Deepwater Wind CEO Jeffrey Grybowski turned some heads recently when he said that offshore wind is less expensive than solar power.

The planned 1,000-megawatt Deepwater Wind Energy Center (DWEC) will sell electricity at “$0.13 to $0.14 per kilowatt-hour,” Grybowski told local TV news after Deepwater Wind won the nation’s first offshore wind site lease auction in July with a $3.8 million bid. That is “significantly less expensive than solar.”

“The levelized cost of energy comparison among technologies is problematic,” explained Lawrence Berkeley National Labs Staff Scientist Ryan Wiser. Solar and offshore wind are “two different products” and comparing their LCOEs does not account for their very different production profiles.

But the comparison of them in the Northeast could be relevant, Wiser said, because the region’s RPS demands make it important to know which is most cost-effective.

The price of offshore wind

The present LCOE for Germany’s 400 megawatts of operational offshore wind is $0.169 to $0.188 per kilowatt-hour, according to the report Cost Reduction Potentials of Offshore Wind Power in Germany. The report estimated that those costs can come down between 32 percent and 39 percent by 2023.

The present cost of offshore wind in the U.K. is estimated at $0.203 to $0.219 per kilowatt-hour. The U.K.’s June 2012 Offshore Wind Cost Reduction Task Force Report concluded that it is feasible to bring the price down to $0.156 per kilowatt-hour by 2020.

In the U.S., electricity from the 420-megawatt Cape Wind project in Massachusetts’ Nantucket Sound, set to begin construction soon, is contracted with National Grid and NSTAR at $0.187 per kilowatt-hour in its first year. The fifteen-year contract has a 3.5 percent annual escalator.

Grybowski negotiated a $0.244 per kilowatt-hour contract with National Grid for his 30-megawatt Block Island demonstration project just off the Rhode Island coast. The twenty-year contract will escalate to $0.469 per kilowatt-hour.

If Grybowski negotiates a $0.13 to $0.14 per kilowatt-hour contract for DWEC, it will also almost certainly be for twenty years and have a similar 3 percent annual escalator provision.

The price of solar

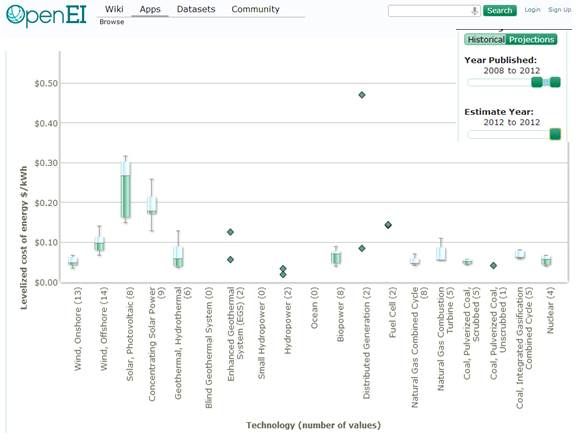

The 2012 LCOE for solar was $0.15 to $0.32 per kilowatt-hour, according to the U.S. DOE’s OpenEI database. Its price for offshore wind ranges up to $0.14 per kilowatt-hour.

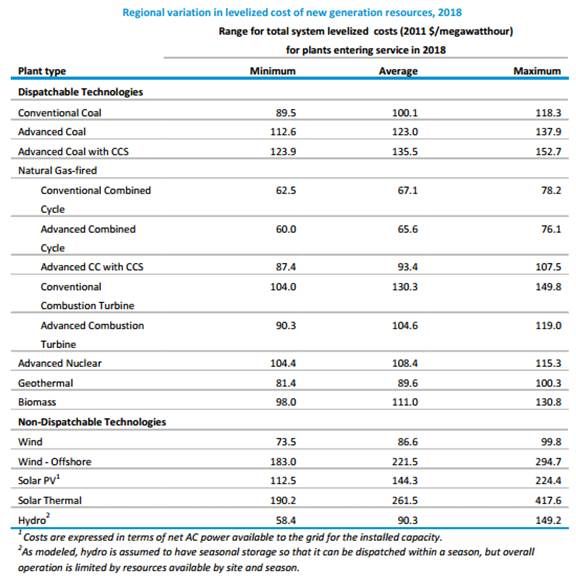

The solar PV high LCOE, according to the U.S. EIA’s Annual Energy Outlook 2013, is $0.224 per kilowatt-hour. The EIA’s LCOE for offshore wind is $0.295 per kilowatt-hour.

To fact-check Grybowski’s claim that offshore wind is cheaper than solar, Rhode Island PolitiFact obtained post-2011 National Grid contracts for eighteen Rhode Island solar projects. The prices, fixed for fifteen years, were $0.185 to $0.33 per kilowatt hour.

Deepwater Wind independently provided PolitiFact with National Grid contract data for twenty-one solar projects -- with the same price range.

The larger-scale PV solar projects had lower prices, but the amount of available space in Rhode Island limits scale and therefore hampers PV’s competitiveness with enormous offshore wind projects.

SolarReserve’s 110-megawatt Crescent Dunes concentrating solar power (CSP) project in Nevada has a $0.135 per kilowatt-hour contract with NV Energy. And CSP is thought to have a higher cost than utility-scale PV.

“In the desert Southwest, there are solar PV PPAs for as low as $0.06 per kilowatt-hour,” Wiser said. “In the Northeast, there is not the ability to build 100-megawatt solar plants and it is a lot less sunny.”

The GTM Research U.S. Solar Market Insight Q1 2013 report puts the average residential PV system price below $5.00 per watt and the average non-residential system price below $4.00 per watt. It is difficult to translate these numbers into per-kilowatt-hour prices. But they are more relevant to consumers, highlighting the scale and application differences between solar and offshore wind.

DWEC’s $0.14/kWh price, escalating at 3 percent annually, would be more expensive at year eleven than the contracted $0.18/kWh price for NextSun Energy's 1.1-megawatt North Smithfield project, according to PolitiFact. At year fifteen, DWEC would be about $0.22 per kilowatt-hour.

North Smithfield, however, is at the low end of the solar projects’ cost range. After twenty years, even the projected DWEC escalated price would beat most of the solar projects’ prices.

So how accurate is Grybowski’s claim?

The EIA’s estimate for offshore wind’s LCOE is twice what Grybowski said he can sell to National Grid for. According to PolitiFact, Grybowski said the EIA’s method for calculating LCOE is “flawed.”

But efforts to get Grybowski to explain the flaws he sees in the EIA methodology or to substantiate his price claim went unanswered.

If Grybowski’s estimate for DWEC is accurate, “Its price would ultimately be cheaper than nineteen of the twenty-one solar projects,” PolitiFact concluded in explaining why it judged the Grybowski statement “Mostly True.”

“Over time, offshore wind will become less and less expensive,“ Wiser said. “But most of the offshore PPAs we’ve seen so far are closer to the twenty-cent range.”