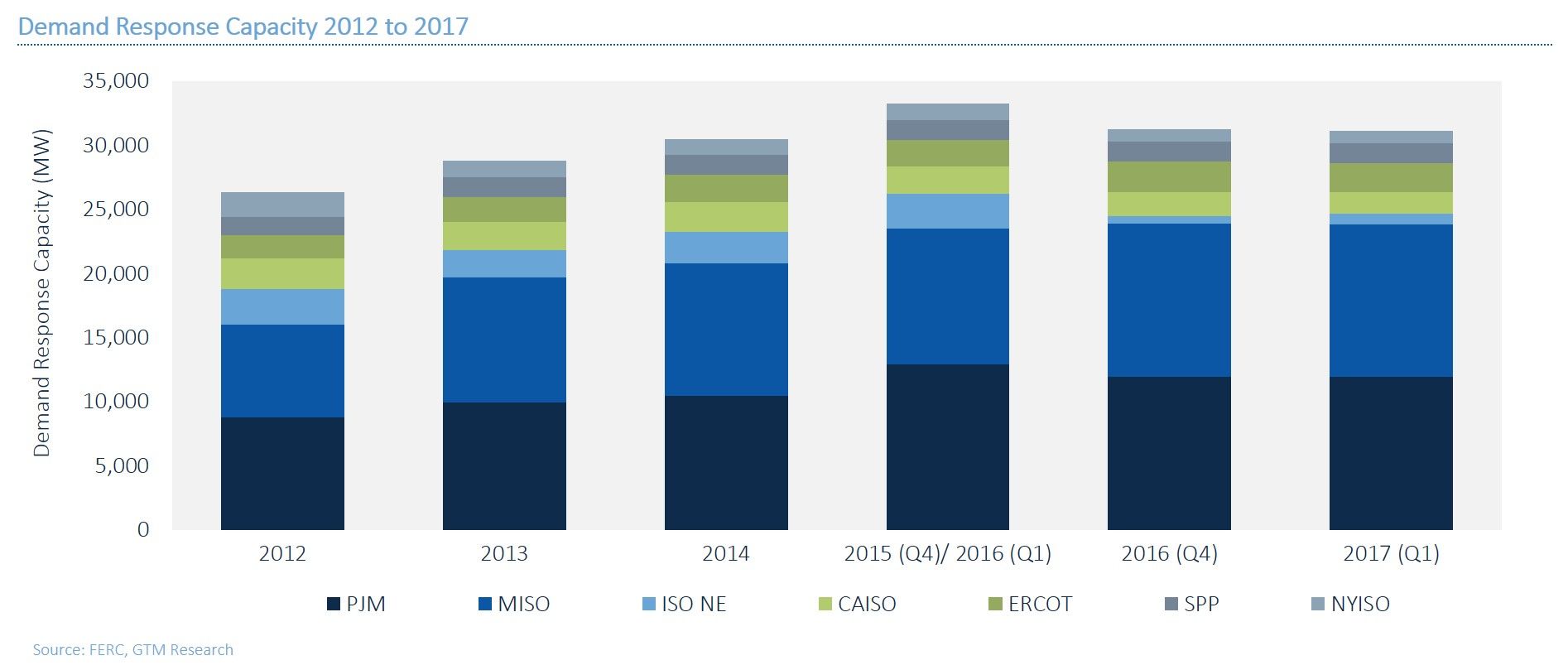

After FERC Order 745 was issued in 2011, demand response procurement increased steadily from 26 gigawatts in 2012 to 33 gigawatts at the start of 2016.

However, the effects of looming uncertainty over jurisdiction and compensation for demand response (DR) began manifesting in 2016. As a result, the total estimated DR availability in ISO/RTO territories dropped from 33 gigawatts to 31 gigawatts between Q1 2016 to Q1 2017, according to GTM Research’s latest U.S. Wholesale DER Aggregation report.

Source: FERC, GTM Research

The decline comes at a time when state- and federal-level regulation is impacting the requirements for participation in wholesale services, presenting challenges and opportunities for distributed energy resource (DER) owners to test new models of energy resource governance.

According to the Wholesale DER Aggregation report, DER participation as demand response in PJM's capacity market dropped from 2.7 gigawatts (23 percent of the overall capacity) in the 2015-2016 delivery year to 1.2 gigawatts (12 percent of the overall capacity) in the 2016-2017 delivery year. A majority of these emergency resources were diesel gensets, and so curtailment service providers -- PJM aggregators -- attribute the abrupt capacity decline to the Environmental Protection Agency regulations on the use of gensets for emergency demand response.

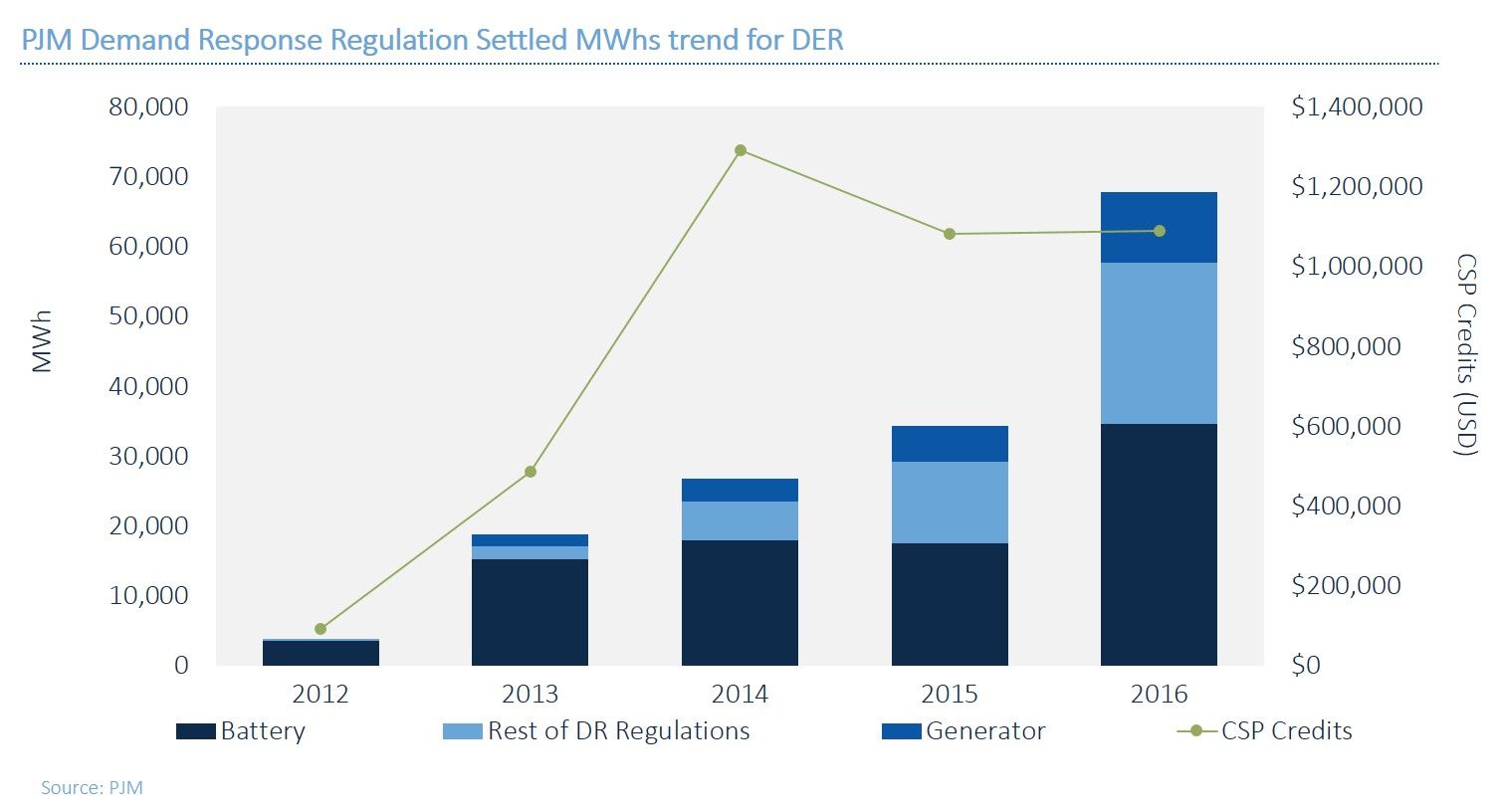

In contrast, PJM’s ancillary services market reflects capacity growth and a change in resource mix resulting from DERs. The volume in the regulation market has doubled since 2015, supported by a 98 percent increase in the use of battery energy storage. Last year's Notice of Proposed Rulemaking from FERC will likely continue to drive energy storage growth in wholesale markets.

Source: PJM

“The effect of increasing regulation is truly felt in traditional demand response programs; in PJM, curtailment service providers are seeing a decline in volume and revenue from load management in capacity markets, but there is still value to be found in both energy and ancillary services markets, when appropriate technologies and market mechanisms are matched,” said Elta Kolo, grid edge analyst and lead author of the report.

PJM is adapting to these broader market changes; specifically, the RTO is supporting aggregation of seasonal resources in the capacity market, Kolo said. Proposed revisions to its Open Access Transmission Tariff recently went into effect for the 2020-2021 capacity auction (the Base Residual Auction). Auction results will illustrate how the newly proposed aggregations of seasonal resources work in practice to make year-round available capacity performance offerings.

Further south, slow growth in DERs in ERCOT’s territory has not precluded the ISO from studying how rising consumer interest in DERs could impact reliability and grid planning. According to the GTM Research report, ERCOT estimates that just over 1 GW of DER availability already exists within the territory. The study highlights existing roles for DERs and the market and regulatory challenges that will need to be overcome to accommodate greater penetration of DERs, underscoring a broader theme among wholesale markets.

“Stakeholders have been grappling with appropriate regulatory and market design constructs to accommodate the proliferation of existing and new DER technologies," Kolo writes in the report. “Policy and regulation has limited the pool of resources that can participate in demand response programs and the way in which resources are procured.”

---

This insight is pulled from the full report on market mechanisms and regulation in U.S. wholesale markets. Download the brochure to learn more.