In 2011, the U.S. arm of Germany's SolarWorld formed CASM (Coalition for American Solar Manufacturing) to pursue and eventually "win" the case for imposing stiff anti-dumping tariffs on the importation of Chinese solar cells. We covered the 2012 ruling by the Department of Commerce as we followed every twist of the international legal case.

Here are the final tariff schedules:

Chart courtesy of CASE

But what happens if the instigator of a case of this nature goes out of business? What happens if there is essentially no domestic solar panel market to protect?

SolarWorld is saddled with massive debt and is considering delaying its annual press conference "if it fails to clinch a deal with its creditors on a debt restructuring," according to the firm's CEO, as quoted in Reuters. "If we don't have an agreement with banks until then, an annual press conference doesn't make any sense," said Frank Asbeck in the same report.

SolarWorld, at one time one of Germany's largest solar companies, now has long-term debt of close to $1 billion in a savagely competitive solar business market.

In January, SolarWorld had to warn bondholders of a debt restructuring, writing that "serious adjustments on the debt side are necessary, in particular with regard to the bonds (ISIN XS0478864225 and ISIN XS0641270045) and the assignable bank loans."

When the terms "appointed restructuring expert" and "expert in German insolvency law" are used in press releases by German public companies, it is almost always a very bad sign. Q.Cells and a number of other German firms have faced debt restructuring or insolvency in the solar industry's consolidation and have used the same foreboding language.

However, most recently, SolarWorld said it was in "constructive" talks with its creditors in forming a restructuring plan, according to Reuters.

Other struggles for SolarWorld include a suit by Hemlock Semiconductor for breach of contract, as reported by Bloomberg, the departure of its COO, Boris Klebensberger, as reported in Sustainable Business Oregon, along with looming job cuts.

It turns out that if SolarWorld stops building product in the U.S., parties can file a "changed circumstances" request letter with the Department of Commerce. The letter would ask that the orders be reversed because circumstances have changed, and because without SolarWorld, there is no meaningful domestic c-Si solar cell industry. Without U.S. production and no U.S. industry to shield, the orders shouldn't stand.

The "changed circumstances" letter is a common procedure at the Department of Commerce (DOC).

Some of the regulatory language pertaining to the absence of a domestic manufacturing base, from the DOC website:

Under section 751(d) of the Act, the DOC may revoke an AD Order or terminate a suspension agreement based on a changed circumstances request if it concludes that 1) producers accounting for substantially all of the production of the domestic like product have expressed a lack of interest, in whole, or, in part, in an order or a suspended investigation, or 2) other changed circumstances sufficient to warrant revocation or termination exist. [...] The specific products under review are usually products that the domestic industry no longer produces and does not intend to produce in the future.

If the party making the request is requesting a revocation in whole of the order, it will need to provide evidence that the domestic industry no longer exists, or provide a letter from the domestic industry explicitly stating it is no longer interested in any of the merchandise under review and will not oppose the revocation. Thus, the requesting party cannot simply allege that the domestic industry should no longer have an interest in the merchandise described in the revocation request, because the domestic industry no longer appears to be producing the merchandise in question. The expression of no interest must come from the domestic industry itself.

Jigar Shah of the opposition coalition, CASE, notes, "It is not pleasant to see SolarWorld and its employees in a precarious financial situation. Blunt instruments like tariffs were not the right solution to promote a U.S. solar cell manufacturing industry. We should all work together to figure out how to promote local manufacturing without raising prices for 98 percent of the U.S. solar value chain.”

Tim Brightbill of Wiley Rein LLP, Counsel to Coalition for American Solar Manufacturing responds via email: "Mr. Wesoff’s article, and its entire premise, are incorrect. The AD/CVD orders on solar cells and modules would not be revoked, and would not be affected at all, by a changed circumstances review request.

First, it is important to understand that the orders were supported by the domestic industry as a whole, including seven U.S. cell and/or module manufacturers and about 230 other U.S. solar companies. Therefore, “changed circumstances” would not support revocation of the order even if one or more companies were forced to stop production.

Second, even if the entire U.S. cell and module manufacturing industry were forced to stop production due to China’s unfair trade practices – which will not occur – the non-producing members of the domestic industry would still have a strong interest in maintaining the orders and would fight to keep them in place, because fair market competition best serves everyone’s interests. It would be unprecedented and wrong for the Commerce Department to grant a changed circumstances request after the Chinese industry – the dumpers and subsidizers – had driven the entire U.S. industry out of business.

Changed circumstance review requests are almost never granted by Commerce, and when they are granted, it is at the request of – and with the approval of – the domestic manufacturing industry.

It is important for all solar cell and module importers and purchasers to understand that the U.S. antidumping and countervailing duty orders on China will be in place for a minimum of five years, and very likely for many more years to come. It is unfortunate that Greentech would indulge Mr. Shah’s speculation, which is unsupported by law or precedent."

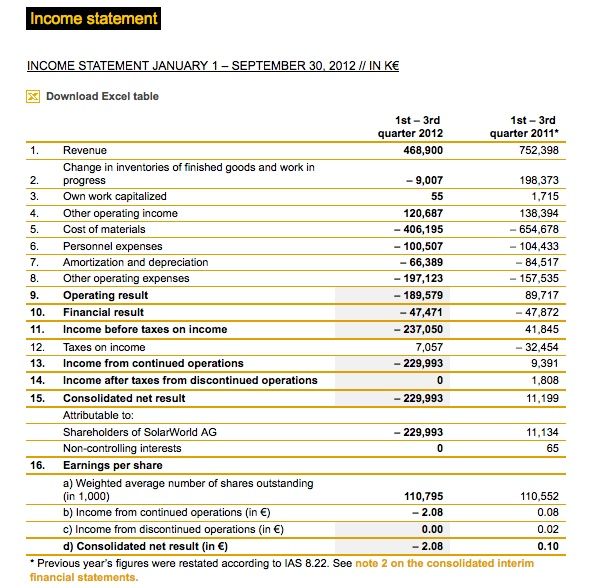

Here's a recent income statement from the firm for the first three quarters of 2012 showing painfully large losses amidst depressed revenue: