Satcon (NASDAQ CM:SATC) has filed for protection under Chapter 11 of the U.S. Bankruptcy Code.

Satcon was one of the leaders in the U.S. inverter markets -- the firm claimed it was the number-one utility-scale inverter supplier in the U.S., as well as the number-one large-scale commercial supplier. Clearly, troubles in solar are not limited to module suppliers or thin-film CIGS startups.

In January of this year Satcon laid off about 140 employees, primarily within its Ontario operations.

In July of this year, we were hearing rumors of Satcon exiting the solar business. We received staunch denials from Satcon VP Michael Levi even as the firm flirted with a Nasdaq delisting. Levi said, "We are quite focused and dedicated to continuing to build upon the commercial leadership position that we have achieved in North American over the past few years, and toward the continued strengthening of our worldwide position in the 3 Phase inverter market, as is reflected in our significant and consistent gains since 2009."

Today, Steve Rhoades, the CEO of Satcon, wrote in a statement, “This has been a difficult time for Satcon. After careful consideration of available alternatives, the Company’s Board of Directors determined that the Chapter 11 filings were a necessary and prudent step, allowing the Company to continue to operate while giving us the opportunity to reorganize with a stronger balance sheet and capital structure. Our goal is for Satcon to emerge from bankruptcy reorganization and continue to provide our customers with the quality products that they need.”

So, what's to blame for this solar casualty? Price pressure is present in every facet of the solar space. There's weaker demand and incentives are diminished. But It's difficult to fault China, as the "market share of Chinese inverter companies in the U.S. is virtually zero," according to GTM Research solar analyst MJ Shiao. (That excludes made-in-China inverters by Advanced Energy, Satcon, et al.) The $7 billion inverter market is dominated by Germany's SMA and other European and American vendors such as Fronius, Advanced Energy, Kaco, and, up until now, Satcon.

Revenue at Satcon in the most recent quarter was $23.7 million.

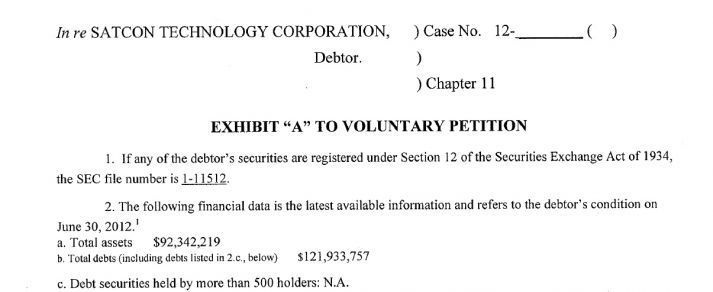

Satcon stock is trading at $0.09 per share and the firm has a market cap of $1.65 million. According to recently filed court documents, Satcon has $93 million in assets and $121 million in debts. Venture capital firm Rockport Capital owns 18.1 percent of Satcon.