Japan’s solar installers are bracing for a large cut in subsidies after a 61 percent increase in PV deployment over the last year. A reduction to the feed-in tariff (FIT) could be introduced as soon as this quarter, depressing demand for new solar installations.

The reduction in FITs across several sectors could be as much as 20 percent to 30 percent, according to GTM Research’s Q2 2016 Global Solar Demand Monitor.

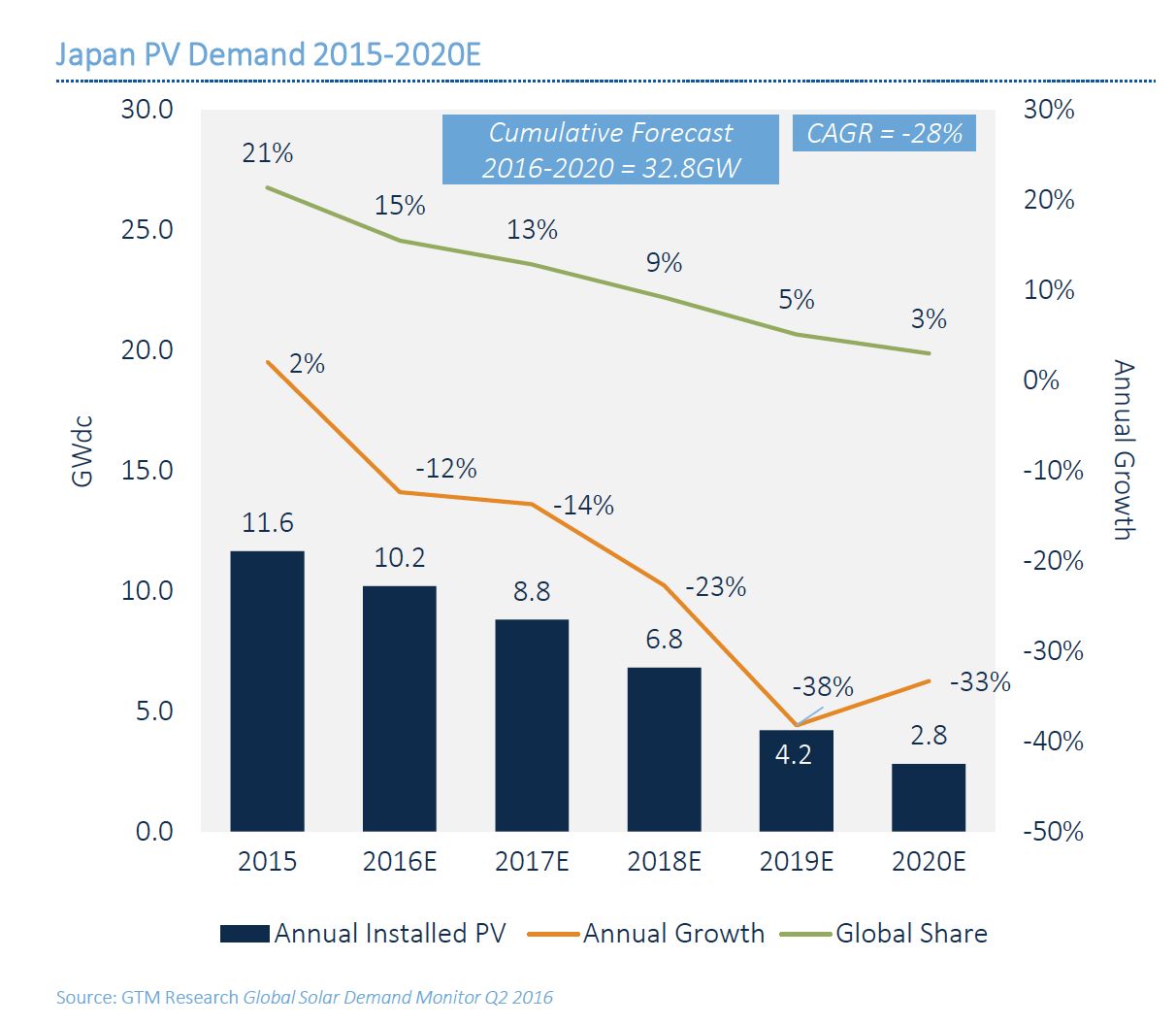

As a result, GTM Research predicts: “The market will take a sharp negative turn in 2016, contracting by 12 percent to 10.2 gigawatts and shrinking a further 73 percent to reach 2.8 gigawatts in 2020.”

The drop will cause Japan to lose its place among the top three markets for PV demand. It will lag behind China, the United States and India in terms of cumulative PV demand between 2016 and 2020.

At the same time, peak PV production is being curtailed by utilities because nuclear power is now re-entering Japan’s energy mix after being paralyzed by the Fukushima Daiichi disaster in 2011.

Nuclear is now expected to make up 22 percent of Japan’s energy mix through 2030. The government is putting the brakes on excessive PV production, auctioning off the remaining project pipeline in discrete parcels.

Nevertheless, GTM Research notes, FIT cuts might take a while to feed through to installations on the ground. Lead times in Japan can take up to three years between project approval and commissioning.

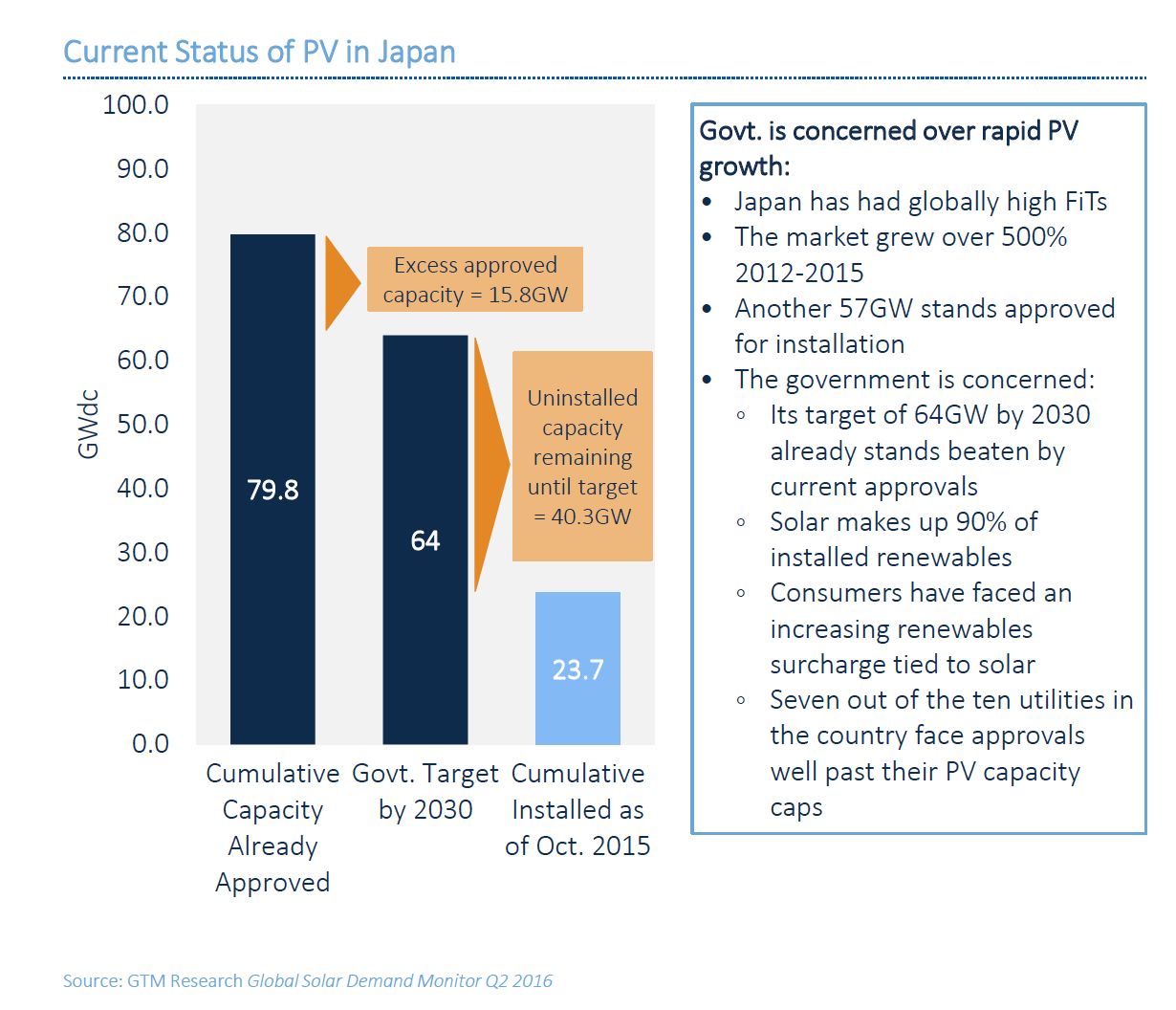

As such, projects going live in 2018 could still benefit from current high tariffs. This pipeline of approved projects is a source of concern for the government because it already exceeds the nation’s 2030 target for solar installations by some 15.8 gigawatts.

“The government is scrutinizing the 79.8-gigawatt pipeline of approved capacity to eliminate the excess approved 15.8 gigawatts and reassign the uninstalled 40.3 gigawatts in phases annually up to 2030, to reach its 64-gigawatt target,” writes Mohit Anand, author of the report.

“April 2017 is the deadline by which approved projects will have to prove that they are ‘alive’ by showing interconnection agreements from utilities," he explains.

Lawmakers have already approved measures to eliminate FITs for projects over 2 megawatts. Instead, these projects will be tendered through auctions that could offer as little as 200 megawatts of capacity a year. The government is planning to kick off the auctions next April.

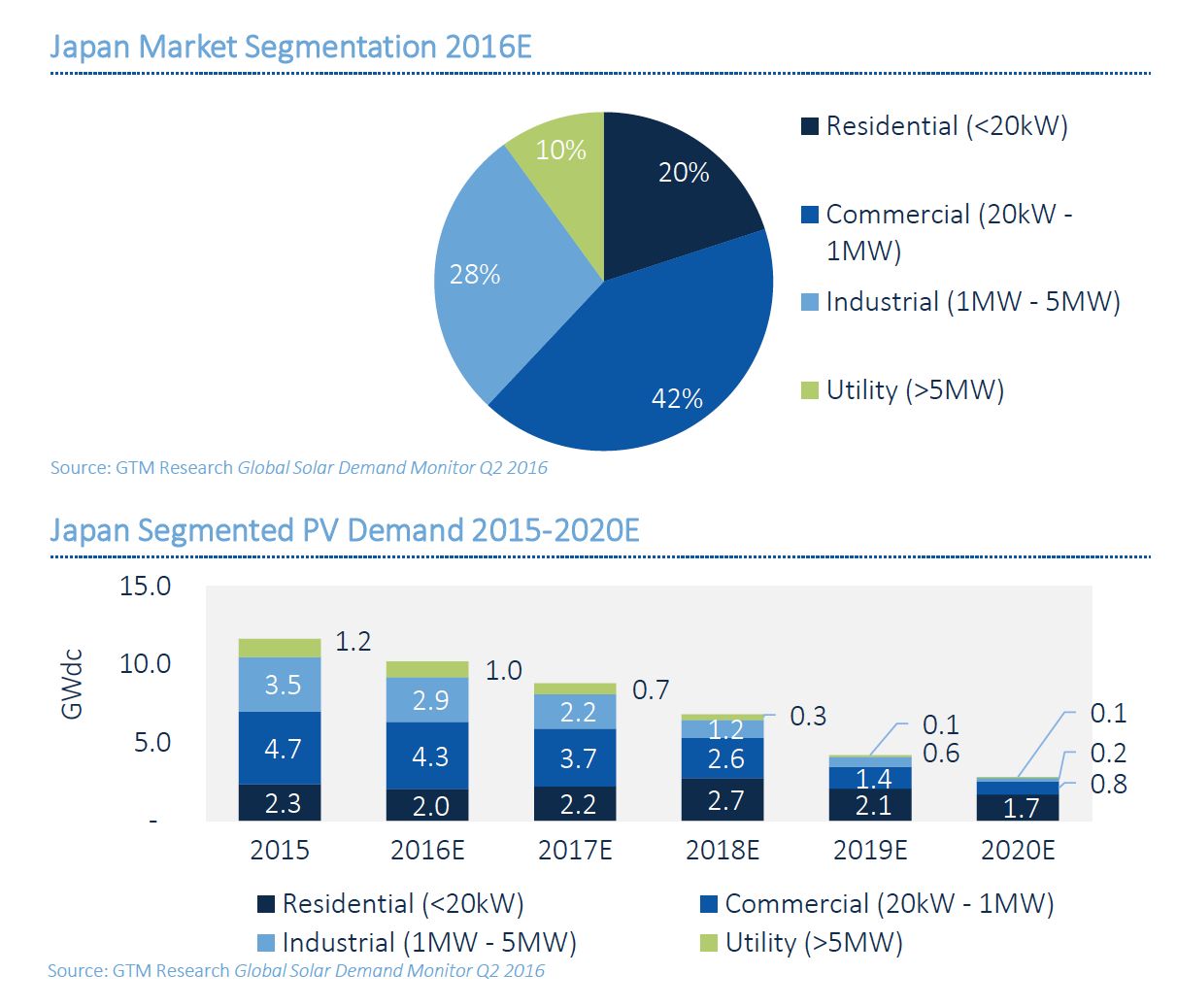

Authorities have already cut residential and commercial FITs by 11 percent from last year’s levels, and there is speculation that the subsidies could be scrapped altogether within the next two years.

Nevertheless, writes Anand, rooftop solar could still survive, "as business models for residential solar with storage are fast approaching viability.”

On a levelized cost of energy basis, solar has been competitive with residential electricity rates since 2014. "Companies like Mitsubishi, Hitachi, Solar Frontier and SMA are starting to offer PV home solutions combined with energy management,” and that is improving solar's value, states Anand.

Since the introduction of incentives in 2012, Japan has tripled its clean energy output. But now leaner times are ahead.

Listen to Mohit Anand explain the dynamics of the global solar market on a recent episode of the Energy Gang: