Tesla got a lot of attention last week for its new batteries for solar-equipped homes. But there’s an even bigger business opportunity for batteries to help commercial buildings shave peak load, manage demand charges and improve the economics of rooftop solar systems, according to GTM Research.

Tesla and sister company SolarCity are only one of a number of contenders in this space. Startups including Stem, Green Charge Networks and Coda Energy have installed megawatts' worth of behind-the-meter batteries in commercial buildings. The market potential is big enough to draw mainstream players like electric equipment distributor Gexpro, which is bundling storage systems for installers and energy services companies to compete with the vertically integrated offerings we’ve seen so far.

But controlling pumps, fans, HVAC systems and industrial processes to manage the ups and downs of peak demand or rooftop solar output is still a lot cheaper than batteries -- at least, if you consider the real costs involved, and not the no-money-down financing deals that behind-the-meter energy storage players are offering. That means that commercial building owners will want to tap that “virtual storage” before they start looking to batteries to flatten their demand profiles and slash their utility bills.

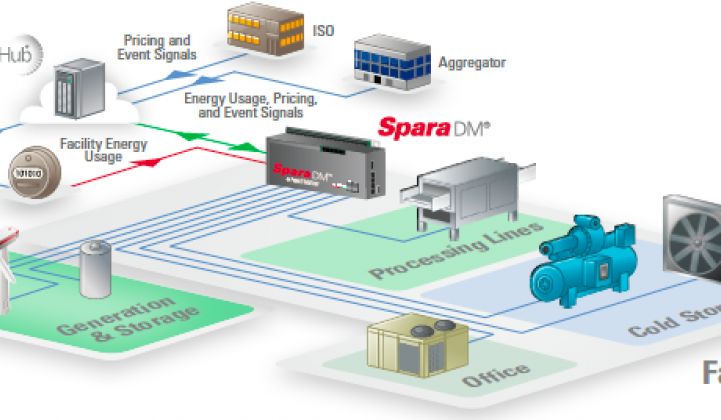

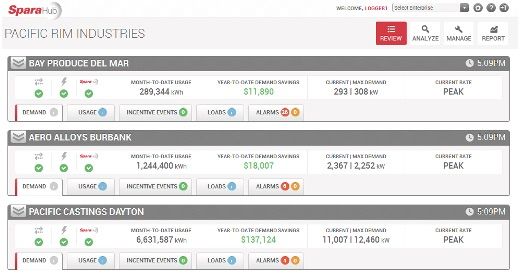

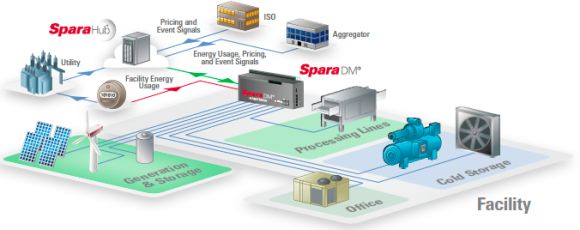

So says Kevin Klustner, CEO of Powerit Solutions. The Seattle-based company has hundreds of industrial and commercial sites using its Spara technology platform to shift and shape on-site energy consumption. Powerit’s main customer base is industrial sites, where it connects and controls systems ranging from cold storage facilities to steel smelters to avoid peak demand charges, take advantage of shifts in wholesale power prices, and earn revenues for demand response or other grid programs.

As Powerit’s customers start to add solar PV to their sites, that energy management equation becomes more complex, Klustner said. Solar can help reduce energy bills, but it can also fade away at the moments when overall building energy demand is rising, causing new peaks that have to be managed. And because solar power is intermittent, it increases the volatility of a facility’s demand for grid power -- and volatility is something that can really jack up utility charges for big commercial and industrial customers.

That’s led several of Powerit’s existing customers, such as big avocado and asparagus packer Mission Produce, to start installing behind-the-meter battery systems, he said -- “we’ve worked with Tesla, we’ve worked with Stem” at several sites in California, which has lucrative state incentives for on-site energy storage. Indeed, Powerit’s new Microgrid Controller platform, launched in February, is designed specifically with these new solar-and-storage-equipped customers in mind.

But the bottom line remains: “Based on our experience, it’s much better economically to plan the use of storage on site with demand management, because the cost is exponentially less per kilowatt-hour than the cost of storage,” he said.

Specifically, Powerit has seen battery project proposals at customer sites at costs between $1,600 and $500 per kilowatt, he said. That’s a reasonable range for today’s all-in costs for lithium-ion battery systems, although Tesla can be expected to push its lower boundary with its new commercial storage products.

Even so, that’s a lot more than the $125 per kilowatt it costs Powerit to identify, connect and control on-site equipment to shave peak loads during 15-minute intervals, or the $240 per kilowatt it costs to enable multi-hour demand response load reduction, he said. Plus, adding software to a building doesn’t require adding new equipment and working through unfamiliar permitting processes, as adding batteries does, he said.

This isn’t a case against batteries, he clarified. But it is a reminder that customers should take all the available demand-side capabilities into account before deciding how much battery storage to buy.

“Using demand management in conjunction with renewables and storage really brings the cost of ownership down, in a way that makes the cost of storage plus demand management much more attractive,” Klustner said.

We’ve seen other demand management companies make similar points, even as they start adding batteries to the mix of building loads they’re controlling. Companies like Enbala Networks, Tangent Energy, Blue Pillar, Innovari and Demansys are some good examples.

On the other hand, energy storage does offer some key benefits compared to demand management as “virtual storage.” One is the relative simplicity of how batteries work to inject power into buildings, compared to the complexity of altering energy use in industrial processes and commercial building systems. Another is the fact that many behind-the-meter battery companies are offering no-money-down, shared-revenue deals that can erase customers’ upfront costs.

Demand management and energy storage are “absolutely complementary,” Paul Detering, CEO of Coda Energy, said in an interview this week. At the same, companies like Powerit face the challenge of “going in and getting their solutions in and running, which requires a fair amount of upfront work, with a fixed cost to figure out what processes, what machines, you've got,” he noted.

Coda Energy’s upfront cost, by contrast, is “zero,” he said. “We are willing to own and operate the asset, and share the savings with the customer.”

Of course, any battery system that’s going to earn its keep will have to come with significant pre-installation analysis of how the building uses electricity, when its load is triggering excessive charges, and how much storage capacity is needed to manage those problems, he said. It also has to predict upcoming facility peaks and keep abreast of ever-changing utility and energy market prices an ongoing basis.

Powerit's Klustner noted that the company does offer financing for customers, "and in a number of cases, [we] finance a system for a net positive cash flow from day one." At the same time, lots of its industrial customers prefer to finance the installation as a capital project with a payback that's measured in 15 percent to 30 percent reductions in utility bills per year.

Tesla’s behind-the-meter battery partners include SolarCity, which has built its own Demand Logic software for commercial solar-storage customers, and EnerNOC, which also recently partnered with SunPower to merge solar systems with its demand response business and energy management software portfolio. Other energy storage vendors come with their own software, or use platforms from companies like Greensmith, Younicos or Geli to manage their interplay with building loads.

At the same time, building control systems will increasingly start to incorporate rooftop solar and behind-the-meter batteries, as they become an increasingly common feature of the built environment. These combined systems could be called microgrids, or virtual power plants -- or they could be called business as usual. It's all a part of the shift of the energy landscape from the central generation model toward a "grid edge" future, where what happens inside buildings is as important as what happens on the utility side of the meter.

***

Join Greentech Media at our Grid Edge Live conference on June 23-25 in San Diego to learn more about how distributed energy resources are challenging regulators, utilities and businesses to create new models for valuing demand-side resources.