Trade wars have become a defining characteristic of the Trump administration. Since taking office, President Trump — a self-proclaimed “tariff man” — has thrown trade duties at billions of dollars in goods, including wine, tulip bulbs, aluminum and steel, uncooked pasta, and, yes, solar cells and modules.

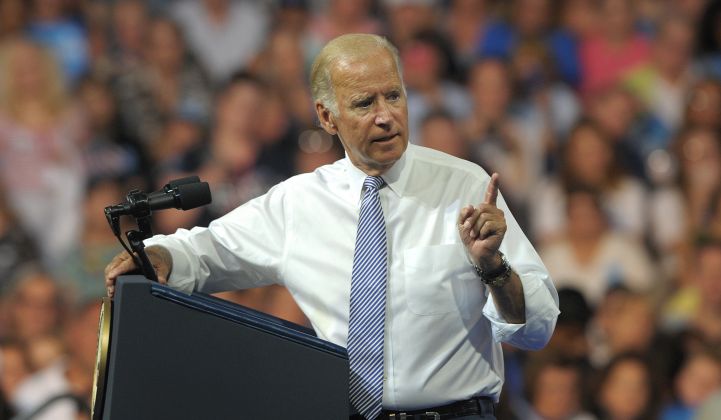

But if Biden and his newly picked running mate Kamala Harris are to take over the White House in 2021, tariffs on solar may well stick around.

“Tariffs, I think, will still be on the table,” said Jeff Navin, a co-founder at consultancy Boundary Stone Partners who worked at the Department of Labor and the Department of Energy during the Obama administration. “Just because Trump is for something doesn’t mean Joe Biden’s against it.”

Historically, Democrats have not shied away from protectionist trade policy. Trade was a policy priority for President Obama, and the Commerce Department imposed tariffs on some imported solar panels during his administration.

The Trump administration’s solar tariffs, established under Section 201 of the Trade Act of 1974, are wider-ranging geographically than those of his predecessor. But as Biden plans for a clean-energy transition that he hopes to supply with equipment manufactured at least in part in the United States, a continuation of trade duties in some form is a real possibility.

“You take the Biden 2035 target of 100 percent clean energy; that’s going to [require] a massive scale-up in all these technologies,” said Daniel Kammen, a professor at the University of California, Berkeley, and chair of the school’s Energy and Resources Group. “Any administration wants to capture not just the installed energy but a lot of the jobs and other benefits of that.”

The $2 trillion clean energy plan Biden’s campaign released this summer calls for U.S. workers to “build American infrastructure and manufacture the materials that go into it.”

Have Trump's solar tariffs worked?

Since Trump imposed 30 percent import tariffs on solar cells and modules in 2018, solar companies such as First Solar, Hanwha Q Cells and JinkoSolar have built about 3 gigawatts of U.S.-based manufacturing capacity, leading some to label the tariffs a relative success for the Trump administration. However, the duties haven't helped the companies that filed the trade complaint, defunct SolarWorld and idled Suniva.

“The reason the tariffs exist is because they’re designed to counter uncompetitive behavior,” said Navin. “To date, the most effective tool to encourage domestic manufacturing of solar panels has been on the tariff side of things.”

Domestic solar manufacturing in the U.S. is still centered on modules, though, and U.S.-based panel makers rely on imported PV cells. Even after recent module factory additions, the U.S. still imports most of the modules that are installed each year, many of them from Southeast Asia but with a growing proportion coming from China.

Tariff-based encouragement of the U.S. manufacturing sector also comes at a cost: increasing solar prices, narrowing the market and sowing uncertainty. The Trump administration's tariffs prevented deployment of 10.5 gigawatts of solar that would otherwise have been built, according to analysis from the Solar Energy Industries Association, the industry’s largest trade group.

A midterm review of the existing tariffs, which have now stepped down to 20 percent, concluded that the policy did encourage some domestic manufacturing. But “if the purpose of the policy is to protect and grow the entire solar industry, then the added cost and supply constraints have been counterproductive,” argued Xiaojing Sun, a senior solar analyst at Wood Mackenzie, in a recent piece for Greentech Media.

Tariffs have also created a schism in the U.S. solar industry; solar manufacturers with domestic operations support them while U.S. installers argue they hamper business. The Solar Energy Industries Association officially opposes the tariffs, but not all of its members do. Should the Biden administration opt to keep the tariffs in place, it would be at odds on the issue with the most influential trade group in an industry Biden views as central to a national transition to clean energy.

The Biden campaign did not respond to request for comment on the potential for tariffs under his administration.

In any case, it’s likely that a Biden administration’s support for the solar industry would hew closer to strategies pursued by Obama rather than Trump, pairing any punitive trade duties with significant investment and incentives such as extended tax credits and loans — potentially softening any industry opposition. But the solar sector should also not expect immediate relief from tariffs if Biden is elected in 2020, according to energy and policy experts.

“We do it for other products — medical products, food — so I would expect that to take place in the energy space as well,” said Kammen, “even under a very aggressive clean energy plan.”