America has fallen behind when it comes to investing in new energy infrastructure.

According to the latest report card from the American Society of Civil Engineers, energy companies have chronically under-invested in the electrical grid, oil and gas pipelines, and storage facilities for fuels. The organization gave America a sorry D+ grade for the shortfall.

When it comes to the aging U.S. grid, ASCE estimates that there's a $94 billion investment gap on both the distribution system and transmission system. That doesn't even account for the coming turnover of aging power plants, which are 30 years old on average.

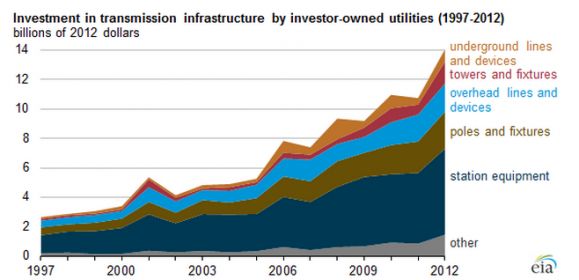

However, that gap is beginning to close a bit on the transmission system. After decades of very little build-out of new transmission lines, investor-owned utilities have boosted spending fivefold over the last 15 years. The U.S. Energy Information Administration documented the increase using data from Ventyx in the following chart.

After the long process of electrifying the nation ended in the 1960s, utilities didn't have much of a reason to build lots of new lines. But after a few decades of decline, as populations shifted and early power lines started to reach their end of life, investment rose in the 1990s. As EIA shows in the chart above, transmission investments in 1997 were at $2.7 billion; in 2012, they reached $14 billion.

The big surge came in 2005, as utilities responded to reliability concerns after the 2003 blackout in the Northeast U.S. Around that time, wind started to take off in the Midwest, and more transmission lines were built to connect those projects to load centers.

EIA says that population shifts have played a role as well. As more Americans have moved to warmer climates like the Southwest, new transmission projects have been needed to serve the budding region.

Another factor could increase transmission development further: FERC Order 1000. That rule, which was recently upheld by a Court of Appeals, would encourage more competition among developers and enforce a regional planning process that takes renewable energy policies into account.

The same is also true of distribution system planning. Throughout the 1990s, U.S. utilities cut their spending on distribution infrastructure from 5.7 percent of revenues to 3.5 percent. However, driven by resiliency initiatives and planning for extreme weather, along with new preparations for managing distributed energy, many utilities are boosting their investments once again.

To read about how utilities are investing differently in infrastructure after Superstorm Sandy, download the free GTM eBook today.