Monday was analyst day at Enphase. The microinverter and energy storage firm is making good progress in product development, cost reduction, and opex reduction. And company executives say they see a path toward sustainable profitability.

The big question is whether Enphase has enough time (or in this case, enough money in the bank) to get to that promised land.

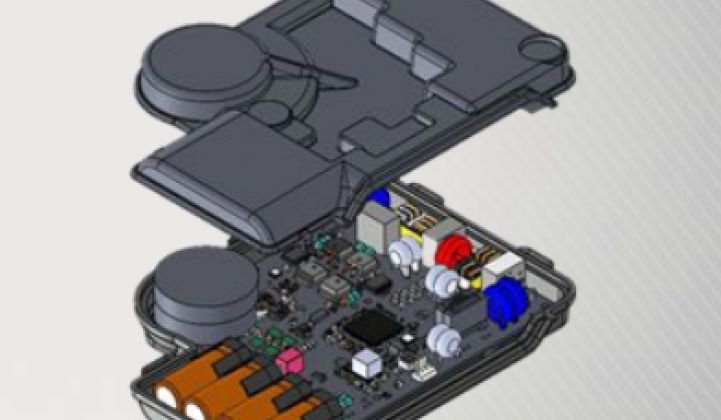

New, slick microinverters

Enphase is rolling out new microinverter designs that are progressively smaller, more functional and more integrated. The microinverters are going to have to be cheaper, too; Enphase expects inverter pricing to settle at a 7 percent to 10 percent year-over-year reduction in cost.

Oppenheimer Equities "came away impressed with the company’s technology roadmap, which reaches $0.10 per watt cost structure on software-defined products which are expected to operate as plug-and-play microgrids."

Reaching profitability?

Enphase set a goal of reaching a $0.10 per watt cost (a 50 percent reduction) in 24 months, and the company is running "approximately six months late."

The company has streamlined its operations, let go of a large number of employees, and will have to continue to run lean to reach the profitability of module-level electronics market leader SolarEdge.

Growth in residential will be tough this year

"Welcome to the era of sub-15 percent annual growth. This is the new normal for residential solar," notes Austin Perea, a solar market analyst at GTM Research.

Enphase is counting, heavily, on the long tail to grow its market share in 2017.

Do the math

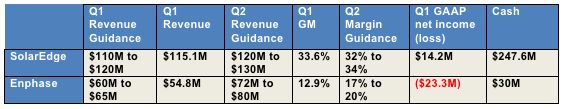

Enphase is losing money, expects an opex of $18 million this quarter, and has $30 million on its balance sheet. That leaves "limited wiggle room on execution," according to Oppenheimer.

Solar module-level electronics rivals SolarEdge and Enphase reported their respective first-quarter earnings last month, allowing for a side-by-side comparison of their financial results.

Storage

As we recently reported, despite the optimism and a claim of "60,000" AC battery preorders, Enphase's AC battery and energy storage aspirations seem to be fizzling, or are at least very delayed.

Enphase CEO Paul Nahi did some backpedaling: "We are facing a more competitive pricing environment and are actively working to reduce our cost in 2017. In addition, we believe the total addressable market is developing slower than anticipated." He added, "I don't think we’re going to see those [preorders] materialize. I think the actual numbers are going to be substantially less."

For the more conspiratorially minded...

In a recent SEC filing from Enphase, spotted by the GTM AI platform, we see a licensing agreement between Enphase and its manufacturing partner, Flextronics:

On June 13, 2017, Enphase Energy, Inc. (“Enphase”) entered into a Master License Agreement (“Agreement”) with Flextronics Industrial, Ltd. (“Flextronics”), under which Enphase licenses its intellectual property to Flextronics in order to allow Flextronics to market, manufacture, and sell certain Enphase products. Such rights may be used to assure continuity of supply to Enphase customers.

That seems like an innocent enough assurance of continuity to its long-tail installer base. Or a pragmatic plan B if Enphase runs out of runway.

Oppenheimer has a price target of $2.00 per share for Enphase stock, currently trading at $0.80 per share with a market cap of $65.5 million.