Here’s another footnote to the less-than-stellar record for smart grid startup returns in the M&A space. Joe Hogan, CEO of grid giant ABB, said in the company’s July earnings conference call that it spent $35 million on “one small deal” in the quarter: the purchase of Tropos Networks, a Sunnyvale, Calif.-based startup with beefed-up Wi-Fi for municipal and utility clients.

Tropos, founded in 2000 as a would-be muni Wi-Fi provider, has raised more than $30 million from investors Benchmark Capital, Duff Ackerman & Goodrich, Voyager Capital, et al. A $35 million purchase price -- assuming Hogan didn’t misspeak, and excluding other forms of compensation we might not know about -- would indicate that investors barely broke even on the deal.

ABB declined to comment on the matter Wednesday, beyond saying that it has incorporated Tropos into its network management business unit, part of its North American power systems division. The Swiss grid giant bought low-voltage equipment maker Thomas & Betts for $3.9 billion in January, giving it a much bigger footprint in North America.

Certainly compared to that acquisition, ABB’s purchase of Tropos was a “small deal,” as Hogan said in his July conference call. Still, “We think we acquired terrific technology,” he said, which could serve ABB’s Power Systems line for grid communications, as well as its Process Automation division for factories and other industrial sites.

On Thursday, ABB and Tropos announced their first big project since the merger, a $49.8 million Department of Energy smart grid demonstration grant-funded project to connect distribution automation gear via Tropos' wireless mesh for Midwest utility Kansas City Power & Light.

Depending on how you look at it, low valuations for smart grid startups getting bought is either a problem or a bargain for the industry. Certainly on the investor side, the news hasn’t been stellar. We’ve seen some well-known smart grid companies sell for bargain basement prices, notably Comverge, the demand response provider bought by H.I.G. Capital in March for $49 million -- a fraction of its former public value.

Other deals are harder to measure, but still don’t look all that lucrative for investors. SmartSynch, the cellular smart meter networking company that Itron bought for $100 million in February, had raised about $65 million over the previous decade, for example. In May, ZigBee chipmaker Ember sold to Silicon Labs for only $72 million, little more than the $62 million it had raised from its many investors since its 2001 founding.

That’s in keeping with the going prices for acquisitions in the smart grid space over the past year or so, which (at least for reported transactions, and for some rumored transaction values, as well) haven’t approached the 5X-and-up returns that VCs tend to aim for. Industry insiders say stats like these have taken a toll on new venture fundraising efforts.

Meanwhile, the IPO sector is all but closed to the smart grid sector, except for one announced company at the gate. That’s Silver Spring Networks, which has managed to build up a U.S. smart meter networking market share to compete with longstanding meter giants Itron and Sensus, but has yet to hold the IPO it filed plans for last summer. Since then, it has found new investors such as EMC and Hitachi to fill its coffers, but is staying mum on when -- or if -- it might go public.

Things look different from the acquiring side, however. There’s been a healthy -- some would say, ravenous -- appetite amongst grid giants like Siemens, Schneider Electric, Alstom, General Electric, Toshiba and ABB for acquisitions in the grid space. Some of them, like Eaton’s $11.8 billion purchase of Cooper Industries in May, have created new grid giants in their own right.

As for valuations, Toshiba’s $2.3 billion purchase of metering giant Landis+Gyr last year came in at about an 11.5X multiple of earnings before interest, taxes, depreciation and amortization (EBITDA), at a price that seems to have paid off well for Bayard Capital, the private equity firm that built L+G through acquisitions since its 2004 purchase. In comparison, Melrose PLC’s $2.3 billion buyout of German metering giant Elster in June stood at a 10X multiple of EBITDA, and a 49-percent premium of the company’s publicly traded stock price (the company has since replaced its entire executive team).

ABB, for its part, has earmarked $9 billion to $18 billion for acquisitions over the next five years. Previous big purchases include grid software developer Ventyx for $1 billion and efficient motor maker Baldor Electric for $4.2 billion in 2010, along with a number of undisclosed deals.

Tropos gives it new customers, including the cities of Fort Collins, Colo.; Naperville, Ill.; and California’s Silicon Valley Power and Burbank Water and Power. As for revenues, CFO John Eichhorn said last year that the company was seeking an additional $5 million to $6 million in VC, but also described the company as “slightly cash flow negative, but right on the cusp of being break-even” at the time.

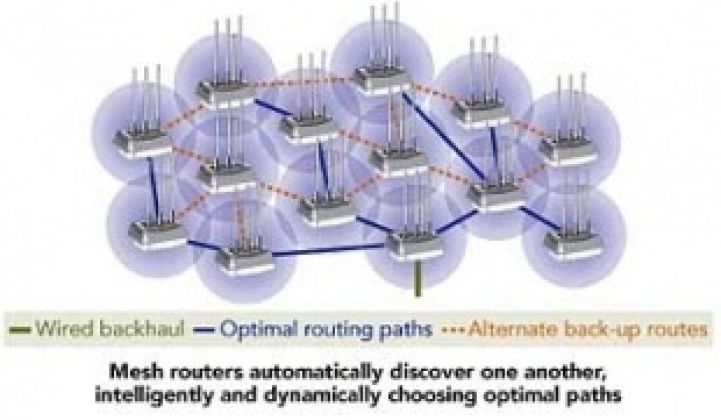

As a backhaul provider for smart meters, Tropos integrates with such diverse partners as Itron, Elster, Landis+Gyr and Trilliant, as well as power line communications (PLC) providers in Europe, Rob Pilgrim, Tropos corporate and business development director, said in a June interview. It also works in the Middle East, with projects including one in Abu Dhabi where Amplex is providing the PLC technology and Itron and Elster are doing the meters, he said.

Importantly, Tropos is IPv6-compliant and runs over the open 2.4 gigahertz spectrum, just like Wi-Fi does. Internet protocol is the future for smart grid communications, and all the big meter makers, telecommunications providers and power grid companies are incorporating it into their efforts in one form or another.