TerraForm Power, the YieldCo created by SunEdison to bundle projects for public investors, is buying up another 930 megawatts of wind projects.

The $2 billion portfolio comes from Invenergy, the biggest independent owner of wind power plants in the U.S. TerraForm will own 90.1 percent of the projects and Invenergy will hold a 9.9 percent stake.

The deal consists of two phases. By the fourth quarter of 2015, TerraForm will buy 460 megawatts of projects directly from Invenergy. The other 470 megawatts will be acquired through a warehouse facility and dropped into the TerraForm YieldCo in tranches.

In its first year as a public company, TerraForm has pursued a number of large wind deals. In January, SunEdison and TerraForm acquired 521 megawatts of projects after buying leading U.S. developer First Wind. In June, the companies bought another 521 megawatts of wind from Atlantic Power Corporation.

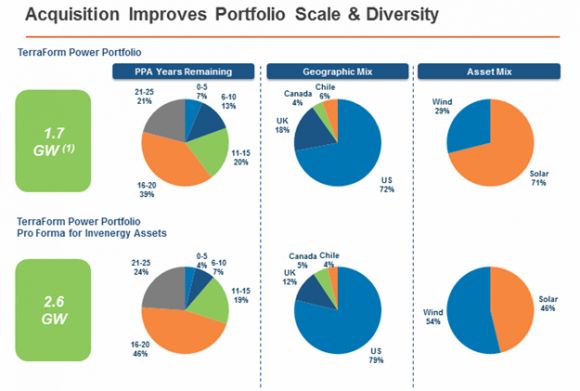

When closed, the deal with Invenergy will bring TerraForm's acquired wind portfolio to nearly 2 gigawatts -- getting the YieldCo closer to a 50-50 split between wind and solar.

"While First Wind added wind exposure, Invenergy goes further by adding 'mainland' wind (42% in Illinois) and further diversification from the solar-heavy SunEdison," wrote UBS equity analysts.

The deal is good news for shareholders. TerraForm management says the new portfolio will increase cash available for distribution by $141 million. That will increase the 2016 distribution per share from $1.53 to $1.70 -- a sign that TerraForm is bullish about growth. By 2019, TerraForm expects distribution per share to reach $2.71.

"We continue to see ample growth opportunities in North America," said Alex Hernandez, the chief financial officer for TerraForm, during a call with investors.

Executives at SunEdison and TerraForm say they have developed a close relationship with Invenergy, which will likely result in more wind transactions for the YieldCo.