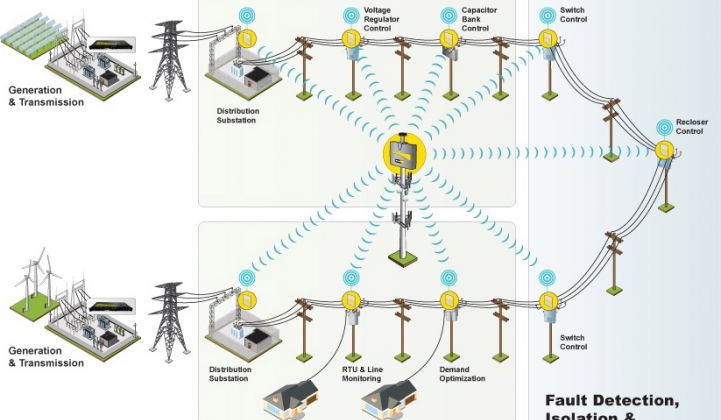

At its heart, distribution automation (DA) technology is aimed at turning a deaf, dumb and blind swath of the power grid -- the low to medium-voltage distribution networks that connect substations to customers -- into a modern IT asset. That means lots of computers and chipsets running the systems that actually control power on the grid, and a modern communications system to manage it all.

The market for DA communications is undeveloped, fractured and complex, however. Utility-to-substation communications via fiber-optic or high-speed radio connections and SCADA control systems are well established. But from substation to end-user, the distribution grid is being lit up by different technologies, all being asked to perform functions that put the last generation of SCADA and grid estimation and modeling techniques to the test.

At the other end, U.S. utilities are also trying to put their smart meters and AMI networks to use in DA. That can include using smart meters as remote outage detectors and power quality monitors, or using the AMI wireless network that supports them as a common communications channel to the utility for all kinds of gear.

At the same time, utilities are also seeing new models emerge for them to rent, rather than own, their DA communications. Public wireless carriers are offering M2M grid communications platforms and services at prices competitive with privately owned and operated utility communications networks, which are the traditional way of doing things in an industry that gets a regulated rate of return out of such capital investments.

GTM Research’s new report, Distribution Automation Communication Networks: Strategies and Market Outlook, 2012-2016, gets into these and other findings in depth, while providing a low- and high-scenario estimate of the U.S. DA communications market at between $600 million and $1.8 billion over the next four years.

That figure represents the communications portion of private utility spending on intelligent distribution grid management and distribution grid operations automation, which comes from vendors like Schneider Electric/Telvent, ABB/Ventyx, General Electric, Siemens, Alstom, Eaton/Cooper, S&C Electric, Schweitzer Engineering Laboratory, UtiliData, Dominion's Edge platform, etc.

That figure is for utility-owned investment, which means it doesn’t include spending utilities may direct at carriers like AT&T, Verizon, Sprint et al. that are making big pushes into M2M communications for smart grid in the U.S.

That figure also doesn’t include network management systems from the likes of Cisco, GridMaven, Proximetry Networks and many others, GTM Research Smart Grid Analyst Ben Kellison noted, as that’s a class of enterprise IT investment not directly calculated in the research figures. That’s not to say that utilities and vendors aren’t spending on NMS for their AMI and DA projects, however. As the report states:

“Utilities are currently managing AMI networks with solutions supplied by the vendors of communications and networking equipment. Network management is not the core competency of these vendors. As a result, these element management systems (EMS) provide services with limited analytics and data to measure and manage network performance.”

That means, in turn, that “technologies that can improve the interoperability of deployed equipment are in high demand by utilities looking to use some AMI equipment to support DA, demand response (DR) and other systems,” the report continues. At the same time, the report warns utilities that the benefits of DA can be “severely eroded if utilities that are now looking to deploy DA plan their systems in the same way that many planned AMI: as a lowest-possible-cost, single-purpose communications system.”

All of this is by way of stating that the benefits of doing DA right can be huge for utilities. Smart meters, at least in the U.S., have turned into a front for consumer opposition for some utilities, and a potential flashpoint for others. DA, on the other hand, is entirely within a utility’s control, with clear operational and regulatory benefits.

Indeed, a recent Ohio PUC audit of Duke Energy’s smart meter and DA programs showed that the benefits of voltage conservation reduction (CVR) alone were equal to the benefits derived from AMI operations and maintenance savings, or about 40 percent of the overall system benefits of $379 million. CVR projects elsewhere are proving their worth as well: one at Progress Energy is saving enough peak power to avoid spending hundreds of millions of dollars on new power plants.

In the meantime, hosted and cloud-based services are quietly running many of the production smart grid platforms in operation today. Silver Spring Networks runs millions of networked smart meters for big utility customers over what’s essentially a cloud-based platform, and is also conducting DA data over its network for customers like AEP. Other smart grid players moving in the same direction include Accenture, General Electric, Honeywell, Sensus and S&C Electric, to name a few.

While GTM Research doesn’t find the same opportunity for hosted systems in DA as found in the AMI space, “it will likely be a strong offering for many utilities seeking to minimize project and operations-based risk,” according to the report. That could be particularly true for the smaller to mid-size municipal and cooperative utilities that don't get to nail down returns for capital expenditures in rate cases, and thus have less incentive to own their own networks.