When Americans talk about energy subsidies, the focus is usually tax breaks or other financial incentives for new technologies, such as solar or wind, versus subsidies for mature, fossil fuel technologies, like oil and natural gas.

But if we step back and look at the global scale, the billions of dollars that go to traditional energy dwarfs even the spending in the U.S., and is limiting access to clean energy for billions of people who live without regular access to electricity and rely on dirty, expensive petroleum products.

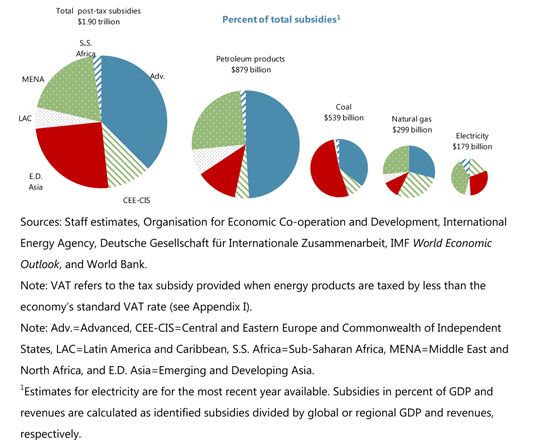

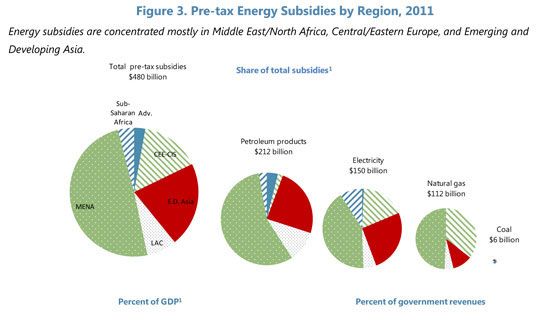

In a new report, Energy Subsidy Reform: Lessons and Implications, the International Monetary Fund identified $1.9 trillion in post-tax energy subsidies in 2011, with another $480 billion in pre-tax subsidies. Advanced economies lead in the post-tax field, with the U.S. in front at $502 billion, followed by China with $279 billion and Russia with $116 billion.

The U.S. and other developed countries, however, are a drop in the bucket compared to emerging economies in pre-tax subsidies, where petroleum products are significant recipients of subsidization. The Middle East and North Africa make up nearly half of the globe’s energy subsidies in the pre-tax categories.

The problem is not just that it puts cleantech like solar at a disadvantage, but externalities like health costs and carbon pollution are almost never taken into account in developing countries. The IMF found that if tax-inclusive subsidies were eliminated for petroleum products, there would be a 10-million-ton reduction in SO2 and a 13 percent decrease in energy-related CO2 emissions.

Although the figures are significant, the IMF warns in the report, “These estimates are likely to underestimate energy subsidies and should be interpreted with caution.”

To move away for energy subsidies, the IMF makes six recommendations, all easier said than done:

- A comprehensive reform plan

- A far-reaching communications strategy, aided by improvements in transparency;

- Appropriately phased energy price increases, which can be sequenced differently across energy products;

- Improving the efficiency of state-owned enterprises to reduce producer subsidies;

- Targeted mitigating measures to protect the poor; and

- Depoliticizing energy pricing to avoid the recurrence of subsidies