After much Muskian fanfare, Tesla's Battery Day revealed a smattering of improvements to cut battery prices in half.

Tesla CEO Elon Musk insists he measures the company's success by the extent to which it accelerates the arrival of sustainable energy. Powering electric cars and running a grid on renewable electricity requires a drastic expansion of battery production. The meat of Battery Day was Musk's step-by-step breakdown of the battery production process to squeeze cost out and raise productivity.

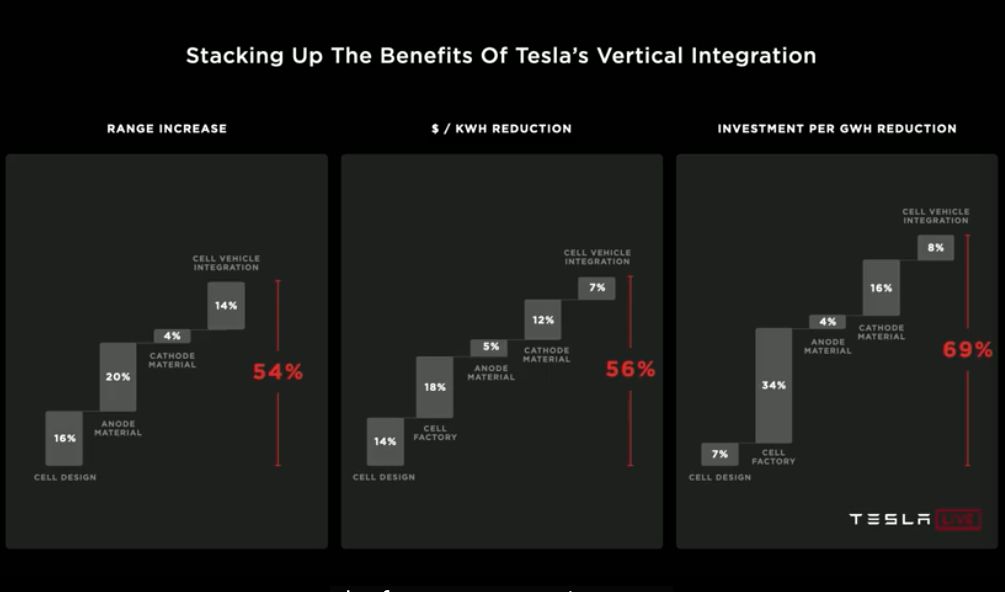

All told, the series of advances will yield a 54 percent increase in range, a 56 percent decrease in the dollar per kilowatt-hour pack price, and a decrease in capital investment required for manufacturing.

The implementation of these improvements will take more than a year, and could take three years for full realization, Musk said.

"If we could do this instantly, we would," Musk told the crowd, socially distanced in Tesla cars like a drive-in theater. "It just really bodes well for the future."

The transparency around the fact that the improvements were not yet fully in effect marked a change from past Tesla events, which portrayed new products as fully formed when they weren't. But instead of flashy product unveilings, Musk stayed true to the framing of Battery Day, delving into the particularities of cathode and anode design, lithium supply chains and custom-cast aluminum alloy battery enclosures.

All the subject-matter expertise adds up to one big takeaway: cheaper electric cars and cheaper energy storage.

"One of the things that troubles me the most is that we don't yet have a truly affordable car," Musk said. "That is something that we will make in the future."

He later added some detail to that claim: Tesla will make a $25,000 electric vehicle in three years (and it will be fully autonomous).

A slide from Tesla's Battery Day presentation shows how several targeted improvements add up to significantly more competitive batteries.

Thicker cells, faster production

The new era starts with a much thicker cell form factor, the 4680. The new design eliminates tabs, rendering it "tabless," which simplifies manufacturing and improves the power-to-weight ratio. The new form factor adds 16 percent range compared to Tesla's current battery cells and reduces the cost per kilowatt-hour by 14 percent.

In a break from the past, Tesla plans to manufacture these cells in-house. Tesla built its car business off a supply partnership with cell manufacturer Panasonic. Panasonic makes cells in the Nevada Gigafactory, then Tesla takes them and turns them into highly engineered battery packs for cars and stationary storage.

But Tesla is ramping up a 10 gigawatt-hour pilot factory in Fremont for its new cell design. It will take a year to hit full capacity there, Musk noted. A full production plant would get to 200 gigawatt-hours or so.

In total, Tesla plans to produce 100 gigawatt-hours of its own cells in 2022, ramping to 3 terawatt-hours by 2030.

The shift to in-house manufacturing does not spell doom for Tesla's cell supply relationships. Instead, Musk said it would be additive in a Tweet posted on Monday: Tesla will buy more cells from Panasonic and new suppliers CATL and LG Chem, and it will produce a bunch of its own.

Besides the new cell design, Musk described a series of manufacturing process improvements. The company is eliminating the solvent addition step, which requires bulky machinery plus considerable time and energy, and replacing it with a dry process.

Tesla watchers had speculated that there would be some announcement of this kind, based on Tesla's 2019 acquisition of Maxwell Technologies, which was working on a dry electrode coating. Musk noted, though, that Maxwell had a proof of concept for dry coating and that Tesla had revised the machinery four times already. “It’s close to working,” he said, making clear it was not commercially ready yet.

Those reforms, plus advances in high-speed, continuously moving manufacturing machines, will improve a single factory line's output sevenfold, Musk said.

Material improvements

Tesla is making headway on new anode and cathode designs as well.

The company is working on a silicon anode, which it thinks will increase range by 20 percent and cut costs by 5 percent. The company is also working on a high-nickel cathode that eliminates cobalt, leading to a 15 percent reduction in cost.

But Tesla is also pushing deeper into the supply chain, and re-engineering cathode and anode production to eliminate wasteful intermediate steps. The company will establish cathode manufacturing using domestic lithium and nickel supplies, Musk said. In fact, Tesla secured mining rights to a 10,000-acre lithium deposit located in the U.S.

A pilot recycling facility will kick off in Nevada next quarter, which could lead to turning old Tesla batteries into new Tesla batteries.

All these measures, if enacted, would streamline supply chains and could insulate Tesla from criticisms of the human costs of global lithium and cobalt mining.

***

Wood Mackenzie's free overview of the US storage market in Q2 2020 is now available. The deck includes high level trend analysis and storage forecasts for all sectors through 2025. Download it here.