First Solar's acquisition of high-efficiency startup TetraSun took many by surprise when it was announced Tuesday afternoon. One, because it marks the first foray by First Solar -- until now a thin-film monogamist -- into the realm of crystalline silicon technology. Two, because few, including this analyst, had heard much about TetraSun, although its founder and CEO, Denis De Ceuster, is a former SunPower technologist and is well known in industry circles.

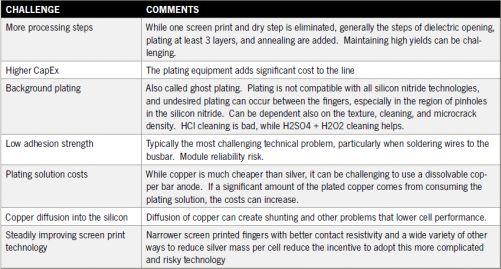

Right off the bat, what strikes me as interesting about TetraSun is its usage of copper as opposed to silver as a metallization solution. Silver has been a major thorn in the side of cost-reduction efforts in cell fabrication, being both expensive and volatile with regard to its pricing. As Andrew Gabor details at length in his report, Innovations in Crystalline Silicon PV, 2013, reducing silver usage has been a major focus of paste producers and cell manufacturers since commodity prices spiked to levels of more than $40 per ounce in early 2011, with multiple strategies being pursued to do so. Doing away with silver entirely remains the holy grail of the metallization industry, with copper being the obvious substitute. The use of copper metallization really does give TetraSun a shot at being a truly low-cost, high-efficiency technology concept. However, as the table below shows, there are multiple barriers associated with copper as a metallization solution, and thus far, little progress has been made at the commercial level.

Figure: Barriers to the Adoption of Copper Plating as a Replacement for Front Silver Metallization

Source: Innovations in Crystalline Silicon PV 2013: Markets, Strategies and Leaders in Nine Technology Areas

I think the strategy behind the acquisition, in principle, makes complete sense -- First Solar currently has almost no foothold in the rooftop markets given its low efficiency. This is an issue because two important solar markets, Europe and Japan (which does not like cadmium in any form), are predominantly rooftop markets. Acquiring TetraSun and commercializing its technology could put First Solar right up there with Panasonic's HIT and SunPower's N-type all-back-contact modules in terms of having a high-efficiency rooftop product.

However, there are some concerns I have about this strategy. First, TetraSun's technology is far from being proven as commercially viable -- right now, the firm is a company of fourteen people with probably little more than a pilot cell manufacturing plant. There are going to be all the usual challenges associated with being able to mass-produce this technology in a cost-effective manner and still hit high efficiency and a level of reliability that banks are comfortable with -- so lots of uncertainty there. I wonder that with such an aggressive commercialization timeline (First Solar says that volume production is planned to commence in mid-2014), if it would perhaps not have been wiser to acquire a high-efficiency startup that is further down the line with a proven product, like Silevo (representatives from which will be speaking at GTM's upcoming Solar Summit) or Solexel (which just had some layoffs), although it is possible they are currently not for sale.

Two, while chasing the rooftop market is definitely the right idea, it does not mean one has to own the technology or production. First Solar already has internal manufacturing -- would it not perhaps be a safer bet to procure Chinese silicon modules for its rooftop business instead? In the event that prices for Chinese modules continue falling as they have been, this would allow First Solar to leverage the availability of low-cost, medium-efficiency module technology without taking on the investment and technology risks associated with bringing a new technology to market. In general, I believe it is wise for a project developer (which First Solar now is) to be hedged between internal production and external supply in the long run. The two points in favor of First Solar's approach versus this strategy are that 1) Chinese c-Si modules are not in the same high-efficiency range as what TetraSun promises to be (at best 16.5 percent today versus 20-plus percent for TetraSun), and 2) First Solar owns the technology and all the benefits associated with it, which would give it a differentiated offering and a potential ace in the hole. But all that said, I wouldn't be surprised to see a high-efficiency Trina module in a First Solar installation a few years down the line.