Denmark's Ørsted, the world's leading offshore wind developer, posted a quarterly loss on Wednesday with sagging power demand a major factor. But the company remains bullish on its growth prospects even as competition in the offshore wind sector heats up.

Ørsted recently lost to Shell and Dutch utility Eneco in a major Dutch offshore wind tender. The company will not be sucked into near-term price wars, said outgoing Ørsted CEO Henrik Poulsen.

“No doubt, there will be more players with big ambitions. But it's also going to be a very big market, and it's...an expanding market opportunity,” Poulsen said on a call with analysts.

European oil majors BP, Equinor and Total are among those looking to leverage their offshore engineering and operations experience to bolster their energy transition plans with offshore wind.

“When you look at the auction dynamics, it's clearly an allocation mechanism where you have to stay disciplined. And we do remain disciplined, which means that we won't always win,” Poulsen said.

Poulsen pointed to Ørsted’s record-breaking 920-megawatt corporate power-purchase agreement deal with Taiwanese microchip manufacturer TSMC as an example of how competitive auctions aren't the only route to market for Ørsted's projects. “You can imagine a future where large corporates around the world actually buy and sponsor their own offshore wind farms under more of an open-door regime. I wouldn't rule it out,” he said.

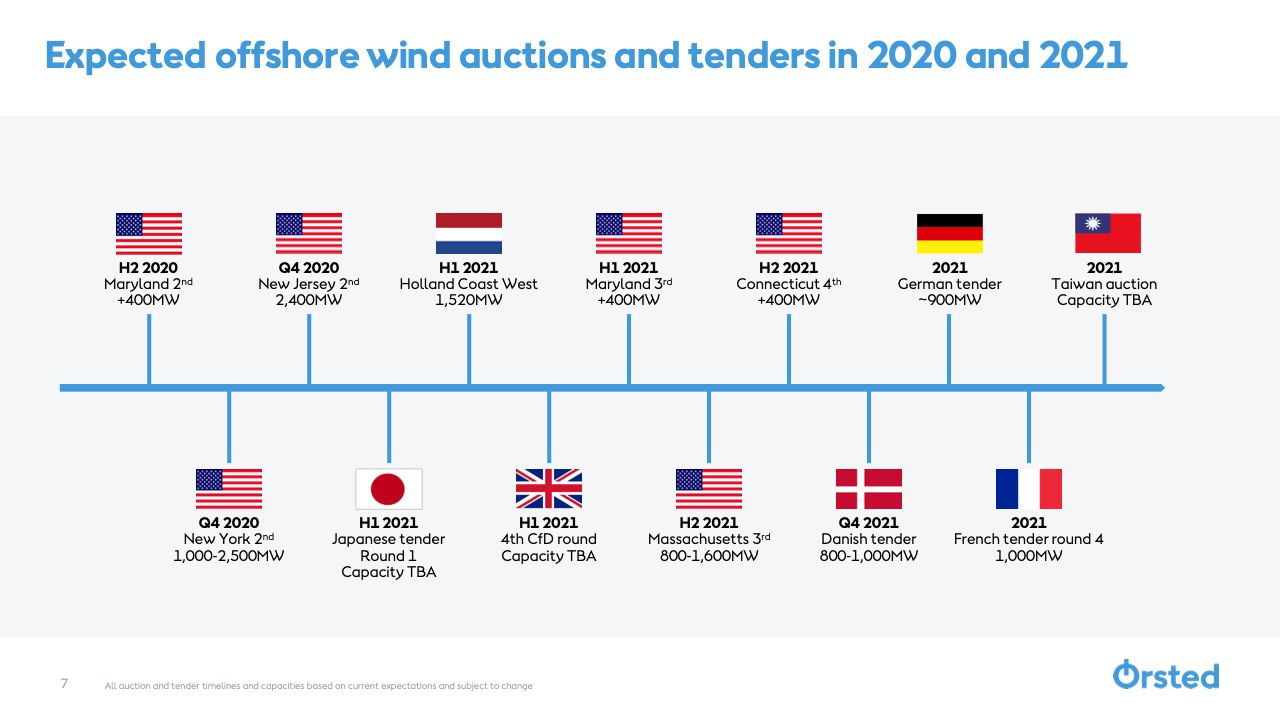

There is no shortage of opportunities for the growing list of offshore wind developers and investors. (Credit: Ørsted)

Power demand in Europe is expected to grow as the EU puts meat on the bones of its 2050 net-zero ambition. The European Commission (EC) estimates that the bloc will need 400 gigawatts of offshore wind by 2050. There were 22 gigawatts installed as of February this year.

The EC will soon reveal its offshore wind strategy, and Poulsen said he hopes the plan is sufficiently ambitious.

“We would also like to see increased alignment across European markets,” he said. “In terms of regulatory frameworks and permitting processes, the more we can align standards and processes across markets, the more transaction costs you can take out of the end-to-end process.”

Quarterly results dragged down by depressed power prices

At this point, the COVID-19 pandemic's impact on Ørsted would appear to be largely limited to lower revenue from electricity sales. Construction delays, which have been maxing out at two months, are not expected to be enough to force projects to miss deadlines or budget targets, the company says. Substations for two projects have been delayed by two months after the shipyard building them was closed by a COVID-19 lockdown.

Poulsen said Wednesday that any delays would have a “limited impact on project economics.”

Despite Ørsted having installed another 1.2 gigawatts of offshore wind capacity since last year, its power sales were down 3 percent by volume, and power prices in the quarter fell 39 percent across Ørsted's international portfolio.

The Danish firm posted a Q2 loss of DKK 825 million ($132 million), a big swing from its DKK 1,093 million profit in Q2 2019. Setting aside a one-off tax bill of DKK 1.2 billion related to its U.S. projects, the company would have squeezed out a slim profit.

Quarterly revenue fell 29 percent to DKK 11.6 billion.

Poulsen confirmed that the board’s search for his successor was looking at both internal and external candidates. The company’s planned capital markets day has been pushed to H1 2021 so the new CEO has some time to become acclimated to the role prior to the event.