Sure, the launch comes nearly a year behind schedule, includes only a handful of devices, and only supports the simpler “OpenADR 2.0a” profile specification, though Barry Haaser, managing director of the OpenADR Alliance trade group, said a more complete 2.0b version is expected out by year’s end.

Still, for the utilities, vendors and regulators that support the standard, OpenADR 2.0 is a big deal. That’s because it doesn’t just promise the potential for interoperability, Haaser said -- it sets up a testing and certification regime to prove it.

“With 2.0, we now have a profile specification we can point to that’s consistent among all of the products that are developed, which is a problem that plagued OpenADR 1.0,” Haaser explained. Simply put, previous versions of OpenADR required all kinds of customization in the field to support different devices from individual providers, he said.

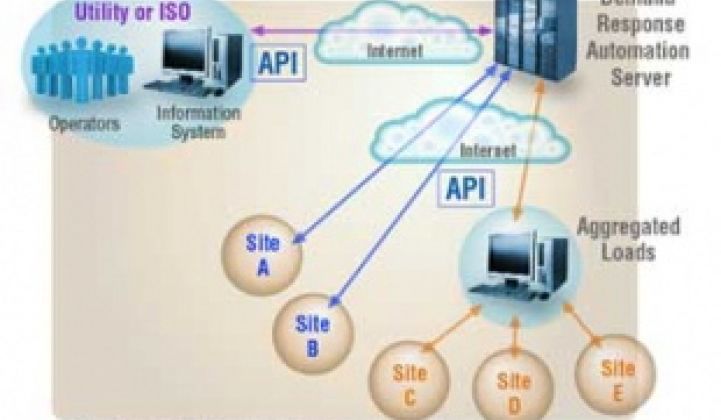

Those included the “virtual top node,” or VTN, servers that receive the utility signals at the customer premise, as well as the “virtual end node,” or VEN, client servers that translated those signals into energy-saving actions for building control systems and other end devices, he said.

Right now, there’s only one major vendor of VTNs for the industry. That’s Honeywell, which in 2010 bought OpenADR server maker Akuacom, the company that worked with Lawrence Berkeley National Laboratory to bring the technology from R&D to real-world use in the state.

Akuacom’s servers now run the vast majority of the roughly 260 megawatts of OpenADR-controlled demand response in California, and Honeywell has launched OpenADR-based projects in other parts of the U.S., as well as in China and the U.K.

But Haaser said that he knows of about a dozen companies working on OpenADR VTN servers based on the new 2.0 specification, though he wouldn’t name names. Other companies that have been reported to be working on OpenADR servers include Lockheed Martin, the LonMark International nonprofit representing users of the LonWorks building management protocol from Echelon, and UISOL, the California smart grid software developer acquired by French grid giant Alstom.

Not surprisingly, Honeywell was one of the vendors included in last week’s product launch with its OpenADR 2.0a-compliant Akuacom demand-response automation servers. But it was joined on that list by big U.S. demand response provider EnerNOC and its OpenADR 2.0a-compliant Site Server, which collects meter data from end-users and streams it in real time back to the company’s network operations center.

EnerNOC has been less sanguine than Honeywell about the impact of OpenADR on the market, however, saying that most customers are leery about turning over control of their facilities’ energy use to a new technology.

At the same time, EnerNOC is supportive of the push to standardize automated demand response, particularly to support fast-reacting power-down commands needed to serve the more lucrative grid balancing markets like ancillary services and frequency regulation. Utilities will need fast-acting DR systems like OpenADR to balance intermittent solar and wind power, and Haaser said that OpenADR 2.0 has proven its ability to act at speeds as fast as 4 seconds, which could make it useful for such tasks.

Also on the list is IPKeys, which has built VTN and VEN devices, making it the first company with a device specifically built to translate OpenADR 2.0a-compliant utility signals into end-device commands. Of course, other companies like Powerit Solutions are designing their building power control technologies to accept and act upon OpenADR 1.0 commands, and can be expected to upgrade to the 2.0 version over time -- Haaser noted that a clear migration path exists between the two technologies.

Honeywell, as a major vendor of building automation and control systems, also plans to migrate its deployments from 1.0 to 2.0 over the coming year, Ed Koch, co-founder and CTO of Akuacom, said in an interview last week. Honeywell is also working with Pacific Gas & Electric and the California ISO grid operator to use OpenADR 2.0 with the automatic generation controls (AGC) and other systems now used to send grid-balancing commands to gas-fired turbines and other sources of fast-acting grid power, he added.

The fourth company on the list is home automation integrator Universal Devices, which now includes native OpenADR 2.0a along with ZigBee, INSTEON, A10 and X10 in the list of technologies it supports. While OpenADR has been used exclusively in the commercial and industrial fields so far, it’s also being considered for residential demand response, and supportive utilities like Pacific Gas & Electric have already started asking the industry for OpenADR 2.0-compliant thermostats, making it clear that they intend to use the standard for that purpose as well.

Finally, it’s important to differentiate the OpenADR standard’s development to another important standard in utility-to-customer energy management. That’s Smart Energy 2.0, the technology developed by the low-power wireless ZigBee Alliance that also supports Wi-Fi and the data-over-powerline HomePlug standard.

The key difference between the two standards is that, while SE 2.0 is meant to contain all the instructions to command individual devices to take power-saving actions, OpenADR is more of a communications standard to get messages from utilities to their customers, Haaser said.

That’s why OpenADR’s functionality is split up between the VTNs, which receive utility signals, and the VENs, which translate them into building system commands. But once OpenADR 2.0 is solidly established, its backers hope to see more and more companies including VEN-type functionality in their building-side equipment.

“This is a game changer -- it completely changes the framework for automated demand response,” is how Haaser put it. “Now the whole market is going to shift. You’re seeing some utilities offering programs directly, there will be others that will continue to turn to aggregators and other sources. [… Y]ou’ll find that OpenADR becomes a standardized feature on a wide range of products.”

How quickly will that happen? That’s an open question, but no doubt the industry will be watching closely for new OpenADR 2.0-compliant products and devices coming onto the market. They’ll also be watching the regulatory front -- Haaser said that California’s big three investor-owned utilities are planning to require all OpenADR 1.0 systems to be compliant with the 2.0 version by next summer, for example.