As new low-cost entrants begin to dominate the solar PV module landscape, the threat of commoditization may already be realized. With module prices skydiving from 2009 highs of $2.70/Wdc to sub-$1.80/Wdc, developers and policymakers alike are increasingly focusing on non-module components for cost-cutting initiatives. Programs like the U.S. Department of Energy’s Sunshot Initiative that target installed costs at $1.00/Wdc include aggressive targets in balance of systems and inverter costs to $0.40/Wdc and $0.10/Wdc respectively. Indeed, a recent SunRun report shows that standardized local permitting laws could reduce installation costs by $0.50/Wdc. Germany’s balance of systems costs are half of average U.S. balance of systems costs.

Inverters, however, tend to be ignored in discussions of system cost reductions. The drop from current factory-gate pricing of large-scale inverters to $0.10/Wdc is dramatic, but achievable by the DOE's goal of 2017, though some manufacturers have indicated that cuts in initial $/W need to be balanced with reliability and quality concerns. Similar to PV modules, raw materials comprise over 70% of final product costs. Yet, whereas raw materials found in PV modules, like polysilicon, encapsulants, tabbings, etc., are specialized and bill of materials are limited, part counts for inverters run in the multi-hundreds.

Most of these components are non-application-specific, which means that inverter companies have to compete with the larger electronics industry. In early 2010, with the greater semiconductor industry suffering from the effects of the global recession, critical power electronic components like IGBTs and controller boards were in dire shortage and led to global inverter shortages. With limited purchasing power, even leading inverter manufacturers were unable to procure components to meet booming demand. The shortage coupled with the growth of commercial and medium voltage segments in key markets allowed newer companies to capture significant market shares at the expense of global leader SMA, which however, still controls nearly three times the next largest player.

As component supply constraints have eased, plans for capacity expansion have skyrocketed, with announced 2010 year-end capacity reaching over 32 GW (and module manufacturers thought they had a tough environment). This capacity value, however, can be misleading, as inverter throughput is a function of raw material procurement, labor availability (often in the form of temporary workers), and testing bandwidth. Capex costs for new facilities is extremely low -- often below 1% to 2% of final cost of product -- and typically represents empty warehouse/assembly space and new testing equipment. As such, capacity is easily overstated. Actual shipments in 2010 were closer to 21 GW.

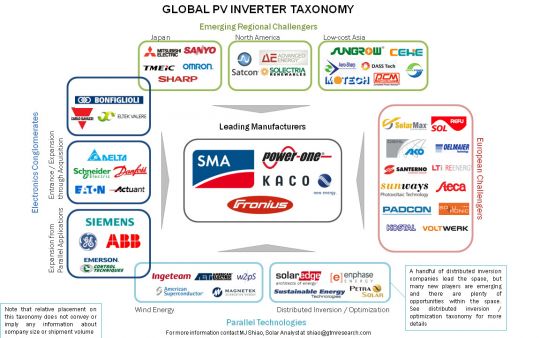

(click image above for a larger view)

In 2011’s environment of eroding European subsidies and rapidly falling module and balance of systems pricing, traditional inverter leaders will be under heavy siege from many new challengers. From North America and Asia, emerging regional inverter manufacturers like Advanced Energy, Sungrow Power Supply, and even the Japanese conglomerates who were once content on defending their domestic turf are mounting significant expansion efforts into Europe.

The competition will rise in North America, too, as European challengers seek the next growth market. New U.S. production facilities like those announced by KACO New Energy, Power-One, Ingeteam, and Delta/LTi Reenergy show that European players are dedicated to establishing a long-term presence in the North American market. The entrance into Ontario’s market has been less committed, with most of the new capacity either poised to serve both the U.S. and Canada or to be acquired through contract manufacturing. Thus far, new competition from Europe has been delayed due to certification barriers, as many European inverter manufacturers are having difficulty passing their inverters, especially of the transformerless type, through the UL standards process. However, with newly minted transformerless inverters from SMA and Fronius now certified for the North American market, it is only a matter of time before waves of certification follow suit.

Meanwhile, attracted by the promised gold rush of solar energy, global electronic conglomerates like GE have adapted existing technology from their wind and other related product lines into solar inverters. These conglomerates will be especially difficult to compete with given their purchasing power and established supply chain, which will allow them to weather downward pricing pressure. Although counterintuitive, these new entrants still have to pass stringent bankability and reliability tests. Both banks and developers have thus far shown remarkable distinction between corporate bankability and product bankability. Considering inverters are the root cause for over 50% of PV system downtime incidents, even the strongest corporate parent does not get an automatic pass. Nevertheless, their diversified nature gives these new entrants more flexibility in the scenario of depressed global demand.

On a collision course with traditional inverters are micro-inverter and distributed optimization players, whose market grew over 125% in 2010. While Enphase generally receives most of the buzz with its estimated 17% share of the U.S. residential market in 2010, SolarEdge has relatively quietly shipped over 50 MW in the same period. These two market leaders represent a combined $167 million plus in venture capital backing, and the brimming war chests have allowed for aggressive global expansion campaigns. Nevertheless, there are dozens more in the space maneuvering for an edge; in just the first two months of 2011, there has already been one un-stealthing, several new product announcements, and entrances into the multi-MW market.

So even though inverters are not resigned to commoditization yet, 2011 will not be a cakewalk. And with aggressive expansion strategies by established and new inverter companies alike, the “it’s a good time to be an inverter company” attitude of 2010 has the potential to quickly sour.

***

Editor's note: Executives from Advanced Energy, Enphase Energy, SMA and SolarEdge, among others, will discuss the future of PV inverters at Greentech Media's Solar Industry Summit 2011 on March 14 and 15.