I might have been the first and only journalist to report on the founding of solar startup NetCrystal. So it seems fitting that I'm the first, and perhaps only, person to report on their "acquisition" by India-facing solar company Solar Semiconductor.

NetCrystal was founded in a different time. In the 2005 to 2008 timeframe, venture firms were giddy about founding early-stage solar firms -- firms that in most cases were best left in the lab.

But Wellington Partners, Siemens and X/Seed Capital saw fit to fund this firm with IP based on the work of Stanford University's Peter Peumans and helmed by a newcomer to solar, CEO Bala Padmakumar.

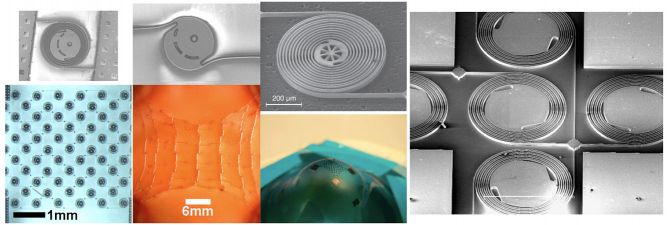

NetCrystal had developed a MEMS-style solar technology that let photovoltaic silicon stretch and expand to cover large areas. NetCrystal’s CEO claimed that the device’s efficiency would rival and exceed that of SunPower (~20%) while beating the price claims of the then mightily hyped Nanosolar ($.99/watt -- a low number at the time).

Padmakumar said this to me with a straight face.

The technology employed Interconnected nodes of PV silicon surrounded by coiled silicon fabricated in a DRIE process upon a flexible polymer substrate. The substrate was then mechanically stretched to expand many times, resulting in distributed photovoltaic zones connected by the now-uncoiled silicon -- ostensibly eliminating the cell-to-cell interconnection now performed on panels using crystalline silicon.

The firm had been awarded a $99,000 SBIR Phase I project focused on the development of high-efficiency, lightweight, non-tracking PV arrays based on stretched silicon. According to the SBIR document: “The stretchable silicon process can achieve accurate placement and electrical wiring of thousands of miniature solar cells in one parallel and potentially low-cost step. As if that wasn't risk-laden enough, there was also a concentrating lens aspect to the design.

At the time, the CEO said he already had some potential customers and was preparing to reveal some dramatic customer news along with some funding activity. Suffice it to say, that never occurred. Padmakumar also said that the company had megawatts of "conditional purchase orders" and plans for large factories.

For those not familiar with the term "conditional purchase orders," I discussed this recently with a VC colleague, so allow me to explain. I have placed "conditional purchase orders" with the Ferrari company of Maranello, Italy to deliver 4 California models (see below) to me if they achieve a price point of $10 per unit of horsepower. That is a conditional PO.

At a talk given by Stanford's Peumans in 2010, he said of the technology: "We have not seen anything yet that shows it won't work," adding, "I'd like to think it's going to work."

NetCrystal is listed on the X/Seed Capital portfolio page as having been "Acquired by Solar Semiconductor." I have contacted that firm and await their response.

Here are some photos of the innovative technology:

Here is a Ferrari California.