The earnings results of publicly traded Chinese solar companies are well covered by outlets including Seeking Alpha, sell-side analysis firms, and Greentech Media itself. However, as the industry continues to suffer due to the effects of persistent overcapacity, consolidation-related events (insolvencies, plant closures and financial results) have taken center stage, while a number of lesser-known, yet important, trends continually pass under the radar due to lack of coverage.

In this series, we hope to highlight some of these overlooked global supply chain data points by sharing a selection from our coverage in GTM Research's Global Competitive Intelligence (CI) Tracker. Here, we examine a surprising development: how the best-in-class manufacturers in Korea and Singapore have managed to reduce costs to competitive levels with Chinese firms in recent months.

Generally, GTM reserves the title of “low-cost” producers for select Chinese firms, since, historically, manufacturing costs for Chinese producers have been more than 15 percent lower than their closest competitors. Although this is attributed mostly to lower labor costs, in reality labor accounts for only a small portion of overall PV manufacturing costs. The real reason is the difference in the price of key consumables: the past three years have seen the emergence of a large domestic supply chain for materials such as steel wire, slurry, silver paste, glass and frames in mainland China. Firms in this supply chain (e.g., Xingda for steel sawing wires) have priced their offerings significantly below European and Japanese competitors (e.g., Bekaert), to the benefit of customers such as GCL-Poly and Yingli Green Energy.

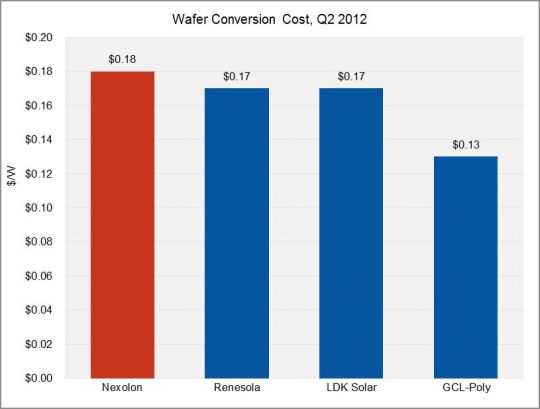

However, in Q2 2012, South Korean wafer manufacturer Nexolon reported a wafer conversion cost of $0.18 per watt, just one cent higher than Renesola and LDK. Looking to Q3, the company guided continued conversion cost reductions to $0.16 per watt. If Nexolon achieved this cost reduction, it would remain on par with Renesola (Q3: $0.15 per watt) and would easily surpass LDK (Q3: $0.25 per watt, the result of lowered utilization rates). This compares to Q4 2011, when Nexolon reported a conversion cost of $0.25 per watt -- 32 percent higher than Renesola.

Source: GTM Research Competitive Intelligence Tracker

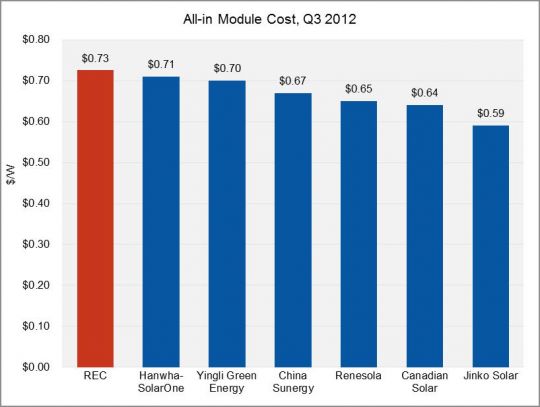

Similarly, REC has demonstrated an all-in module cost that is competitive with its Chinese peers. The company reported a cost of $0.73 per watt, less than 5 percent higher than its closest cost competitors, Hanwha-SolarOne and Yingli Green Energy. The company is calling for further cost reductions, targeting a Q1 2013 all-in cost of only $0.59 per watt.

Source: GTM Research Competitive Intelligence Tracker

What is driving the increased cost-competitiveness of these RoA manufacturers? First, the price spread for consumables between mainland China and the rest of the world has contracted significantly in recent quarters, as non-Chinese producers have had to respond to aggressive price cuts by their Chinese competitors. Secondly, unlike most Chinese solar firms, Nexolon and REC have made investments in advanced technology platforms such as quasi-mono ingot growth, diamond wire sawing and backside passivation that, while requiring meaningful upfront capital investment, have yielded significant improvements in their processing costs. (All three of these technology concepts are covered at length in GTM’s recently published report on crystalline silicon innovations.)

We'll cover additional important but less-than-obvious trends about the global PV supply chain next week in Part II. In the meantime, check out GTM Research’s Global CI Tracker.