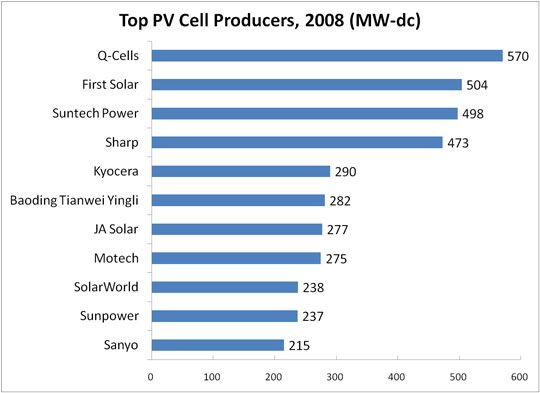

Leading German cell producer Q-Cells has gone from weakness after weakness over the last 12 months, and someone had to pay. As things turned out, it happened to be the man at the top. CEO Anton Milner quit his job last Thursday, citing a "huge loss of confidence" on account of the company's terrible 2009 results. The company declared a loss of 1.36 billion Euros ($1.84 billion) for 2009, compared to a net profit of 190 Euros (about $257 million) in 2008. It would be difficult to feign surprise at the outcome: the company had cut working hours for about 80 percent of its staff in April, later laid off 500 employees in August, and slashed its 2009 sales outlook no less than three times in six months. The question, however, remains: how did the number-one cell producer in the world in 2008 (see chart) virtually bleed itself dry? What follows is an attempt to provide some answers.

Cost Structure: Just Not Up to Scratch

I was on a panel with Anton Milner at Intersolar Munich last May where we were asked to speak on the topic of "Targeting Grid Parity". Milner's talk, however, had little to do with the subject: he dismissed any discussion about cost reductions as a waste of time, claiming that these could safely be taken for granted. Instead, he placed responsibility solely on the shoulders of policymakers, talking about the need for drastic regulatory reform that would enable the European Photovoltaic Industry Association (EPIA) goal of 12 percent penetration by 2020.

Listening to his grand proclamations, one had to wonder whether this was hubris born of self-delusion or just good old-fashioned spin. Q-Cells had already suffered a significant loss in the first quarter of 2009 (391 million Euros, or $529 million), as demand for its cells had slumped even further than that of the global market. The reason? The very issue that Milner had so casually waved aside in his presentation -- cost reductions. More specifically, Q-Cells' inability to drive costs down to the levels of Asian pure-play cell producers such as JA Solar, E-Ton and DelSolar, as well as in-house cell producers like Suntech, Yingli, Trina, and Canadian Solar. The result is that the company is simply unable to price its cells at a competitive level with its Asian competitors: its cell ASP in the third quarter of 2009 trended at around $1.50 per watt, compared to only $1.32 for competitor JA Solar. The company insisted that the "Made in Germany" cachet of their products would result in both a price premium and preference over what it perceived to be potentially unreliable Chinese cells. It turned out to be wrong: making crystalline silicon cells out of wafers isn't exactly rocket science. As a result, Q-Cells ended up losing considerable market share through 2009, and barely earned any gross margin on the cells it did manage to sell.

Complacency: Behind the Eight Ball

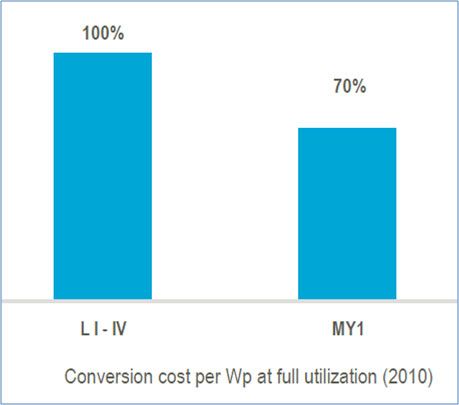

The fact is that cost structures for European cell and module producers are by and large simply not competitive with those typically achieved by producers in low-cost locations. Lower labor and utility costs that Asian manufacturers enjoy are only one factor; significant benefits also come from tax breaks and lower SG&A (selling, general, and administrative) costs in the developing world. It turns out that Q-Cells actually does have a manufacturing facility in a low-cost location, namely, a wafer/cell plant with an estimated capacity of 520 MW in Malaysia, where First Solar's CdTe plant is also located. As the chart below indicates, cell conversion costs at the Malaysia fab, once fully ramped, are expected to be 30% lower than those at Q-Cell's German plant in Thalheim.

Unfortunately, the plant did not come online until mid-2009, and spent the better part of the rest of the year ramping up, meaning that its cost structure was not especially competitive at this time. This was much too late to fight off Chinese competition, even if -- as the industry originally anticipated -- structural oversupply would manifest in 2009/2010 rather than late 2008.

On top of this, the company signed long-term wafer sourcing contracts in 2008 that eventually proved to be an albatross around its neck: when oversupply did come around and cheap wafers were available via the spot market, Q-Cells found itself paying about 20 cents a watt more for wafers than its competitors due to these "legacy effects" (see chart below). Again, the Malaysia plant, which was designed to be an integrated wafer-cell facility, could have offered a measure of relief if it had ramped up in time. As a pure-play cell manufacturer in a market that was witnessing a continually growing Asian presence, it seems obvious that Q-Cells' business model would be extremely vulnerable in an oversupply situation, begging the question as to why it lacked the foresight to bring the plant up to speed sooner than a year and a half after the market turn. Its behavior can only be attributed to complacent thinking, i.e., that its established position in the market would see it through the early stages of such a market environment.

Half-Baked Investments

Common sense dictates that a degree of technology diversification is a sound long-term strategy in PV manufacturing: the industry is still far from mature, and it remains uncertain which technology will eventually emerge as dominant. Investment in alternative technologies by a crystalline silicon-based firm therefore acts as a hedge against its core competence.

However, Q-Cells' actual strategy in this area has bordered on the ridiculous: over the past three years, it has spent huge sums of money investing in practically every PV technology under the sun. The list goes on and on: string ribbon (33% stake in Sovello/EverQ), CdTe (Calyxo), CIGS (Solibro), amorphous silicon (Sontor, now Sunfilm AG), flexible cells (VHF), the decision to source 30% of its 2009 feedstock needs from upgraded metallurgical silicon (UMG), and a planned $3.5 billion thin film manufacturing complex in Mexico. Essentially, this amounts to placing a bet on every single horse in the race, regardless of each of their prospects. Considering that a return to abundant polysilicon supplies and "normal" polysilicon prices by 2009-2010 was widely predicted by analysts back in 2008, the company's bet on UMG at the time was particularly suspect. Similar myopia was exhibited in the case of the string ribbon investment, whose value proposition hinges almost entirely on the cost of polysilicon. Both of these investments have backfired badly: Sovello, its string-ribbon JV with REC and Evergreen Solar, is on the verge of bankruptcy, and UMG has become practically worthless in a $50/kg polysilicon environment. Sunfilm, meanwhile, has been accorded a book value of zero, and the company has maintained pin-drop silence as to the status of the Mexican thin film plant. This cavalcade of half-baked investments has left deep scars on the company's balance sheet (to the tune of EUR 158 M for asset write-offs for Sovello and Sunfilm alone) -- and betrays a troubling lack of fiscal and strategic discipline.

Not Out of the Woods Yet

Looking forward, the company has taken a number of measures to rectify the situation. It is likely that most of the German production lines will be shut down permanently in favor of a Malaysian ramp (thus nullifying any "made in Germany" advantage the company had previously claimed). Administrative and overhead cost reductions are also underway. Expensive legacy wafer contracts will roll off as the company sources its feedstock needs from the spot market (composed mostly of Chinese producers). And finally, it is also in negotiations to sell its stakes in Sovello and Sunfilm.

Still, it is difficult to shake the sense that the restructuring changes at Q-Cells have come too late in the game. Chinese producers have continued to expand capacity and lower costs aggressively in recent months; by the end of 2010, JA Solar should be able to convert a wafer into a cell for about 20 cents per watt, which may be out of Q-Cells' reach in the near future, and further price drops are on the way in the second half of 2010. Moreover, internal confusion still abounds as to Q-Cells' future place in the solar value chain. While Milner was hell-bent on growing the utility-scale project business of subsidiary Q-Cells International (QCI), interim CEO Nedim Cen has spoken of a "de-risking" strategy that favors residential system sales and module production, although how tabbing and stringing cells will contribute to a fundamental turnaround for the company is anybody's guess.

On the surface, Q-Cells may appear merely to be the highest-profile casualty of the market shift that affected most companies in 2009. However, it would be disingenuous for the company to blame its turn of fortunes purely on external factors: in large part, Q-Cells has been a victim of its own myopia, complacency, and lack of strategic focus. For a firm that once epitomized crystalline silicon PV, the road back to the top will be slow and arduous -- and much soul-searching lies ahead.