A123 (Nasdaq: AONE) had a rocky 2011. 2012 is turning out to have its significant challenges, as well.

In the face of recent genuinely positive design wins for the lithium-ion battery maker across its target markets of transportation and utility-scale storage, the firm is facing threatening self-induced -- as well as external -- issues.

On the positive side, A123 announced new automotive customers Geely, a growing Chinese automaker, and Tata Motors, India's largest automaker. The firm is developing an engine start battery for the "microhybrid" market and has announced contracts with McLaren Automotive and a German OEM. A123 has also embarked on a joint manufacturing agreement with Shanghai Automotive, one of the largest automakers in China, to produce A123's prismatic cells.

Microhybrids are a fast-growing new market. The global market for microhybrids could reach more than 39 million vehicles in 2017 and may create a $6.9 billion market for energy storage devices, according to Lux Research -- although lithium-ion will not be the dominant technology in that market, as per the research firm. A123's inclusion in Tata's hybrid buses and commercial vehicles also represents the company's inroads into a growing market in a high-growth region.

According to Jeff Osborne at Stifel, the Tata battery packs are in the 12-kilowatt-hour range, and margins are expected to be better in the bus business than the automotive business, with volumes starting in the hundreds and potentially growing into thousands of units in late 2012 and 2013. The company also noted that over the past three months it has been awarded five contracts representing 17 megawatts of grid business.

That's the good news.

The painful news is related to the just-announced "field campaign to replace battery modules and packs that may contain defective prismatic cells produced at A123's Livonia, Mich. manufacturing facility," according to a release. The "defect has been discovered only in some prismatic cells" built at the firm's Livonia facility. Up to five customers, including Fisker, might have received faulty cells.

The A123 replacement "campaign" will have a price tag of $55 million, spread out over several quarters. That's one-quarter of the revenue projected for 2012, which A123 recently guided as falling in the range of $230 million to $300 million. Since A123 will continue to operate at a loss, it will have to raise significant capital to cover its losses, the recall, and a recently announced shareholder suit. The firm has not revealed how it will raise that money.

About a year ago, VC investor Vinod Khosla spoke to about 300 energy storage experts at the annual Energy Storage Association (ESA) meeting and predicted that A123 would not be around in ten years. He cited lithium's volatility and inherent safety issues. That news was less satisfying for the audience (which included A123).

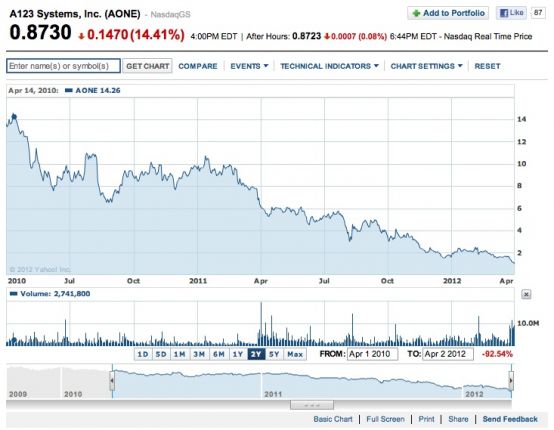

The stock market is showing its displeasure with the lithium-ion battery maker, sending its shares to record low prices. The company's stock sank 14 cents, or 14 percent, to 87 cents per share, and has shed more than 90 percent of its value since its 2009 IPO price of $13.50. The company has a market value of $117 million.

As Jeff St. John has reported:

A123 Systems may be struggling with the automotive battery business, but it’s making some strides on grid energy storage, announcing several projects in December that show how large-scale lithium-ion batteries can help the power grid. A123 announced an 11-megawatt energy storage project to back up a wind farm that Sempra Energy plans to build on the Hawaiian island of Maui. A123 is also supplying 32 megawatts to AES Energy Storage to provide frequency regulation and wind power smoothing in West Virginia.

As of July, the Waltham, Mass.-based company had grid battery installations and orders that added up to 100 megawatts by the end of 2011, much of it in partnership with AES Energy Storage.

Another project with Massachusetts utility NSTAR is a 2-megawatt pilot that A123 will own and operate to serve ISO New England’s frequency regulation market under the grid operators Alternative Technology Regulation (ATR) pilot program.

A123’s project with Hawaii’s Maui Electric Co. is aimed at supplying a different set of energy storage functions. The battery array will be installed at a substation serving the high-end resort community of Wailea, and will be able to supply 1 megawatt-hour of energy storage, both to reduce peak load by as much as 15 percent and to smooth voltage and improve power quality, said Chris Reynolds, Maui Electric’s operations superintendent.

Grid energy storage is still cost-prohibitive in all but a handful of edge cases, but it’s also expected to be increasingly important as intermittent wind and solar power take a larger role in power generation.

Of course, in order for A123 to continue to win and deliver to these utility-scale and automotive contracts, the struggling firm must raise the cash it needs to pay for its recall and losses.