Solar Frontier, which produces copper indium gallium selenium sulfur (CIGSS) solar cells, has signed an agreement with IBM to develop a solar cell devised by IBM that gets rid of that pesky indium.

Earlier this year, IBM unveiled a copper tin zinc selenium sulfur (CTZSS) solar cell with a 9.6 percent efficiency. CTZSS devices have existed in labs for years, but have generally had low efficiencies, which have hampered the product's commercial prospects. IBM's technique involves spraying copper, tin and zinc onto a film containing selenide and sulfur in a process that's akin to inkjet printing.

Indium is a rare and typically expensive element that's also consumed by manufacturers of large-screen TVs. Zinc and tin are common, so swapping out the indium potentially could make these solar cells cheaper. At a minimum, they shouldn't be more expensive. More importantly, zinc and tin will alleviate fears about shortages.

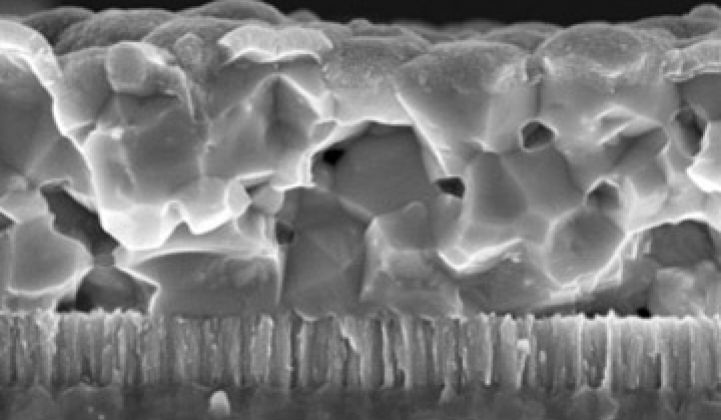

"Indium is often indicated as a problem for CIGS on a terawatt scale," David Mitzi, who led the team at IBM Research that developed the cell, told us earlier this year. (That would be a microscope image of the CTZZ cell from IBM in the photo.)

IBM's cell is in the copper family of solar cells (CIGS, CIS, CIGSS, CTZSS, etc.). Ideally, Solar Frontier will be able to adapt its existing manufacturing processes to produce CTZSS cells. An efficiency of 9.6 percent is below what will be required for commercial cells, but IBM is confident the number can rise.

My colleague, Eric Wesoff, wrote about Solar Frontier, which is a subsidiary of Showa Shell, earlier today and how it is part of a revival of the Japanese solar industry. The relatively quiet (until now, that is) firm has had product in the field since 2003, and with the backing of Shell, Showa and other big-money sources, has a sizable balance sheet. They are ready to invest billions of dollars and they're already on their way with a 900-megawatt panel factory in Miyazaki, Japan which will be one of the largest PV factories in the world when it is completed.

The deal is also another example of how U.S. companies are licensing technology to Asian manufacturing conglomerates in solar. Today, 1366 Technologies said it has come up with a way to reduce the cost of producing silicon wafers by 80 percent. Its first customer is module maker Solarfun, part of Hanwha Chemical. Meanwhile, Innovalight said it would sell its solar ink for boosting efficiency to Solarfun.