Building and operating a new offshore wind farm would bring at least $600 million in economic benefits to the Eastern seaboard state where it's constructed, according to a new analysis by BW Research on behalf of environmental advocacy group Environmental Entrepreneurs.

Taken together, the five states included in the analysis — New York, New Jersey, Virginia, North Carolina and South Carolina — would reap $3.6 billion in economic benefits by building out new offshore wind farms.

U.S. offshore wind development has notoriously lagged behind European countries and, more recently, China, now the world’s third-largest offshore market.

America's only commercial offshore wind project, the 30-megawatt Block Island Wind Farm, came online in 2016. The Cape Wind project, planned off the coast of Massachusetts in the early 2000s, is finally dead after a decade and a half of legal battles.

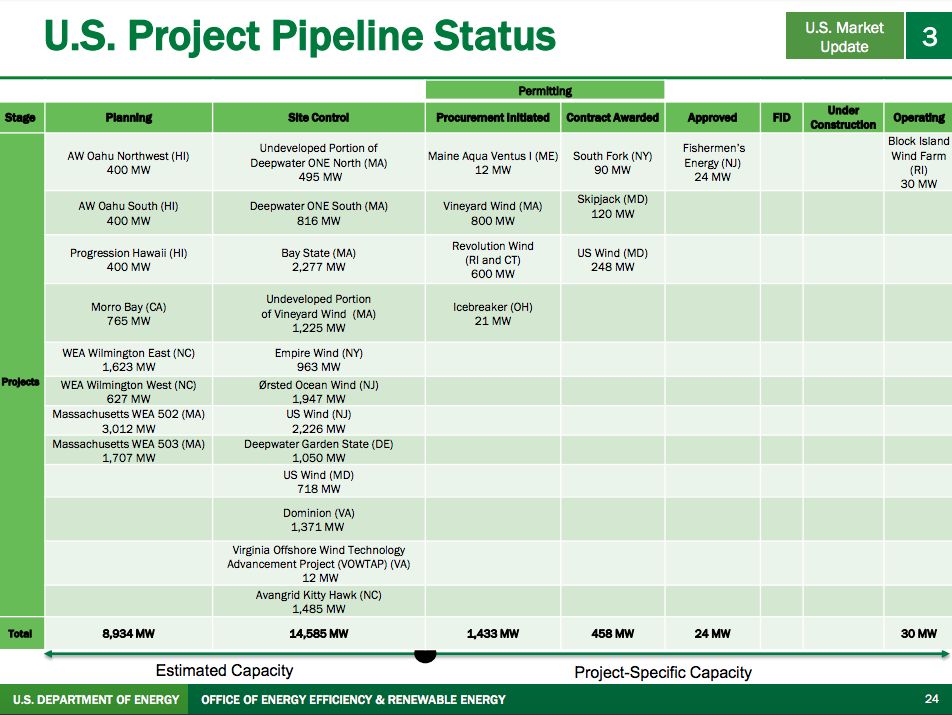

But the pipeline is finally looking full. According to a Department of Energy report released this month, there are now 25,464 megawatts of offshore wind projects planned in 13 states.

Much of that capacity is planned in the states highlighted in E2’s report. New York, for instance, has a goal of 2,400 megawatts of offshore wind by 2030. New Jersey has a target of 3,500 megawatts by 2030.

Although only Block Island reached completion in 2017, U.S. offshore wind took a “leap forward” that year, according to DOE, as more states developed targets and procurement structures for projects.

MAKE Consulting projects an annual compound growth rate of over 50 percent for the U.S. offshore market through 2026. Analysts said state procurement will drive growth.

A project in New Jersey, the 24-megawatt Fishermen’s Energy, is currently the closest to completion in the U.S. Several projects in North Carolina are in the planning and site control phases. New York has projects contracted and in site control.

South Carolina is the only state in E2’s report that has no offshore projects planned for its shores, although the state has shown an interest in development through research and manufacturing.

According to E2’s analysis, South Carolina also stands to gain the most from building just one 352-megawatt wind project (for reference, current projects in the U.S. pipeline range from 12 megawatts to over 2,200 megawatts). If the state did construct one starting in 2022, E2 said it would gain 5,647 jobs, $242 million in wages and $877.8 million in economic benefits.

For every dollar South Carolina spends on such a project, the state would generate $1.60 in returns. While E2 projects total costs at $970 million, 60 percent of that would be spent within the state.

Those economic benefits could expand as falling prices encourage more development. DOE notes that prices are expected to continue to decline, driven by increases in turbine size, installation capacity and more friendly market and regulatory design. This year Germany and the Netherlands both awarded zero-subsidy bids for projects commissioned between 2021 and 2025.

“Although many cost reductions are generally expected to be transferrable to a U.S. context,” the report notes, “the full magnitude of these cost reductions may not be exhibited in the first tranche of full-scale commercial U.S. projects, in part because of physical differences…and the risks associated with deploying in a new market.”

The U.S. is seeing some positive price signals. Earlier this month, the 800-megawatt Vineyard Wind project set a national record with prices at $74 per megawatt-hour in the project's first year.

If America can't capture the offshore wind market, development will go elsewhere. Europe’s offshore pipeline tops 100,000 megawatts. By the end of 2017, the U.K. had about 2,600 megawatts under construction, China was working on over 3,000 megawatts, and Germany was building about 1,900 megawatts.