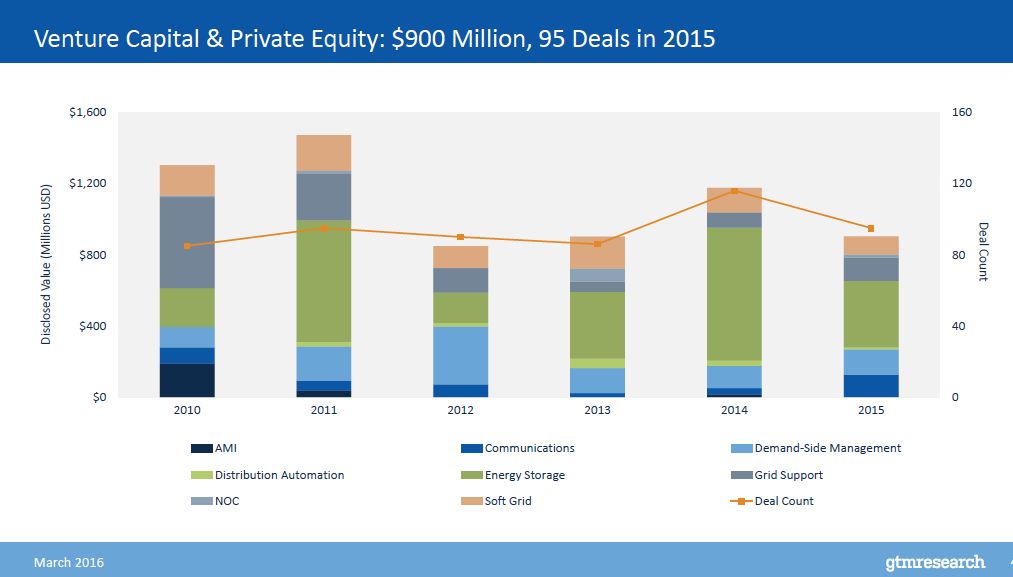

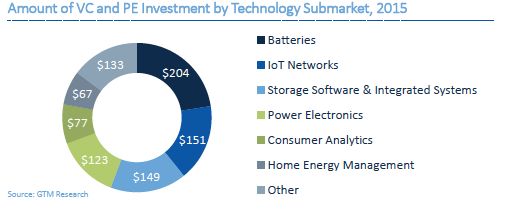

GTM Research tracks a lot of statistics in its quarterly Grid Edge Executive briefings, including a running tally of venture capital and private equity financing in the sector. According to the most recent data, 2015 brought in $900 million from a total of 95 deals, with energy storage taking the lion’s share of $400 million, and batteries racking up half of that.

Last year’s grid-edge investment figures don’t match 2014’s $1.3 billion in 83 deals. Still, they’re better than one might have predicted, largely due to the $300 million or so added in the fourth quarter of the year.

Big fourth-quarter investments included the year’s top three in energy storage: $58 million for flow battery startup Vionx, $50 million for storage software and project developer Younicos, and the last round of behind-the-meter battery startup Stem's $57 million over three deals. Add in $25 million for flow battery maker UET in December and $25 million for Primus Power in September, and you’ve got nearly all the battery-related investment of the year. On the soft side of energy storage, battery systems software vendor Greensmith raised $5 million.

Demand-side management also did well, with about one-quarter of the tally going to building and home energy management vendors, GTM Research reported. Those include eight-figure investments in Netatmo, Tado, Blue Pillar, Optimum Energy and Lucid Design Group, largely for software to integrate various energy-consuming devices and systems.

Power electronics technologies also garnered their fair share, including Transphorm’s $70 million, Smart Wires’ $30.8 million, and Varentec’s $13 million. As we’ve noted in our recent ARPA-E coverage, these types of technologies are just now being deployed to bring more grid control in the face of rising levels of wind and solar power.

The nebulous internet-of-things category (i.e., networking and communications technologies) also brought in some significant investments for companies dealing at least in part with the worlds of the grid and energy. The biggest was Greenwave’s $45 million from investors including Singapore’s EDBI and German utility E.ON.

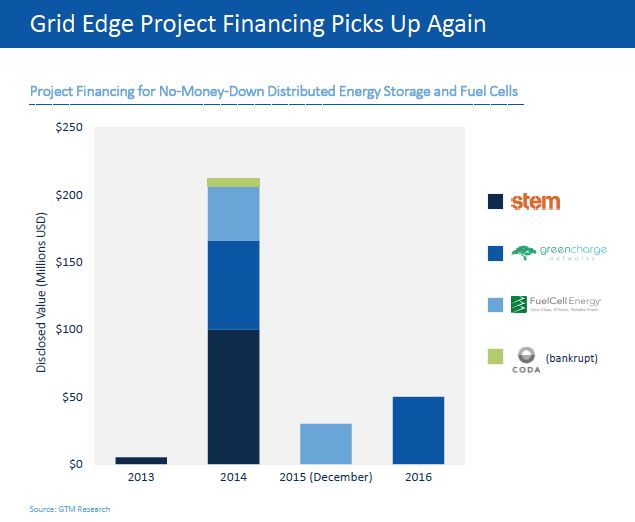

2016 has brought its own news, like Sunverge’s $36.5 million Series C round to help bring its behind-the-meter battery systems to scale in California and Australia. Beyond equity investment, we’ve seen an uptick in project finance, with $30 million from FuelCell Energy in December and Green Charge Networks’ $50 million in project debt financing.

While that’s not much compared to the $200-million-plus brought to the table for no-money-down storage offerings back when they were first launched in 2014, it’s a hopeful sign for the market. Other project financing deals announced last year include one between Bloom Energy and Constellation/Exelon, and another between Advanced Microgrid Solutions and the beleaguered SunEdison, which one may well expect won’t end up being added to the total.