The International Energy Agency has released its latest report on “digitalizing” the world’s key industries, with a focus on the electricity sector.

The report includes some long-range projections for how much the world will need to invest in “smart” demand response, renewable energy integration and electric vehicle charging over the next two decades or so -- and how many hundreds of billions of dollars that could save us.

Monday’s report, titled Digitalization & Energy, represents ongoing work from the IEA on how digital technologies like networked devices, cloud computing and data analytics are transforming energy-intensive sectors including industry, buildings and transportation.

It also lays out how energy industries such as oil and gas have been leaders in these technologies, and could further increase global reserves by about 5 percent over the span of the study, largely in shale gas.

But the report identifies the electricity sector as the central player in the digital transformation of energy, since it’s interconnected with these different energy sectors. “Together with the progressive electrification of the energy system and the growth of decentralised sources of power, digitalization is blurring the distinction between supply and demand, and creating opportunities for consumers to interact directly in balancing demand with supply in real time," reads the report.

Buildings use the most electricity, and IEA finds that digitalization could cut their energy use by about 10 percent by using real-time data from smart thermostats and networked lighting to improve operational efficiency, on top of the efficiencies to be gained from LEDs.

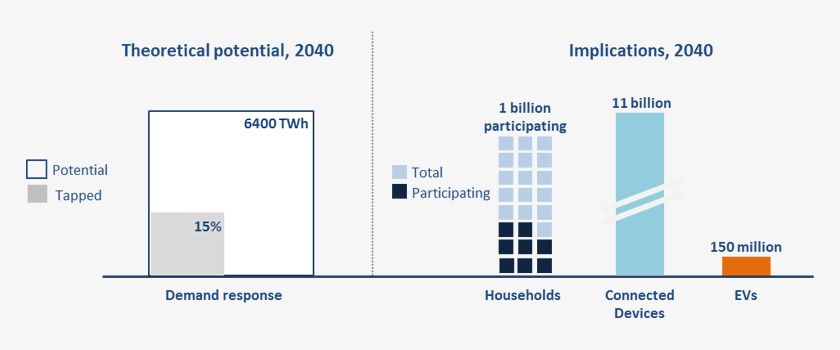

IEA’s analysis also relies on a major investment in demand response that’s much more flexible and adaptive than load controls and remote switches -- specifically, 1 billion households and 11 billion smart appliances by 2040, each actively participating in “interconnected electricity systems, allowing them to alter when they draw electricity from the grid.”

This investment in smarter homes and buildings, however, could provide the equivalent of 185 gigawatts of system flexibility, or as much power as is generated by Italy and Australia combined. It could save about $270 billion of investment in new electricity infrastructure.

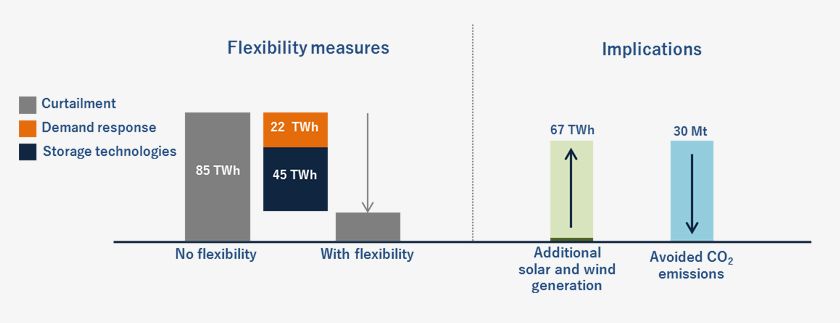

This kind of embedded demand-side flexibility is also a prerequisite for IEA’s next big target opportunity: renewable energy integration. Europe, which is feeling the brunt of market turmoil due to so much wind and solar generation, is a focus of the study. With the right combination of flexible energy storage and demand response, the European Union could reduce the curtailment of solar and wind power from 7 percent today to 1.6 percent in 2040, the report finds.

Energy industry investment in digital electricity infrastructure and software has also grown recent years, rising 20 percent from 2014 to hit $47 billion in 2016 -- more than the $34 billion invested in gas-fired power generation worldwide that year.

Utility-facing benefits of digitalization include tuning up the generation and transmission sectors, via improved power plant and network operational efficiency; reducing unplanned outages and downtime; preventative maintenance; and extending the operational lifetime of assets. IEA finds that these efforts could save $80 billion per year, or about 5 percent of total annual power generation costs.

Finally, IEA is projecting that a lot of electric vehicles will come onto the global market. According to its 2017 Global EV Outlook report, the electric car stock will range between 9 million and 20 million by 2020, and between 40 million and 70 million by 2025.

EVs are a huge new part of digital energy infrastructure, whether as a new source of income for utilities selling electricity, a burden on distribution grid operators, or a source of flexibility for an increasingly distributed grid.

Smart charging technologies, capable of managing each vehicle’s charging needs with a wide range of grid imperatives, could save between $100 billion and $280 billion in avoided investment in new electricity infrastructure between 2016 and 2040, depending on how many EVs end up being deployed.