I was in a meeting discussing the smart grid market with a few partners and associates at Foundation Capital just under a year ago. In no uncertain terms, they laid out their opinion that the door was closed to any new entrants in the smart grid AMI networking space, that Silver Spring had it "sewn up." Granted, it was a bullish and self-serving opinion, given their backing of Silver Spring Networks, the player that everyone seems to be chasing. Nevertheless, and with all due respect to Foundation and Silver Spring, I disagreed. This market is still early days, even a year later.

Fast forward nearly a year to June of 2010: Arch Rock announced their PhyNet-Grid offering, evolving the company from its founding roots in sensor-based building automation networks to that of a full-fledged competitor in the midst of the most active smart grid market sector: AMI networking. 'Full-fledged' may be an overstatement, as the project consisted largely of PowerPoint slides and beta products at that point, but everything else seemed pretty solid: the product architecture, the positioning, the go-to-market strategy, the existing wireless networking technology and expertise, and a CEO with a long history in complex networking systems (not to mention a long history with Cisco). All the while, Silver Spring, barley flinching, was too busy connecting real meters in real distribution networks and most likely responding to real RFPs in North America and abroad. Cisco's acquisition of Arch Rock is debatably a very good thing for Silver Spring, as it essentially further validates the market opportunity and likely drives Silver Spring's valuation even higher.

Last week, Cisco, with its impressive smart grid marketing messages but its until-now-rather-nebulous smart grid product offerings, made two significant announcements.

- On Wednesday, they inked a deal with Itron, a leading smart meter manufacturer with deep utility roots.

- On Thursday, they announced the acquisition of little Arch Rock for an undisclosed sum.

I'm not privy to the details of the transaction, but if I had to venture a guess, I would say that Arch Rock went for somewhere between $80 million and $130 million. Whatever the number was, it was likely much smaller than the price tag Silver Spring is placing on itself as they prep to file their IPO in the not-too-distant future. And if anyone thinks that Cisco hasn't taken a serious run or two at Silver Spring over the past year, I'd say they are seriously mistaken. In the end, it was probably a numbers game or egos or any one of the many other things that lead to deals never getting done that just didn't add up. Either way, I'm rooting for Silver Spring to knock it out of the park if and when they reach an IPO. It will be a positive for the entire industry and a reward for a company that delivered the right product to the market at the right time, one of the hardest things for a startup in any industry to do.

We've got to start giving all of these companies a break for a missing feature here or there or a bug in Bakersfield (or a non-bug in Bakersfield, for that matter). These are extremely complex systems with a large number of variables relating to network topology, physical geography, evolving standards and protocols, and a regulatory environment that isn't necessarily a catalyst for innovation. The good news for everyone in the market is that it's off the ground and is now working in real utility distribution networks around the world. And it's only going to grow.

I digress. Let's get back to Itron for a minute here. What a boring, interesting company they are. Is that an oxymoron? Not really. Itron hails from that well-known, high-tech hub of Spokane, Washington (I can knock it; I lived there for two years in the late '90s, working for a LAN networking startup), but they make electric and gas meters, and that's kind of boring. With that said, they're clearly a market leader in the field, with ties to some of the largest utility companies around the globe, and these utilities are in the midst of a major transition from legacy analog meters to smart digital meters. Now that's interesting.

Itron's problem to date is that they aren't a networking company and though they have some in-house networking technology, it's not living up to the next-generation products being offered by newer companies like Silver Spring and others.

Enter Cisco.

Itron needs Cisco's networking expertise and brand. Cisco needs Itron's deep utility relationships and installed base of meters. Oh, and they also need an AMI networking product.

Enter Arch Rock.

The last piece of the puzzle is that Arch Rock's go-to-market strategy from the time they released their platform in June was not to sell direct to utilities, but rather to partner with entrenched meter manufacturers, providing next-gen networking capabilities. At the time they launched PhyNet-Grid, they also had at least one major meter manufacturer in hand as a partner. They weren't saying who it was. I guess we all know now that it was Itron. There's nothing about last week's announcements from Cisco, Itron and Arch Rock that doesn't make sense. They all need one another and they all complement each other.

Are the big brand names, existing utility contracts, big pre- and post-sales organizations, large customer service organizations and that feeling of safety that comes with it all enough? Well, it can't hurt, but it's too early to tell if it's enough. Companies like Silver Spring, and even Trilliant for that matter, having hit the market earlier with the right feature set for the application is a very strong competitive differentiator. But like I said, it's still early days. Nobody has this market "sewn up."

The bottom line here is that we're entering phase II of the smart grid AMI networking game. Phase II from three perspectives:

- Competition and consolidation. With last week's industry action, competition has just stepped up a few notches. And we haven't even scratched the surface on the many other players, including Trilliant, SmartSynch, On-Ramp Wireless, Tropos Networks, Cooper Systems (Eka), Grid Net (though they look to be shifting product strategy), Arcadian Networks, Echelon, Sensus, Tantalus Networks, etc. Look for more industry consolidation from the likes of GE, Landis+Gyr, Elster and others.

- Increased rate of deployment. Given the armchair-quarterback stance of state PUC onlookers asking tougher questions, and given the pitfalls faced by early adopters like PG&E, Oncor, and others, this may even seem counterintuitive. GTM Research, though, predicts the AMI market (networking and meters) growing steadily through at least 2013 when it hits its peak of roughly $3.5 billion in the U.S. alone, trailing off slightly after that through 2015. This number is part of an extensive smart grid market forecast that GTM Research will be publishing in a few weeks.

- The next wave of applications and feature sets. The market action right now is in AMI, but we expect distribution automation (DA) to be an increasingly important application, potentially delivered by this same set of vendors and others in the space. GTM Research has some quantitative market sizing data on DA coming out as part of the forecast as well, but you'll have to wait for the report to get those details. Networked charging infrastructure for EVs is another logical next step. In the long term, why does the industry need the likes of Coulomb Networks (for the network smarts, not the soon-to-be-commoditized charging stations themselves), when utilities are already laying down an intelligent communications network on the grid? Either way, we believe that these vendors, whether it's through current product sets or new products on the roadmap, will be making more noise in both of these areas over the next year.

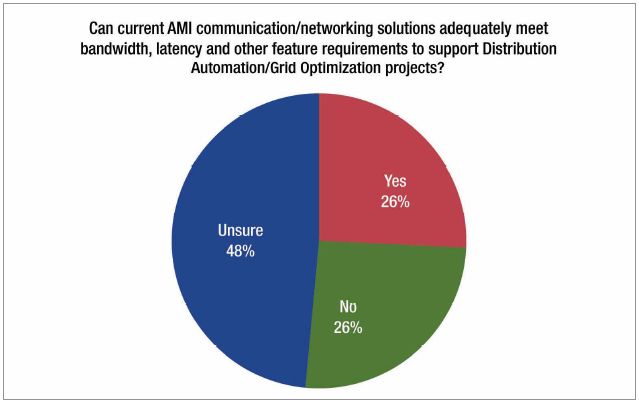

It's debatable as to whether AMI networking solutions optimized for, well, AMI can also handle the more stringent real-time, low-latency requirements of DA. Perhaps they can for a subset of requirements like monitoring grid assets, but probably not for functions that require latencies on the order of tens of milliseconds (maybe with a lot of additional nodes to significantly decrease hop-count, but that tends to blow cost and resiliency [via loss of path diversity] out of the water). Don't take my word for it; GTM Research surveyed a number of North American smart grid utility executives and asked them if they thought that current AMI networking solutions could adequately meet the requirements of DA, and only one quarter of the respondents said yes.

Source: GTM Research

But those are just details that can be managed through product development and a beefed-up product roadmap in an effort to get a larger piece of the overall smart grid market. The interesting part is that they're going to happen, and that Phase II of this market is now beginning.

A final thought, and one not necessarily related to AMI networking (or even smart grid proper) at all. Cisco, you should take a swing over to Redwood Systems and check them out; we think that should be your next purchase in the greentech space.