What does it take to live the EV-PV dream? For starters, you need an electric vehicle and a solar photovoltaic system. The car goes in your driveway, and the solar panels go on the roof. That is pretty much it.

However, in order to get the most out of your investment, it's important to educate yourself about rate structures, installers and EV models. When you're an energy geek, you find that there's a lot more that goes into the decision.

Here's how I did it in California.

Buying the panels

You should know that I’m not really an early adopter -- I’m a cheapskate. I didn’t go solar until March 2011, when the California Solar Initiative (CSI) rebates were in their 7th tier, down to 65 cents per watt. That means that at least 47,000 Californians went solar before I did. I was the sixth person on my block to go solar here in the green ghetto of North Berkeley.

To save a few bucks, I went with One Block Off the Grid (1BOG), back when they were the Costco of solar, aggregating customers into buying pools through city campaigns. Bought by Pure Energies in 2012, they are now a residential “energy advisor.” 1BOG ran an East Bay campaign, generated a couple hundred leads, then put them out to bid for solar installers. GroSolar won, but before my deal went through, it was bought up by SolarCity.

I paid cash to avoid financing charges. My 1.76-kilowatt Yingli/SMA system ended up at $11,441 minus a rebate of $847 and a federal tax credit of 30 percent. That’s about $6.50 a watt -- high by today’s standards, but less than the $8.00 average reported by the CSI for that quarter.

A SolarCity rep came and sat with me at my kitchen table. Looking at my already low energy bill, he gave me a classic and devastatingly effective closing pitch: “Are you sure you want to do this?”

Berkeley has a Mediterranean climate, air conditioned by the fogs rolling in off the Pacific. We have no air conditioning, no pool or hot tub, a house full of CFL and LED lights, and high-efficiency appliances. We use less than 2,500 kilowatt-hours per year.

To be sure, my main motivation was not financial. It was about saving the planet and walking my talk as a professional clean energy advocate.

Fortunately for him, I had already done the math. His company-issued software couldn’t calculate the effect of different PG&E tariffs on the economics of my system.

Doing the math wasn’t easy. PG&E has tiered rates, as well as a time-of-use net metering option (E6), so the price varies by season and quantity. I downloaded my hourly interval data (one week at a time) from the PG&E website in CSV files, imported it into Excel, then put the data into time-of-use rate bins to compare with a flat rate.

To estimate the output of a solar system, I used the Clean Power Estimator, a program from Clean Power Research that was licensed to the California Energy Commission at the time. I dabbled with NREL’s Solar Advisor Model, but soon realized I was hunting a mosquito with a bazooka and gave up.

Overlaying my hourly consumption from 2010 with the expected PV output gave me an estimate of my net energy, and more importantly, of the value of time-of-use rates.

For the three summer months, when TOU rate differences are bigger and solar output is greatest, I would be earning $118 under a TOU rate, almost double the earnings under a flat rate. Without solar, a TOU rate would cost slightly more. If I had a big air conditioning load, it would probably be a lot more. If I had been up in the higher consumption tiers, the numbers for solar would have been better all around.

Since 2011 and the advent of Green Button Data platform, things have gotten a lot more sophisticated for consumers. I got to tour Sungevity’s operation in Oakland last year, where workers used aerial and satellite databases to assess the potential of interested customers and send out a detailed analysis within an hour of the first contact, along with a photo of how the system would sit on their roof.

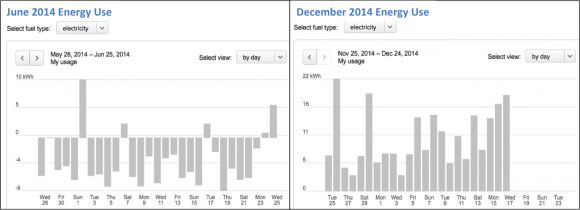

With Opower’s help, PG&E now has a solar dashboard that gives me more information about my usage, including hourly, daily and monthly net energy. It tells me some interesting things, like the fact that last June was a great month for production, when I put 118 kilowatt-hours in the bank, and when I only had a net demand for five days of the month. This month, with the rains finally returning to California, I’m making a lot of withdrawals from the bank, never producing a net excess.

This leads me to the most annoying thing I’ve discovered about California’s endlessly helpful policies for solar. Net metering customers roll over any excess energy production from month to month, with an annual true-up at the end of the year. In 2010, AB 920 directed utilities to pay customers for any net excess of energy over the course of a year, albeit at a low wholesale rate. Before then, customers simply gave away the power.

But customers on a time-of-use rate, like me, can produce a net excess of money, even without producing excess energy. By selling high on-peak and buying low off-peak, I can end up with a bill surplus at my true-up period in April.

I discovered this the hard way in 2012, when my bill surplus of $150 just disappeared.

Vowing not to let that happen again, I starting using electric space heaters, even though I knew this was thermodynamically incorrect -- using gas-fired power plants, with all their generation and transmission losses, to replace my high-efficiency gas furnace. Yet this was the perverse incentive I had due to this policy flaw. (An additional incentive I discovered was that by reducing my gas bill 20 percent, I was entitled to an additional 20 percent discount.)

From a theoretical “cost causation” perspective, time-of-use rates seem like a key part of the solution to the net metering debate. If my power is really worth 29 cents per kilowatt-hour on summer peaks, then I should be compensated at that rate for producing power on those peaks. Instead, TOU is voluntary for NEM customers, and all my excess value is simply stolen away at the end of the year.

Approximately 55 percent of PG&E net metering customers were on TOU rates in 2011, according to analyst Tom Beach of Crossborder Energy. I wonder how many people have the money surplus problem.

If there are any California state legislators reading this, here’s your chance to plug a little gap in the policy infrastructure.

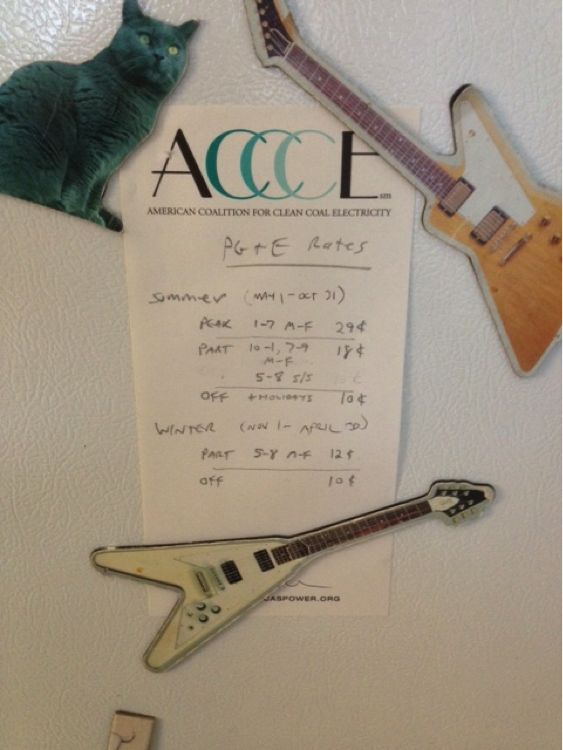

And if any utility executives are reading this, it seems that PG&E is not really interested in promoting TOU rates to residential consumers. They don’t notify me when the seasonal rates change in the fall and spring. They never sent me a card to remind me of the daily hours, so I made my own (seen below). And while they offer a solar calculator on their website, it doesn’t help customers choose between tariffs, using their own hourly data.

There are dockets open now at the California PUC to debate changes to residential rate structures and the future of net metering. All utilities are proposing higher fixed charges, while San Diego Gas & Electric wants to move everyone to TOU rates after 2017.

A big change would be to eliminate the top rate tiers and to boost the rates in the lower tiers. This may be a mixed blessing for solar developers: they will lose the highest-value customers in the top tiers, but become more competitive in the lower tiers. Homeowners in the mild coastal cities, like the Bay Area, San Diego, and Los Angeles -- where most Californians live -- could see rates rise 20 percent or more, and solar could explode.

EV to the rescue

To solve my net excess money problem, I did what I really wanted to do all along: buy an electric car. As a rabid environmentalist, I hate coal and oil, and by extension, coal companies and oil companies.

Living in California, I am mostly beyond the reach of coal companies, since PG&E gets little of its power from coal-by-wire. (Though it does get 21 percent from wholesale power “that is not traceable to specific generation sources by any auditable contract trail,” so who knows.)

Owning a gasoline car meant my money was going to support the Koch brothers, the Exxon Valdez, the BP Horizon, the war in Iraq, and Chevron’s war on the city of Richmond, my neighbor to the west.

While I was eager to indulge my virtues, I still needed a practical car for a family of four, and it had to be affordable. I had never bought a brand-new car in my entire life.

Until recently, the options for EVs were not great. I could cash in my kids’ college funds and buy a Tesla, or I could buy a slightly modified golf cart called a “neighborhood electric vehicle.” Then there were plug-in hybrids like the Volt and the Prius, but these are not gasoline-free.

As California’s ZEV-LEV vehicle mandates started to take effect, companies began to respond with new product. Many of these could be considered “compliance cars” as Fiat Chrysler CEO Sergio Marchionne famously complained.

When Nissan took the opportunity seriously and came out with the Leaf, I was at last able to move. It works as a family car, unlike the Volt (weird back seats) or the Fiat and Smart EVs (too small). The Ford Focus Electric looks good too.

While EVs still have the perception of being expensive cars -- probably thanks to Tesla -- the Leaf is actually one of the most affordable cars on the road, if you consider all costs. The higher efficiency of electric motors overcomes what can be the higher cost of electricity, depending on where you live and fluctuations in the global oil market. A gallon of gasoline is equal to 33.4 kilowatt-hours, so gas at $3 a gallon is equal to electricity at 9 cents per kilowatt-hour. But a Leaf is rated at 108 mpg-equivalent, so it gets three or four times the travel out of that energy.

Edmunds offers a True Cost to Own calculator that compares the five-year total costs of all cars, incorporating depreciation, financing, fuel, insurance, maintenance, and so on.

While a basic car like the 2014 Toyota Corolla has a sticker price of $18,943, the five-year ownership cost is $38,171, including $9,662 in fuel. The similar, though electric, 2014 Leaf SV, with a sticker price of $30,986, has a five-year cost of only $29,075, thanks to $6,000 lower fuel costs and a $7,500 federal tax credit. In states with lower electricity rates than California and state tax credits, the savings are even greater.

So even without the tax breaks, the Leaf is cheaper than a Toyota Corolla. I don't know why Nissan doesn’t put this on every billboard in America.

There are a couple of issues, like range and the availability of charging stations. The Leaf is not for all uses. It has a maximum range of 100 miles, and it takes four hours to charge from dead to full using a 240-volt charger, so it is not a road trip car. You might keep your old stinker around for longer trips, or borrow your neighbor’s.

But it works fine as a Bay Area car. I charge at home on a 120-volt outlet (that’s just a regular 3-prong plug in my driveway). I skipped buying the “Level 2” charger since it added another $1,000 to the bill. My six-year-old daughter plugs in the car for me when we come home, and I charge mostly at night.

Even though the 120-volt outlet results in a 20-hour “trickle charge” from dead to full, it isn’t a problem, since I never drain the battery completely and I don’t drive my car while I’m sleeping.

If I do need a faster charge, or if we need to drive 200 miles in a day, there are a growing number of commercial stations in the Bay Area, as well as a network of EV owners who share their plugs via the PlugShare app. One of the sharers is Felix Kramer of CalCars fame, who lives in my neighborhood.

Some argue that parking garages should install lots of cheap 120-volt outlets, rather than a few expensive 240-volt charging stations. The cost of power is only 15 cents per hour of charging -- too cheap to meter -- and it would vastly increase the number of EV charging points for very low cost. It especially makes sense for long-term parking at airports, where cars can sit for days.

So while a charging network is somewhat important, I suspect almost all EV charging will be done at home or at work. It is so convenient and cheap, it’s hard to beat. The exception could be people who can’t charge at home or at work, though they may not be good candidates at all, like this guy.

So there you have it; I'm living the EV-PV dream. It doesn’t take much, if you have the right roof and a driveway. It is convenient, cheap, and educational -- and you might just do your part to protect the environment in the process.