated away from the brand in the past year for various reasons. In particular, the Global Solar Fund debacle made many developers and financiers wary of the company’s financial stability and reconsidered forward-looking module supply agreements.

-

Of Suntech’s remaining customers, significant inventory exists among other leading module suppliers such that there will be little to no installation delays.

FIGURE: Suntech Distributed U.S. PV Market Share, 2010-2012

Source: GTM Research

The above analysis from GTM Research analyst Andrew Krulewitz is a selection from a larger PDF flash note available only to GTM Research solar subscribers. To learn more about becoming a subscriber, contact Justin Freedman at [email protected].

The above analysis is derived from data harvested for and contained within GTM's U.S. PV Leaderboard and U.S. Solar Market Insight subscription services. To learn more about the U.S. PV Leaderboard, visit www.greentechmedia.com/research/pv-leaderboard; for more on U.S. Solar Market Insight, visit www.greentechmedia.com/research/ussmi.