There’s a new king in town, and his name is DA.

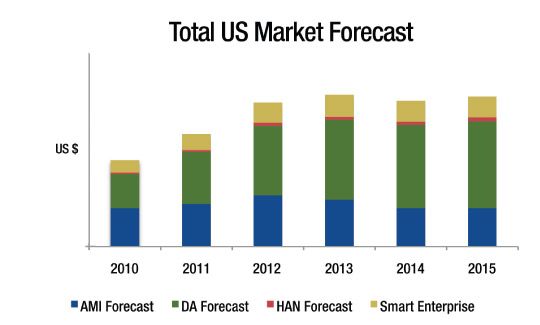

While AMI was clearly the first smart grid application out of the gate, there is now is a growing recognition that smart metering is precisely that, an application of smart grid. To be sure, it’s an important one, as it will network U.S. utilities to their roughly 140 million end-users, enabling widespread demand-side management for the first time. Having said that, we argue that DA is as important, if not more important, than AMI, and predict in our recently released report U.S. Smart Grid Market Forecast: 2010-2015 that this market segment will grow steadily from $2.2 billion in 2010 to $5.6 billion in 2015.

Our DA forecast is predicated on the eventual full deployment of four types of newly networked devices: reclosers, automated feeder switches, capacitor banks and voltage regulators. The first two devices, reclosers and automated feeder switches, are the two key technologies for distribution automation, or “self-healing,” where power can be instantaneously re-routed around a fault. The next two devices, cap banks and voltage regulators, play an integral role in grid optimization. While the current penetration of these networked devices is minuscule, even the most modest projections in the nascent market (we used half of one percent, or 0.5%, in the first year of our model) yield a substantial market.

Over the past six months, we’ve noticed that this market opportunity (or, more aptly, necessity, as the U.S. clearly needs to upgrade its existing electric power infrastructure in order to remain competitive in the global economy and to prepare the coming ramp-up of renewables and electric vehicles), is becoming clearer to more leaders both in and outside of this industry. (We at GTM Research first became convinced of DA’s vital role and inevitable dominance last autumn after speaking with more than 50 utilities in the process of preparing The 2010 North American Utility Smart Grid Deployment Survey report.) While clearly this market evolution is good news for traditional grid vendors, such as S&C Electric, ABB, GE, Areva & SEL, we expect that it will also be good news for the networking players, such as Silver Spring, Trilliant and SmartSynch (in fact, it’s now hard to find a networking player that is not advertising DA solutions; that wasn’t always the case), and represents the next wave of smart grid.

Below are a few selected key findings from both our latest market forecast report and past research:

·As more states and governments move toward mandating grid efficiency (Senate Bill 221 in Ohio is a prime example) and as ISOs and RTOs consider allowing efficiency gains to be effectively bid into the wholesale market, the extraordinary business opportunities for DA will continue to expand.

·Historical under-investment in the distribution grid over the past few decades will drive expansion in distribution automation. However, the general state of the U.S. economy will have a definite impact on the level of DA investment over the next five years, as utilities tend to crank back on CAPEX (and O&M) in recessionary periods, in order to keep profitability up.

·The short-term cycles in the economy aside, we expect the market for DA to continue grow, and grow substantially. Technologies such as EVs, distributed generation (DG), and energy storage are predicated on a more intelligent grid, and the operation of the future grid will need to change from a reactive to proactive approach in order to support these new capabilities.

·Presently, the business case for DA remains not very well understood by state regulators, consumers, and even credit agencies (many of which have not yet embraced the ROI of these investments). The technology, in terms of both devices and communications networks, is sufficiently advanced. However, a fundamental challenge that DA will continue to face is whether regulators will begin to recognize their more holistic benefits for the entire system. (It’s worth noting that it’s been reported to GTM Research that many utilities today are actually hiding their DA improvements in other line items in their budgets and financial statements. For example, large programs such as “Reliability” or “Maintenance” often now have DA tucked inside. This is done to avoid having to play “Mother, May I?” with the regulators. One common maneuver involves utilities changing the underlying spec; this is starting to happen more often with equipment, such as reclosers and regulators.)

·The relationship between DA and DG is evolving, but the requirements are still not very well understood. As the penetration of distributed renewable generation resources starts to rise above the 15% to 20% level, new protection schemes will need to be established, along with new feeder configurations, in order to prevent the possibilities of significant disturbances (transformer explosions, blackouts, etc.). Lastly, the costs associated with large amounts of two-way power flow, while not yet fully understood, are expected to be expensive.