Lyndon Rive, the CEO of SolarCity (SCTY), has a goal of 1 million solar rooftop customers within five years -- helped in part by today's announcement of buying a direct marketing partner, Paramount Solar, for $120 million. SolarCity will acquire Paramount Solar for $116 million in stock, and the rest in cash. Paramount Equity CEO Hayes Barnard will join SolarCity as chief revenue officer in charge of the firm’s sales and marketing groups.

The goal is to be at 1,000,000 solar rooftop customers by July 4, 2018.

It's a "big deal," said Rive, adding, "To achieve that target, we need to be the best."

Rive said that meant incorporating Paramount's "remote and virtual selling" into the SolarCity juggernaut in order to grow from today's 68,000 customers to 1,000,000 rooftops.

Shayle Kann, VP of of GTM Research, had this to say:

- Paramount started out in the solar business acting as an originator for SolarCity, so the two firms already have a very close partnership. More recently, Paramount had been branching out on its own and announced a partnership with CPF just last month. (More of CPF's recent funding here.) Presumably, that branching out stops now.

- Contacts have referred to Paramount Solar as a "closing machine." What the firm does well in solar is what it does well in the mortgage market -- sell customers over the phone. This acquisition is a big move for SolarCity to shore up its sales infrastructure.

- There is an interesting dichotomy here. SolarCity and Vivint are, right now, the two biggest residential solar installers in the country. Vivint has made its name on door-to-door sales, whereas SolarCity just doubled down on a primarily phone- and direct-marketing-based strategy.

Paramount Solar is majority-owned by Guthy-Renker, a strong direct marketing organization. CEO Ben Van De Bunt of Guthy-Renker will join SolarCity’s board of directors later this year.

For companies like SolarCity, solar technology takes a back seat to customer acquisition technology -- and Paramount's brand of "remote and virtual sales" is the engine that gets SolarCity to 1 million customers while lowering customer acquisition costs. It's the ability to sell a customer on solar's benefits and savings without meeting face to face. And it's something that Paramount excels at.

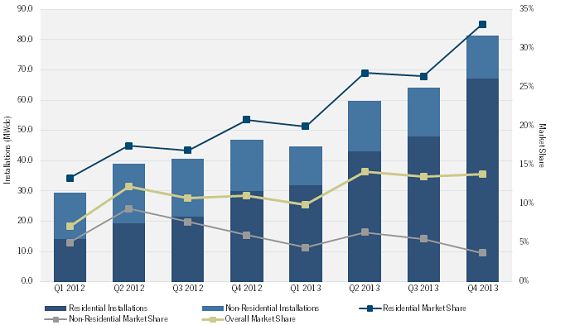

Approximately one in every five new residential solar customers in the U.S. picks SolarCity, according to data from GTM Research.

Nicole Litvak, GTM Research Solar Analyst, suggests, "The purpose of the deal was definitely much more about acquiring Paramount's sales technology than its customers or markets. It's interesting that SolarCity made this move just as Paramount was beginning to raise its own funds and ramp up its integrated installation business."

Litvak sees this acquisition as lowering SolarCity's customer acquisition costs. Note that GTM will be publishing a customer acquisition report in the near future.

Rive said that there was no one single strategy to achieve the sales growth necessary to hit 1 million customers. In addition to the new sales organization, Rive said that new homes represent a key aspect of its planned growth trajectory.

Kann notes in a recent article, "In the first quarter of this year, there were 71.3 megawatts of residential solar installed in California’s three investor-owned utility territories, according to the U.S. Solar Market Insight report. Of that total, 13.2 megawatts (18.5 percent) were installed without the support of rebates from the California Solar Initiative (CSI) or any other state-level program."

That line is worth repeating: "13.2 megawatts (18.5 percent) were installed without the support of rebates from the California Solar Initiative (CSI) or any other state-level program."

Solar that is competitive with the grid without state and local subsidies could be a watershed moment in the solar power story. (Note that the federal 30 percent Investment Tax Credit is still in effect through 2016.)

SolarCity Installations by Market Segment and Relative Market Shares, 2012-2013E

Source: SolarCity, SEIA/GTM Research U.S. Solar Market Insight report, GTM Research U.S. PV Leaderboard

***

Installation data presented in this article is drawn from the SEIA/GTM Research U.S. Solar Market Insight report, and company-specific market share data can be found in the U.S. PV Leaderboard.