The Environmental Protection Agency just announced it expects only 6 million gallons of cellulosic biofuels to contribute to the 16.55 billion gallons of renewable fuels mandated by the Renewable Fuel Standard (RFS) in 2014.

But a tour of emerging sites in Iowa, the leading U.S. producer of first-generation ethanol, suggested that something big is about to happen in cellulosics and advanced biofuels.

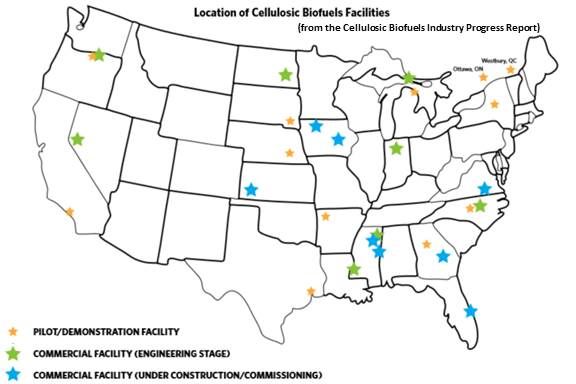

Abengoa Bioenergy, BlueFire Renewables, Fiberight, Fulcrum Bioenergy, LanzaTech, Mascoma, and POET-DSM are scheduled to go into production of cellulosic ethanol in the U.S. within the next eighteen months, according to the Cellulosic Biofuels Industry Progress Report 2012-13.

“We are on the edge of a chemical revolution,” explained Andy Suby, manager of the Iowa State University BioCentury Research Farm. At the university’s “first-generation biorefinery,” Suby said, “multiple feedstocks will come in and multiple products will go out. Pick your market, pick your profit margin, pick your profit.”

Down the road at Iowa State’s 75-acre Sorenson Farm field laboratory, Professor of Biomass Agronomy Emily Heaton is conducting a range of experiments to establish best practices for the management of next-generation cellulosic crops like camelina, switchgrass, and miscanthus.

She is doing a range of experiments, she said, some on crops being turned into biofuels in today’s bioeconomy and some on next-generation dedicated energy crops.

“Biofuels are part of farming today,” Heaton said. “As for their cost-effectiveness, on a fair playing field, there is nothing that beats plants that harvest and store solar energy.”

A lot of technologies can harvest solar energy, she said. “It is how you capture that energy, how you store it, and how you turn it into something useable. Plants have been answering that question for the last billion years."

It will take a lot of different strategies to replace fossil fuels, she added. “They are energy-dense -- but they are killing us. We are not factoring in all of the costs of fossil fuels and the benefits of renewables.”

The POET Technologies-Royal DSM Project Liberty is only a construction project. But it is on track to produce 20 million gallons of cellulosic ethanol per year from corn stover (that is, cobs, leaves, husks, and stalks) at commercial scale in the first half of 2014, according to POET-DSM VP and CTO Wade Robey.

“We are building an integrated biorefinery that combines the production of corn ethanol and cellulosic ethanol,” explained Robey. The concept was tested at POET’s 20,000-gallons-per-year pilot project. “But until you run it at scale, you haven’t run it,” Robey said.

The $250 million project won $100 million in DOE grants and $20 million in financial assistance from the state of Iowa. It is expected to provide 40 permanent jobs and $15 million to $20 million in revenues to local farmers.

Its combined heat and power technology will maximize efficiency by powering the adjacent corn ethanol facility. Greenhouse gas emissions are expected to be 80 percent below fossil fuel emissions, significantly exceeding the EPA-required 60 percent mark for cellulosic facilities, according to POET-DSM Licensing GM Steve Hartig.

“These plants are expensive," Hartig said, adding, “cellulosic fuels will not achieve the production volume of corn ethanol because the sheer bulk of biomass limits economic viability. There are 200 U.S. corn ethanol plants. Not all will be suitable or interested. But in fifteen or twenty years, there will likely be 75 cellulosic facilities.”

The flexibility of the technology makes moving to switchgrass feasible, Hartig said. But there would first have to be switchgrass growers. “Long term, there will be three buckets of feedstocks: corn stover and wheat straw in the Midwest, wood in the North and the West, and energy grasses in the Mid-South.”

The DuPont (DD) $200 million Nevada cellulosic ethanol biorefinery is also a construction project. It is scheduled to be in production by mid-2014 and will eventually produce 30 million gallons of next-generation ethanol from stover. In support of the plant, DuPont operates a local state-of-the-art research laboratory, where it is pursuing cellulosic genome studies.

Green Plains Renewable Energy CEO Todd Becker believes that the algae-based biofuel being looked at by BioProcessAlgae can turn the carbon dioxide byproduct of his ten corn ethanol plants into a feedstock. BioProcessAlgae is just beginning to reach scale at Becker’s Shenandoah plant. A $6.4 million DOE grant will help build the planned $11 million pilot plant.

The technology has a uniquely productive growth medium, plenty of CO2 and sufficient sunlight. Much of its water will be recycled from the adjacent ethanol plant.

“Corn grows 7 tons to 8 tons per acre of biomass,” Becker said. “We’ve seen as high as 40 tons per acre of algae biomass. We can grow five times the biomass, and it has a lot more value than what corn is trading at today.”

The target markets are aquaculture, animal feed, and biofuels. Products for the first two markets have been derived from the process. As of now, the biofuels products are of too low a quality to market, though eventually, algae biomass is expected to provide algal oils of high enough quality to be refined into jet fuels.

Though an environmentalist group once famously called cellulosic ethanol a unicorn that would never really appear, Suby noted, a number of producers “are about ready to saddle that unicorn up and ride it.”