Mexico has the potential to develop a large, thriving solar market. But in order to capitalize on that potential, companies must navigate a complex set of energy reforms and electricity rate structures to find projects that can attract capital in a highly uncertain environment.

Mexico has a enormous role to play in the region’s budding solar sector, according to GTM Research solar analyst Adam James. Electricity demand is increasing, with 22 gigawatts of generation needed by 2025. Furthermore, Mexico has high levels of solar radiation, around 5.5 kilowatt-hours per square meter.

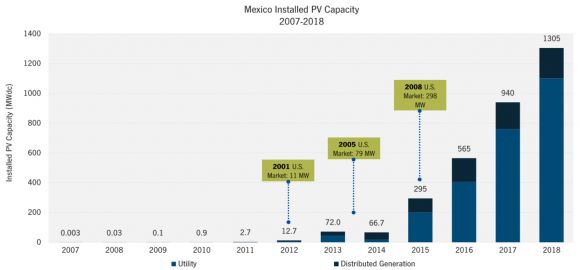

These factors are already driving rapid market expansion. According to James, Mexico’s solar sector has seen triple-digit growth rates every three-year period over the last 10 years, outpacing the U.S. solar market during its early years.

At 72 megawatts installed in 2013, the Mexico market was roughly the same size as the U.S. market in 2005. This year, solar capacity in Mexico could grow to 295 megawatts, which is where the U.S. market was in 2008.

“The Mexico market has grown at a pretty incredible pace, but the opportunity lies ahead,” said James. Ninety-four percent of installed PV capacity in Mexico in 2018 will be installed after 2014, so “by getting involved now, [companies] really have an opportunity to take a slice of the pie,” he said.

The primary opportunity is in utility-scale development, which is expected to make up 77 percent of capacity between 2014 and 2018. The second-largest opportunity is in the commercial market, amounting to 11 percent of installed capacity between 2014 and 2018. Residential projects below 20 kilowatts and industrial projects greater than 1 megawatt also make up significant chunks of the market.

Struggles with policy reform, retail rates and access to capital

While GTM Research projects that the Mexican solar market could be as big as 295 megawatts this year, there’s a significant risk that new capacity could end up being as little as 100 megawatts, said James.

The main reason for that gap is uncertainty around Mexico’s sweeping electricity sector reform, which is moving the country's monopolistic system, controlled by the state-owned electric utility Comisión Federal de Electricidad (CFE), toward a competitive marketplace.

“The key swing factor there is whether projects that procured permits under the old regulatory regime decide that they want to build those out before the end of the year, or wait and transfer to new permits,” said James. Mexico has around 3 gigawatts of permitted projects in the pipeline, he said, but many of those still need an offtaker and financing, and it’s unclear if the permits will remain valid as the projects evolve.

Also, as part of the reforms, large industrial customers can now purchase power directly from the wholesale market. This opens up a big opportunity for solar companies, since Mexico’s industrial sector accounts for 60 percent of electricity demand. But at the same time, the reforms do away with a perk that allowed industrial customers to take advantage of discounted transmission fees to purchase renewable power, removing one of solar's advantages.

Retail electricity rates are another concern. In the industrial market, a large portion of customers’ bills are demand charges that cannot be offset by solar. On the residential side, electricity rates for the vast majority of customers are heavily subsidized (reducing them to between 6 cents and 9 cents per kilowatt-hour for customers up to 150 kilowatt-hours), which hurts the economic case for solar.

Developers in the residential space have been homing in on high-consumption customers who are subject to the DAC (“De Alto Consumo,” or high consumption rate), which can bump the price of electricity to 22 cents per kilowatt-hour or higher. Of Mexico’s roughly 23 million grid-connected homes, around half a million pay the DAC.

Whether or not the solar industry can reach those remaining 22.5 million customers depends on if retail rates stay low. Rate subsidies are a popular political move in Mexico; there are currently 40 tariffs available in the country. The perception that rates will continue to stay low, despite the move toward a competitive marketplace, is making it difficult for developers in Mexico to find offtakers and lock in longer contracts.

But many experts, including analysts at GTM Research, believe retail electricity rates in Mexico will eventually have to reflect the actual cost of service, opening up new customer groups for solar companies. Robert Powell, CEO of Envolta, said an upside of Mexico’s energy reform is that it’s putting pressure on CFE to become operationally profitable, which in turn is putting pressure on policymakers to reduce subsidies.

“I anticipate those subsidies will be withdrawn, and when they are, that a larger group [of consumers] will play closer to DAC prices,” said Powell.

Access to and the cost of capital in Mexico are also significant issues. Utility-scale solar projects have the opportunity to find funding from national and international financial institutions, like the Inter-American Development Bank. But funding from those sources is in short supply. Small projects, meanwhile, are often deemed too risky to attract capital at an affordable price.

Developers looking to acquire projects often find assets are overpriced and that local developers often write family and friends into the contracts, which is a red flag for financiers. Foreign developers also have to take into account the risk of violent outbreaks in some areas of nothern Mexico, where much of the solar development is taking place.

“I’m very optimistic that it’s going to be a growth market”

As companies struggle to navigate Mexico’s new regulatory environment, there are also criticisms that the Mexican government didn’t go far enough with its electricity sector reforms. Mexico’s new target of 5 percent renewable energy by 2018 is commendable, but it isn’t much for the solar industry to work with, especially without a solar energy carve-out.

And not only is the renewable target low, but credits allotted to track progress toward meeting the goal have very little value, and so are doing little, if anything, to improve project pricing.

“They’re being given away like candy,” said Dino Barajas, a partner at Akin Gump Strauss Hauer & Feld.

Mexico’s energy credits are not only going to renewables like wind, solar and small hydro; they’re being given to cogeneration plants and high-efficiency fossil-fuel projects, said Barajas, which dampens the value of the certificates given to smaller solar developers.

With the energy reform, “they took away benefits there that worked and replaced them with something half thought-out,” he added. “A lot of the enthusiasm in the market two to three years ago has disappeared because now they’re changing the rules mid-game.”

That’s not to say the enthusiasm is entirely gone. Companies that want to capture a significant chunk of Mexico’s budding solar market in the long term will just have to cope with more uncertainty in the near term.

“Mexico is still in a period of regulatory transition, but it’s still positioned to be one of the best national markets in Latin America overall," said GTM Research's James.

That's because there are opportunities across all segments (residential, commercial, industrial and utility) and because Mexico has long-term growth potential. Unlike other Latin American countries, its powerhouse economy is big enough to underpin longer-term development.

“Mexico is still a very high priority for us. I think that it’s a huge market that has the potential to be a very large solar market,” said Karin Berardo, vice president of emerging markets for M+W Group, on a panel at Solar Summit.

M+W is working on behind-the-meter commercial projects in Mexico ranging from 500 kilowatts to 30 megawatts. M+W has a 50-person office in Mexico City, as well as an office in Brazil and one under construction in Chile.

“I think the energy reform has been unfortunate. It’s been a blip -- we have a lot of momentum that’s really grinding to a halt,” Berardo said. “But I’m very optimistic that it’s going to be a growth market and continue to be one.”

Solar companies from around the world are increasingly interested in Mexico and the broader Latin America market as a hedge against policy uncertainty in more established solar markets like the United States, Japan and China. Latin America has also become the fastest-growing regional market in the world, almost entirely independent of government incentives.

“Companies that are interested in honing their business around competing on a level playing field are interested in getting started in Latin America,” said James, who authors GTM Research's Latin America PV Playbook.

***

Greentech Media is hosting a solar summit in Mexico City in January 2016. Stay tuned for more information.