Lucid Design Group doesn’t want its BuildingOS software to replace the hundreds of different building energy management, analysis and operations software products out there. Nor does it want to build the sensored, networked, and “internet of things”-enabled hardware that everyone is predicting will soon populate the built environment.

Instead, it just wants to merge all that data and functionality into a single platform, and create applications that can open it up to everyone involved in keeping a building running more efficiently -- from facility engineers and finance managers to everyday occupants.

Since 2013, the Oakland, Calif.-based startup has deployed BuildingOS across some 5,000 buildings owned and operated by customers including Sony, Google, Stanford University and the city of Washington, D.C. It’s also integrated with about 160 different building technology vendors, ranging from big building automation system vendors like Siemens and Schneider Electric, to startups like Persistent Efficiency and Rainforest Automation.

Over the past two years, Lucid has also slowly brought in more funding for its Series B round, its first outside investment since it raised $1.5 million in 2009. Last summer it brought in $8 million, adding strategic investor Autodesk to its institutional investors Formation 8 Partners and Zetta Venture Partners.

On Thursday, it announced that it has brought that total to $14.2 million with a new strategic investor -- GE Ventures. According to Lucid CEO Vladi Shunturov, General Electric is interested in finding ways to capture the “few-trillion-dollar opportunity” in networked LED lighting and other internet-of-things-enabled building systems, while avoiding the downside that could befall the traditional equipment sales-and-services model that big building equipment vendors like GE, Johnson Controls, Honeywell and others rely upon today.

“They need to reinvent their entire business model and provide additional services and technology that can allow control and automation,” Shunturov said. To do that, “they need software that creates a pool for these technologies.” In that sense, “they know their business model is going to get disrupted -- and they want to get ahead of that disruption.”

That’s a bold statement, given that today’s building equipment and services business models haven’t changed much over the past half-decade or so. Sure, open standards like BACnet, Modbus and LonWorks have allowed for greater cross-compatibility between different vendors’ building automation systems (BAS), at least at the machine-to-machine level, Shunturov said.

But full-scale building automation is still limited to no more than 10 percent of the buildings in the United States, with only the largest and most high-end properties finding them worth the cost, he said. That opens up opportunities for smaller-step innovations in breaking open the barriers to effective energy data collection for the remaining buildings, starting with moving from monthly utility bills to interval data from smart meters, and then moving into submetering and circuit-level monitoring, he said.

This is where more modern technology can start to overtake the legacy systems that control buildings, Shunturov noted. “The disconnect in the market is beginning to happen [because] next-generation devices don’t support traditional building automation protocols,” he said. “They’re skipping that and going directly to the cloud.”

“That leaves the traditional folks like Schneider and JCI kind of in the dust,” Shunturov said. “A customer wants to future-proof the building; they’re not going to rip out what they have. But they may want to use a 38 Zeros data logger,” which allows submetering data to be sent directly via cellular to the cloud, rather than being ported up through a building automation system’s protocols, for example.

Or, they could skip submeters that run through the BAS, and go directly to wireless sensors from Persistent Efficiency or Panoramic Power, he said. “The hardware is getting commoditized, and our goal is to eliminate the cost of services and integration.”

Even sophisticated building automation systems are limited to use by the relatively rare experts trained to use them, he added. Their data isn’t necessarily widely shared, or correlated with other data, like occupant behavior or sustainability metrics. And if tenants want to report a problem with how the building is running, “I still have to go to the office manager, who speaks with the building manager, who speaks to the facilities manager, who speaks to the technician to go fix it,” Shunturov said.

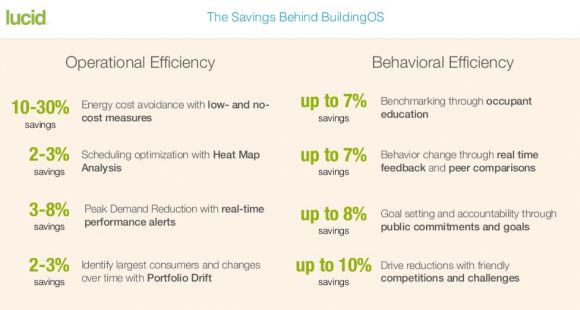

Lucid’s apps are where its aggregated data sets and management features find their human audience. The startup charges about $1,000 per building per year for its mid-tier applications package, which includes core energy efficiency and management optimization, portfolio-wide financial analysis and planning, and engagement for getting tenants involved in efficiency or sustainability, he said.

BuildingOS isn’t claiming to be able to replicate the expertise of the building technologies it’s connecting, he emphasized. Fault detection and diagnostics from companies like SkyFoundry, KGS or Cimetrics, HVAC optimization from BuildingIQ or Optimum Energy, utility billing data acquisition from WegoWise or Urjanet, and remote energy audits from FirstFuel or Retroficiency, are beyond its ken.

But Lucid is also offering a much cheaper way to bring those platforms into contact with a much larger proportion of the human beings who could make use of their insights, he said. “If you look at the market, you’ll see that no single company has been able to realize a successful software-as-a-service model” for buildings, Shunturov said. “You need to be able to on-board the customer at a very low price point. Eventually that price point needs to be zero.”