GTM Analyst MJ Shiao writes, "While there are numerous companies attacking the module-level power electronics (MLPE) space, three companies (Enphase, SolarEdge and Tigo) account for over 93 percent of the total market share of shipments.

Here's some news from those three market leaders.

Enphase just announced its first-quarter 2013 earnings. Revenue and margin continue to grow, while losses persist. Enphase's growth is undeniable -- the firm shipped 315,000 units in Q1, amounting to approximately 68 megawatts. Revenue was $45.6 million for the quarter (at the top end of guidance and up 7 percent year-over-year) at a gross margin of 26.8 percent. Enphase gets roughly $0.67 per watt for their microinverter -- far more than the price per watt of a string inverter.

Tigo Energy raised an undisclosed round of equity for its solar panel optimizers from Alon Ventures and appointed Zvi Alon as Chairman. Sources close to the deal put the round in the range of $10 million. Tigo promises "a major product announcement at Intersolar Munich and San Francisco."

SolarEdge will soon be introducing optimizer products aimed specifically at the commercial market. The new 600-watt units are made to handle two PV modules. SolarEdge shipped almost 400 megawatts in 2012, according to the company.

Solar microinverter and DC optimizer adoption grew from 51 megawatts in 2009 to over 785 megawatts in 2012, according to GTM Research.

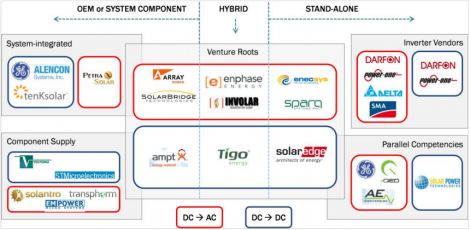

FIGURE: Module-Level Power Electronics (MLPE) Taxonomy

Source: The Global PV Inverter Landscape 2013