A smart grid can't be created without smart buildings.

This can be achieved through a combination of using advanced building energy management systems (BEMS) and enterprise energy management systems (EEM). This has been practiced for some time, but until recently, only on a semi-automated basis.

However, as Memoori's latest report shows, fully automated systems have only just started to get off the ground, despite the fact that the technical potential demand over the next twenty years amounts to $30 billion and could reach $1.7 billion by 2017.

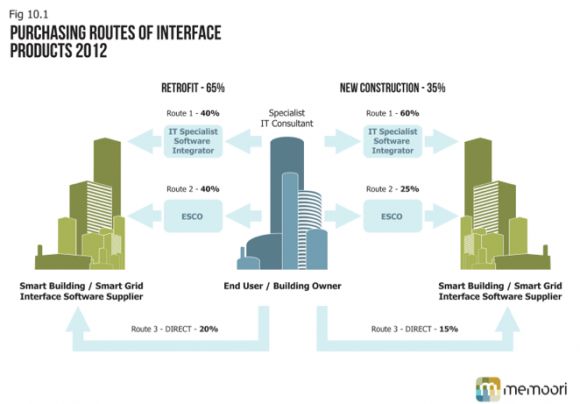

By far the biggest share of this will be spent by the owners and operators of smart buildings, putting the BEMS companies in the lead, followed by ESCOs. These companies include Johnson Controls, Honeywell, Schneider, Siemens and ABB. They are the world’s leading suppliers across both sectors, and the latter four are also leading international suppliers of smart grid products and services. They are in daily contact with the owners of smart buildings who are existing clients, both through installing their BEMS and also taking their ESCO service. This gives these companies a massive heritage estate to work on.

EEM suppliers will have to take this into account when developing their business models, if they are to make an impact on this business. They will need to form alliances with the BEMS and ESCO companies or their system integrators. This is particularly true for smaller EEM companies, which will need to target the priority markets.

This is a very fragmented market, with hundreds of thousands of smart buildings, and identifying the buying influence will not be an easy task. It is a different matter for the major EEM companies, because most of their clients will be owners of very large smart building real estate portfolios. Thus, they will have contact with sources that will influence the decision-making process for EEM purchases.

The process of connecting BEMS in smart buildings to the smart grid to deliver demand response, efficiency and distributed energy remains a niche market. But the potential is clear: the cost of installing it could be less than 1 percent of the investment required to deliver a comprehensive smart grid.

Who will take advantage of it?

***

Jim McHale founded Memoori in 2008. It is a consultancy based in London that provides market research, business intelligence and financial deal tracking services to clients across several industries.

This article was abstracted from Memoori’s report The Market for Connecting Smart Grid With Building Energy Management Systems, 2013 to 2017. It is a definitive resource for smart-grid-to-BEMS-interface market research and investment analysis, combining market size statistics with analysis of mergers, acquisitions and investments.