Fluence, a leading integrator of large-scale energy storage systems, has acquired grid software startup AMS.

The deal hands an exit to AMS investors, including former California Gov. Arnold Schwarzenegger, who bought into the startup's early vision of turning commercial buildings into flexible grid assets. After winning pivotal utility contracts in California, AMS ran up against the capital constraints of managing a multiyear infrastructure build-out as a venture-backed company. In 2017, it pivoted to software to dispatch grid assets more profitably in competitive markets.

That's the expertise Fluence bought. The joint venture between AES and Siemens already provides software to its battery customers to govern system safety and performance, and to dispatch according to market rules and interconnection constraints. But the AI-backed real-time trading algorithm AMS built will help Fluence customers make more money on their projects, said Fluence CTO Brett Galura.

"Energy storage is really the first truly dispatchable digital asset on the electric grid," Galura said in an interview Wednesday. "We knew that the best way to continue to add value would be to continue to add more digital capabilities."

That alignment echoes a partnership from 2019 when integrator NEC Energy Solutions teamed up with AMS competitor Stem to offer wholesale market assistance to storage customers. But those companies did not merge, and NEC ES recently decided to stop pursuing new business.

The goal of these pairings is to make battery plants, and clean energy plants more broadly, more profitable and efficient in power markets, thereby hastening the acceleration of a lower carbon power grid.

Going digital, going global

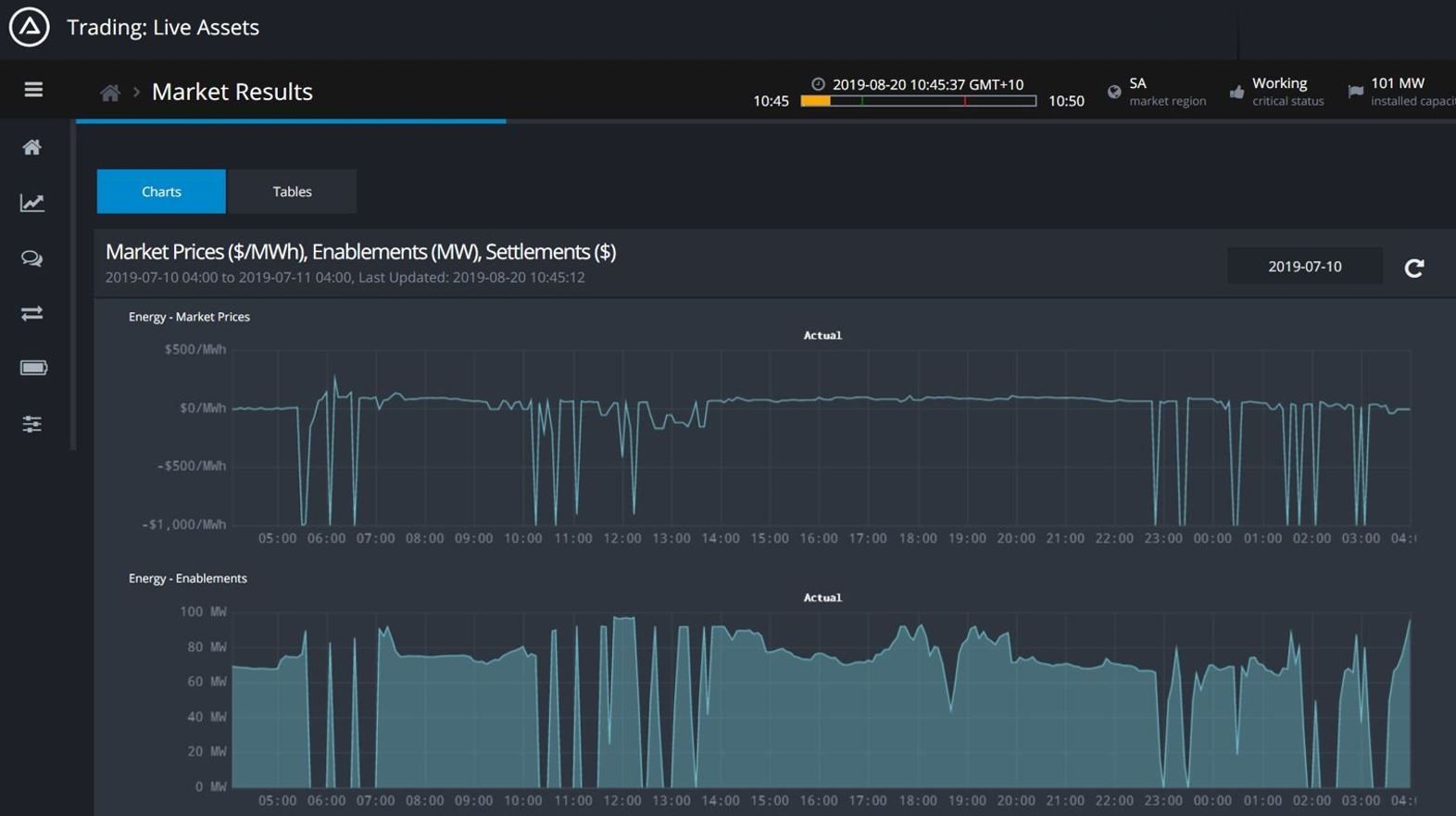

AMS went to market in Australia, attracted by the country's national power market, the rapid rise of renewables and the resulting volatility on the grid. The software helps plant operators juggle real-time fluctuations in many different grid-services markets to make the economically optimal bidding decisions. Sometimes that means pulling out of markets to avoid committing to negative pricing. Other times, it means correctly anticipating and hitting peaks in demand.

Successfully optimizing clean power plant bidding strategy requires crunching too many variables too quickly for a human mind to keep up, AMS contends.

The 100-megawatt Snowtown 1 wind farm in South Australia became AMS' first customer in July 2019. Now AMS dispatches 1.7 gigawatts of Australian renewable or battery plants, with another 500 MW booked. The company more recently launched in California and picked up 200 MW of customers there.

"It’s a really disruptive technology, and the sky is the limit," CEO Seyed Madaeni said. "Fluence is absolutely the right platform for us to scale."

One of the first orders of business is to take the bidding platform, which AMS built out for the particularities of the Australia and California power markets, and adapt it for other geographies. Fluence operates in 22 different countries, and AMS will scale to match, the executives said.

Second time's the charm

They're not starting from scratch: Fluence and AMS have collaborated on joint product offerings to customers for the last couple of years. Indeed, the corporate relationship goes back even further; Fluence parent company AES tried to buy AMS in its earlier incarnation as a project developer with a valuable utility contract after AMS won its Southern California Edison contract in 2014.

AMS founder Susan Kennedy rejected that offer and another one from French power company EDF. Kennedy argued that cracking the code of the digital grid eventually would generate 10x or 20x returns for investors. Kennedy handed the reins to Madaeni last fall but stayed on as an adviser to the company. When AES subsidiary Fluence tried again this year, AMS leadership was ready to accept.

"In the energy storage space, you need to be ready to be surprised at any moment," Galura said when asked about the second acquisition attempt working out. But, he added, "It wasn’t a surprise to me that AMS had developed this incredible capability on the market side, given where they started."

Both executives declined to disclose the selling price for AMS, which has raised at least $52 million in equity funding. The last publicly announced raise was a $34 million Series B in 2017, which included DBL Partners, Energy Impact Partners and Southern Company, as well as Schwarzenegger, for whom Kennedy previously worked as his chief of staff. Madaeni says that "the investors were fully supportive of this deal" and actively assisted in closing the transaction.

When companies at different steps in the value chain combine, it can create second thoughts for potential customers. The creation of Fluence put some distance between the storage integration business and AES' development business, which ostensibly competes with the sorts of developers that might buy Fluence hardware.

But AMS and Fluence are both technology-agnostic, and the combined companies won't limit the bidding algorithm to customers of Fluence's hardware, Madaeni said.

"Our biggest leverage is an eye toward portfolio optimization," he said. "The primary objective for that customer is to provide value in the wholesale markets."

In other words, a customer that owns battery stacks supplied by Fluence competitors could still benefit from dispatching them with a software service owned by Fluence. The software will work with whatever assets the customer has. And a customer that starts buying software could move to buying hardware from Fluence down the road.

As for clients worried about competitors seeing their bidding strategies, Madaeni said his cloud-based architecture keeps customer data private and confidential. Since each customer inputs their preferences around risk tolerance, bidding and hedging, the algorithm produces customized strategies for each user.